【Python】一种红利低波交易策略的探索

文章目录

- 前言

- 策略雏形

- 考虑优化

- 1.构建上升通道区间

- 2.确定买卖点

- 3.测试收益率

- 4.优化参数组合

- 总结

前言

观察红利低波指数的走势可以观察到,红利低波指数近6年时间稳定地在一个上升通道区间内做震荡,因此希望利用这一点制定一个简单但收益率较高的策略,或许可以因此博取更高收益。

选择红利低波指数的原因,是因为其策略本身的优点。它选取50只流动性好,连续分红,红利支付率适中,每股股息正增长以及股息率高且波动率低的证券作为指数样本,采用股息率加权,反映分红水平高且波动率低的证券的整体表现。总体上说,红利低波可以保证10%左右的年化收益率,且波动幅度相对来说非常小。可以说红利低波指数是最适合大部分人的投资标的。

注意:本策略不具有普适性,历史数据不反映未来业绩,无任何投资建议,投资有风险,入市需谨慎。

策略雏形

本策略的雏形源自一种傻瓜式的网格定投法,即每跌4%就买入一成仓位,每涨4%就卖出1成仓位。这种策略的缺点在于资金利用率太低,再加上红利低波本身的波动就小,哪怕将阈值改为2%或者1%也并不能带来很好的收益率,且跑不赢满仓拿住不动。

所以我针对参数进行优化,提出以下策略:价格每跌1%就买入2成仓,每涨5%就卖出4成仓。

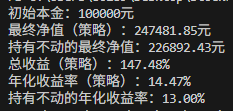

通过写一段简短的Python代码,我们对数据进行简单的回测,以10万本金为例。可以得到如下结论:

代码如下:

# 固定金额网格

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np# 设置中文字体

plt.rcParams['font.sans-serif'] = ['SimHei'] # 使用 SimHei 字体,支持中文

plt.rcParams['axes.unicode_minus'] = False # 解决负号显示问题# 读取数据

data = pd.read_excel('512890.xlsx')

data['时间'] = pd.to_datetime(data['时间'])# 初始设置

initial_capital = 100000 # 初始本金

capital = initial_capital # 当前资金

position = 0 # 当前持仓

cash = capital # 可用现金

last_trade_price = None # 上次交易价格

buy_threshold = -0.01 # 跌幅1%

sell_threshold = 0.05 # 涨幅5%

buy_amount = 20000 # 每次加仓2万元

sell_amount = 40000 # 每次卖出4万元# 保存数据用于计算收益

equity_curve = [] # 策略净值曲线

position_curve = [] # 持仓曲线(股票市值占总资产比例)

buy_sell_points = [] # 买卖点# 初始化全仓持有不动的净值曲线

buy_and_hold_equity_curve = [initial_capital] # 初始全仓买入持有不动的净值# 模拟交易

for i, row in data.iterrows():close_price = row['收盘']# 如果是第一次交易,初始化并执行全仓买入if last_trade_price is None:position = initial_capital / close_price # 全仓买入capital = 0 # 本金已经用完last_trade_price = close_priceequity_curve.append(initial_capital) # 初始净值position_curve.append(position * close_price / initial_capital) # 初始持仓比例(100%)continue# 判断是否需要加仓或卖出if close_price <= last_trade_price * (1 + buy_threshold): # 跌幅1%# 加仓2万,检查是否有足够的现金if capital >= buy_amount:position += buy_amount / close_pricecapital -= buy_amountlast_trade_price = close_pricebuy_sell_points.append(('Buy', row['时间'], close_price))elif close_price >= last_trade_price * (1 + sell_threshold): # 涨幅5%# 卖出4万,检查是否有足够的股票if position * close_price >= sell_amount:sell_value = min(sell_amount, position * close_price)position -= sell_value / close_pricecapital += sell_valuelast_trade_price = close_pricebuy_sell_points.append(('Sell', row['时间'], close_price))# 计算当前净值和持仓比例(股票市值占总资产的比例)current_value = capital + position * close_priceequity_curve.append(current_value)position_curve.append(position * close_price / current_value) # 持仓比例# 计算全仓买入持有不动的净值曲线buy_and_hold_equity_curve.append(initial_capital * close_price / data['收盘'].iloc[0])# 计算年化收益率

days = (data['时间'].iloc[-1] - data['时间'].iloc[0]).days

total_return = (equity_curve[-1] - initial_capital) / initial_capital

annualized_return = (1 + total_return) ** (365 / days) - 1# 计算持有不动的年化收益率

buy_and_hold_total_return = (buy_and_hold_equity_curve[-1] - initial_capital) / initial_capital

buy_and_hold_annualized_return = (1 + buy_and_hold_total_return) ** (365 / days) - 1# 计算持有不动的最终净值

buy_and_hold_final_value = buy_and_hold_equity_curve[-1]# 输出收益指标

print(f"初始本金:{initial_capital}元")

print(f"最终净值(策略):{equity_curve[-1]:.2f}元")

print(f"持有不动的最终净值:{buy_and_hold_final_value:.2f}元")

print(f"总收益(策略):{total_return * 100:.2f}%")

print(f"年化收益率(策略):{annualized_return * 100:.2f}%")

print(f"持有不动的年化收益率:{buy_and_hold_annualized_return * 100:.2f}%")# 绘制净值曲线、持仓比例曲线和买卖点

plt.figure(figsize=(14, 7))# 净值曲线(包含全仓持有不动的参考曲线)

plt.subplot(2, 1, 1)

plt.plot(data['时间'], equity_curve, label='策略净值曲线', color='blue')

plt.plot(data['时间'], buy_and_hold_equity_curve, label='全仓持有不动净值曲线', color='grey', linestyle='--')# 使用实际净值曲线的值来绘制买入卖出点

buy_prices = [point[2] for point in buy_sell_points if point[0] == 'Buy']

buy_times = [point[1] for point in buy_sell_points if point[0] == 'Buy']

sell_prices = [point[2] for point in buy_sell_points if point[0] == 'Sell']

sell_times = [point[1] for point in buy_sell_points if point[0] == 'Sell']# 获取买入卖出点的净值

buy_values = [equity_curve[data[data['时间'] == t].index[0]] for t in buy_times]

sell_values = [equity_curve[data[data['时间'] == t].index[0]] for t in sell_times]# 标出买入和卖出点

plt.scatter(buy_times, buy_values, marker='^', color='green', label='买入点')

plt.scatter(sell_times, sell_values, marker='v', color='red', label='卖出点')plt.legend()

plt.title('净值曲线与全仓持有不动净值曲线')# 绘制持仓比例曲线(股票市值占总资产的比例)

plt.subplot(2, 1, 2)

plt.plot(data['时间'], position_curve, label='持仓比例(股票市值占总资产比例)', color='orange')

plt.scatter(buy_times, [position_curve[data[data['时间'] == t].index[0]] for t in buy_times],marker='^', color='green', label='买入点')

plt.scatter(sell_times, [position_curve[data[data['时间'] == t].index[0]] for t in sell_times],marker='v', color='red', label='卖出点')

plt.legend()

plt.title('持仓比例(股票市值占总资产比例)与买卖点')plt.tight_layout()

plt.savefig('跌1%买2万 涨5%卖4万.png')

plt.show()此策略仅仅带来不到1.5%的增幅,且经过我遍历大量的参数组合后发现,这种策略能够带来的收益上限也极其有限,我上面给出的策略几乎已经是表现最好的参数之一了。但是考虑到股票本身的不确定性,仅仅这点收益的增长完全可以归结于数据的偶然性,此策略本质上没有太大意义,无非就是在其中的一些时间段可以留出一部分本金,保证一定的流动性。

考虑优化

1.构建上升通道区间

接下来我们转变思路,既然水平的网格交易模式表现较差,那么是否可以构建一个上升式的通道区间,在区间内确定低点和高点,实现进阶网格交易?

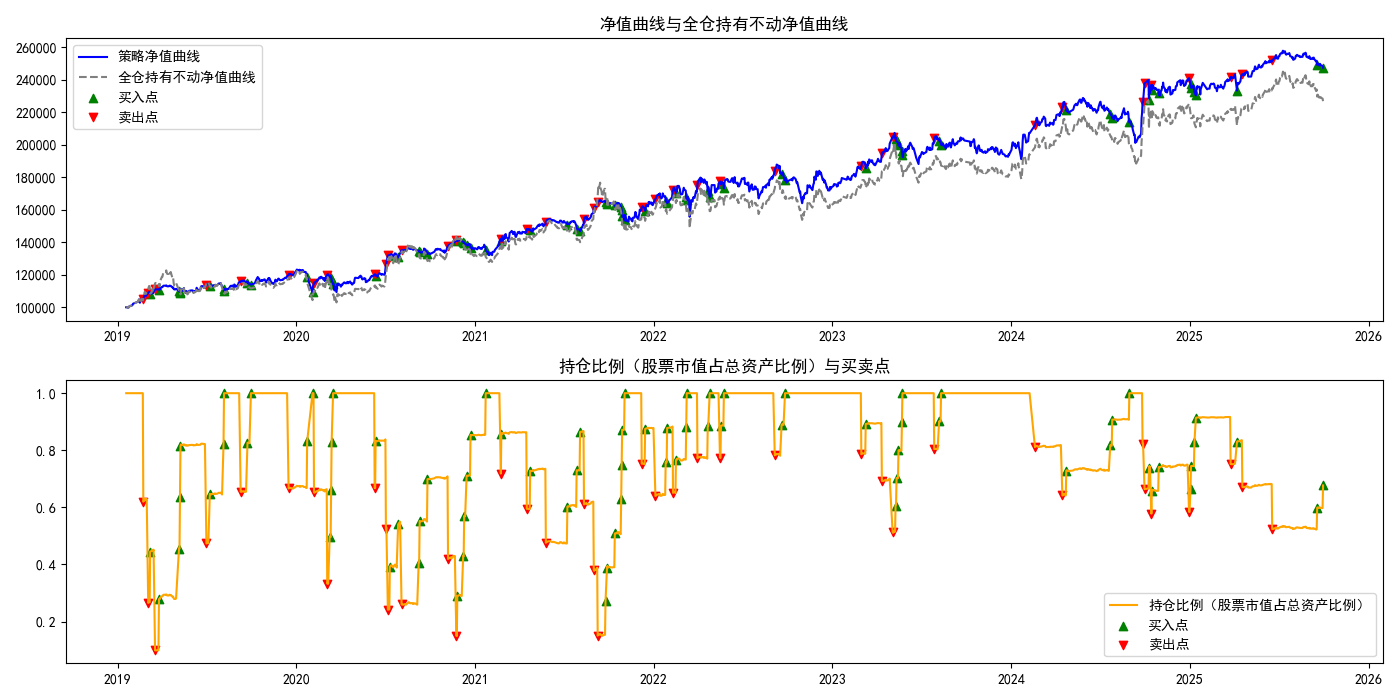

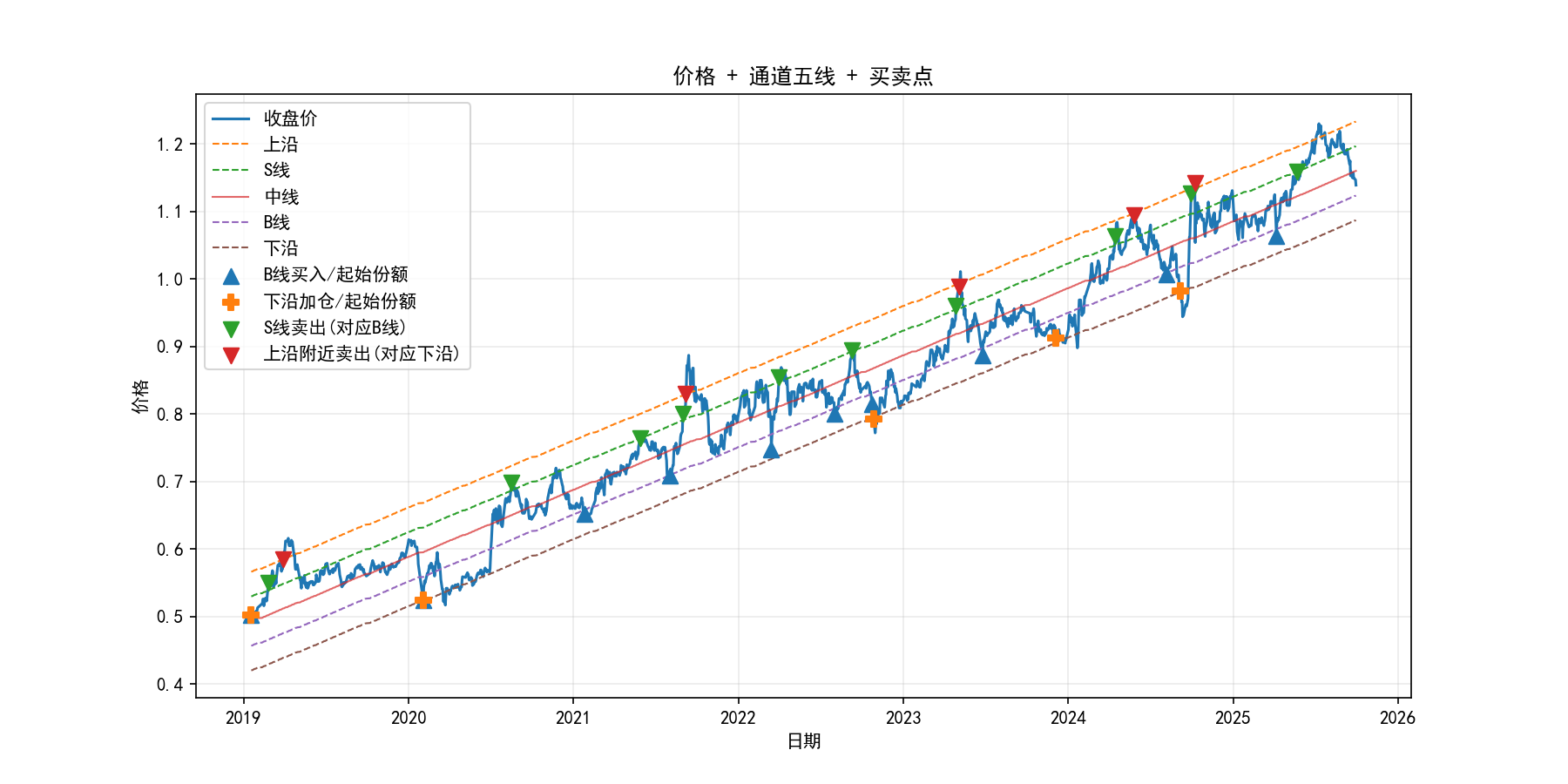

我的初步策略构想是这样的:在上升通道区间的低点分批建仓,在区间高点分批减仓。一个非常简单的逻辑,如下图所示。

具体到操作细节,我们这里暂定为:

首先构建三条平行线,上沿平行线用于描述价格波动的上限,下沿平行线描述价格波动的下限,中间线处于以上两根线的正中间,用于描述价格始终围绕中间线做上下波动。同时,再构造两根线,均平行于以上构造的三根线。这两根线其中一根处于上沿线与中线之间一半的位置,我称之为S线,另一根处于中线与下沿线之间一半的位置,我称之为B线。我策略如下:当价格下穿B线时,触发一次购买,默认买入65%的仓位,当继续下行至靠近下沿线时,再触发一次购买,这里默认是35%的仓位,也就是购买后已经满仓;相应地,当价格上穿S线时,卖出65%,当继续上行至靠近上沿线时,卖出剩下的35%。需要注意的是,如果价格只在B线触发了一次购买就回到了S线,那么这里卖出的量就是对应B线触发的买入的量。如果价格在B线反复波动,那么我们不会多次触发购买,只会触发一次,也就是说,如果最近一次购买是在B线处,那么下一次购买一定是继续下行到下沿线附近时触发,而不会是B线处连续两次的购买。 卖出同理,不会在S线处连续卖出。按以上的逻辑来讲,我们最多连续买两次,一次B线一次下沿线,最多也连续卖两次,一次S线一次上沿线。如果价格在S线和B线之间反复波动,那么我们的策略实际上就之会在B线买一次,S线卖一次,然后继续B线买S线卖。

通道线的计算方式如下:

- 首先先用一元线性回归得到中线 mid

- 计算每一天对中线的偏离:resid = price - mid

- 取绝对偏离的分位数:w0 = np.quantile(|resid|, channel_quantile)

- 把这个 w0(再经 width_scale/width_extra 调整)作为通道半宽 w,于是

上沿 = mid + w

下沿 = mid - w

S/B 线也按 w 的比例定位

channel_quantile 这个参数用来决定通道的半宽度 w取多大。

如果设 channel_quantile = 0.90,那么 w 选的是“|resid| 的 90% 分位数”。这意味着大约90% 的价格会落在中线 ± w 的带内(极端点/离群点可能被排在外面)。

调大 channel_quantile → w 变宽 → 价格更不容易触发 B/S 线(信号更少、更稳)。

调小 channel_quantile → w 变窄 → 更容易触发(信号更多、更频繁)。

为什么用“分位数”而不是标准差?

因为分位数对离群点更鲁棒:一两次异常波动不会把通道拉得过宽。

越接近 1 的分位数,越接近“包含绝大多数样本”的宽度;越接近 0.5,通道会比较窄。

一般 0.85 ~ 0.95 比较常见;

另外,由于我们没有必要等价格真的完全突破区间上下沿线再执行买卖,只需要当价格靠近这条线附近时就可以触发。

我用以下参数来描述这种“靠近”:

near_upper_frac = 0.05 # “靠近上沿”的距离阈值(相对通道半宽的比例)

near_lower_frac = 0.1 # “靠近下沿”的距离阈值(相对通道半宽的比例)

2.确定买卖点

我用以下参数来确定BS线的位置:

s_pos = 0.5 # S线在中线->上沿之间的位置比例 [0,1]

b_pos = 0.5 # B线在中线->下沿之间的位置比例 [0,1]

并用以下参数来控制买卖的仓位:

buy_pct1 = 0.65 # 第一次买入(B线触发)金额占当日总资产比例

buy_pct2 = 0.35 # 第二次买入(靠近下沿触发)金额占当日总资产比例

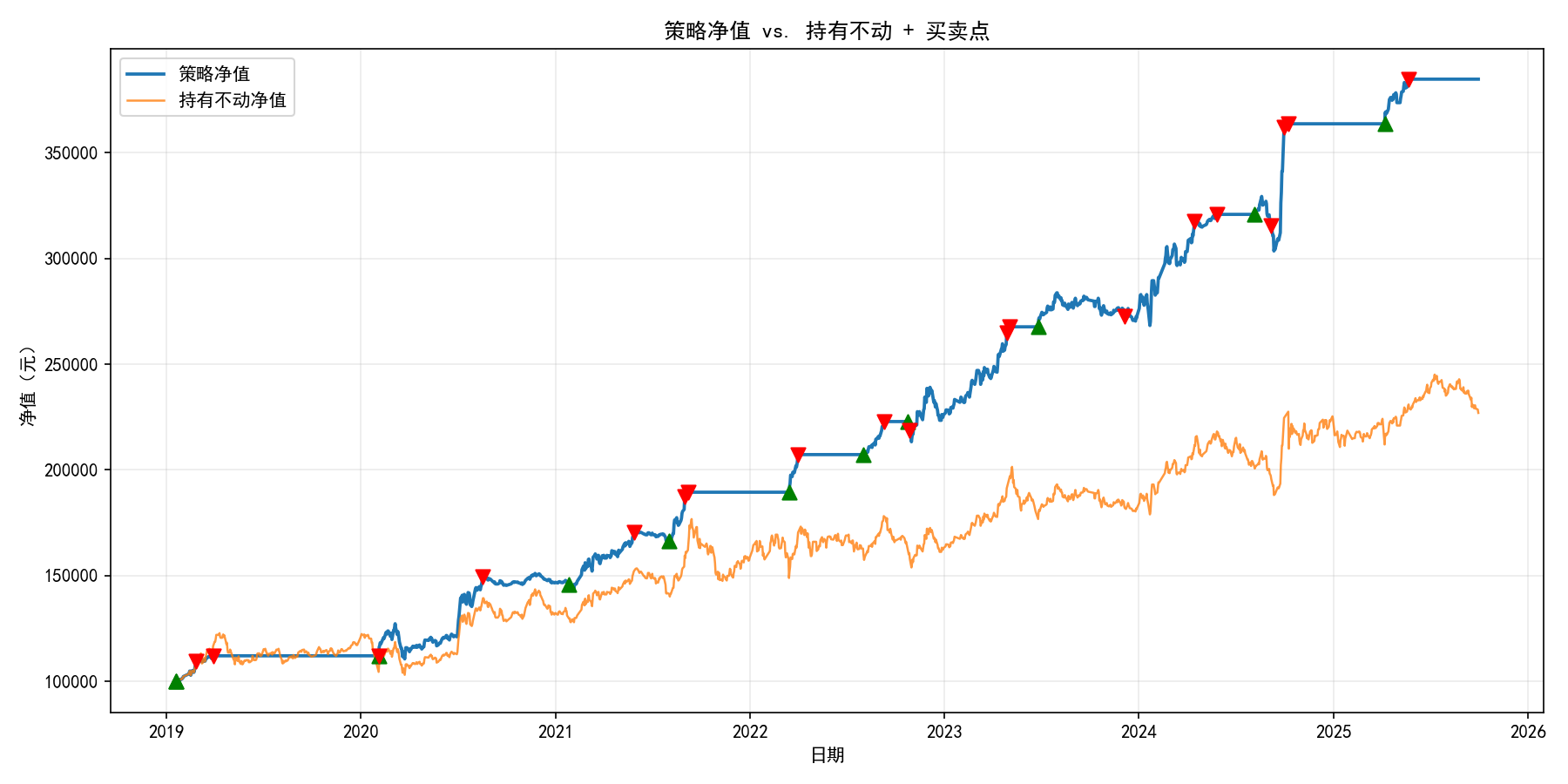

3.测试收益率

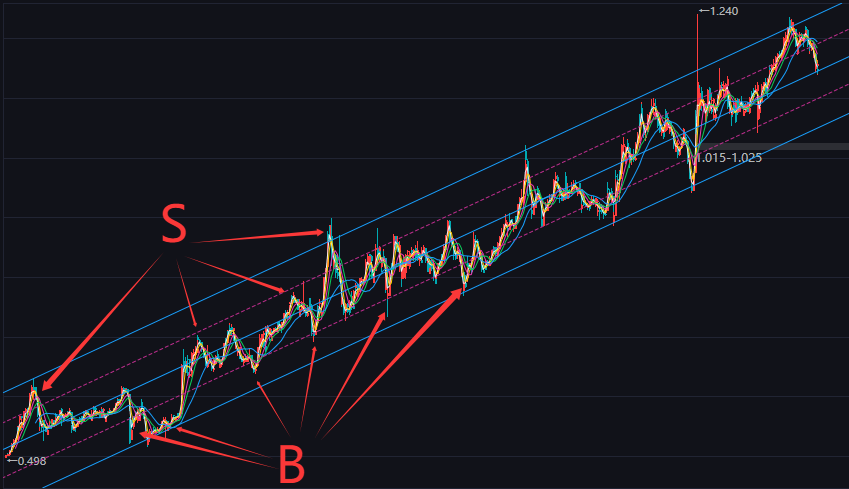

通过以上策略在过去6年多的时间进行复盘,我们可以得到如下结果:

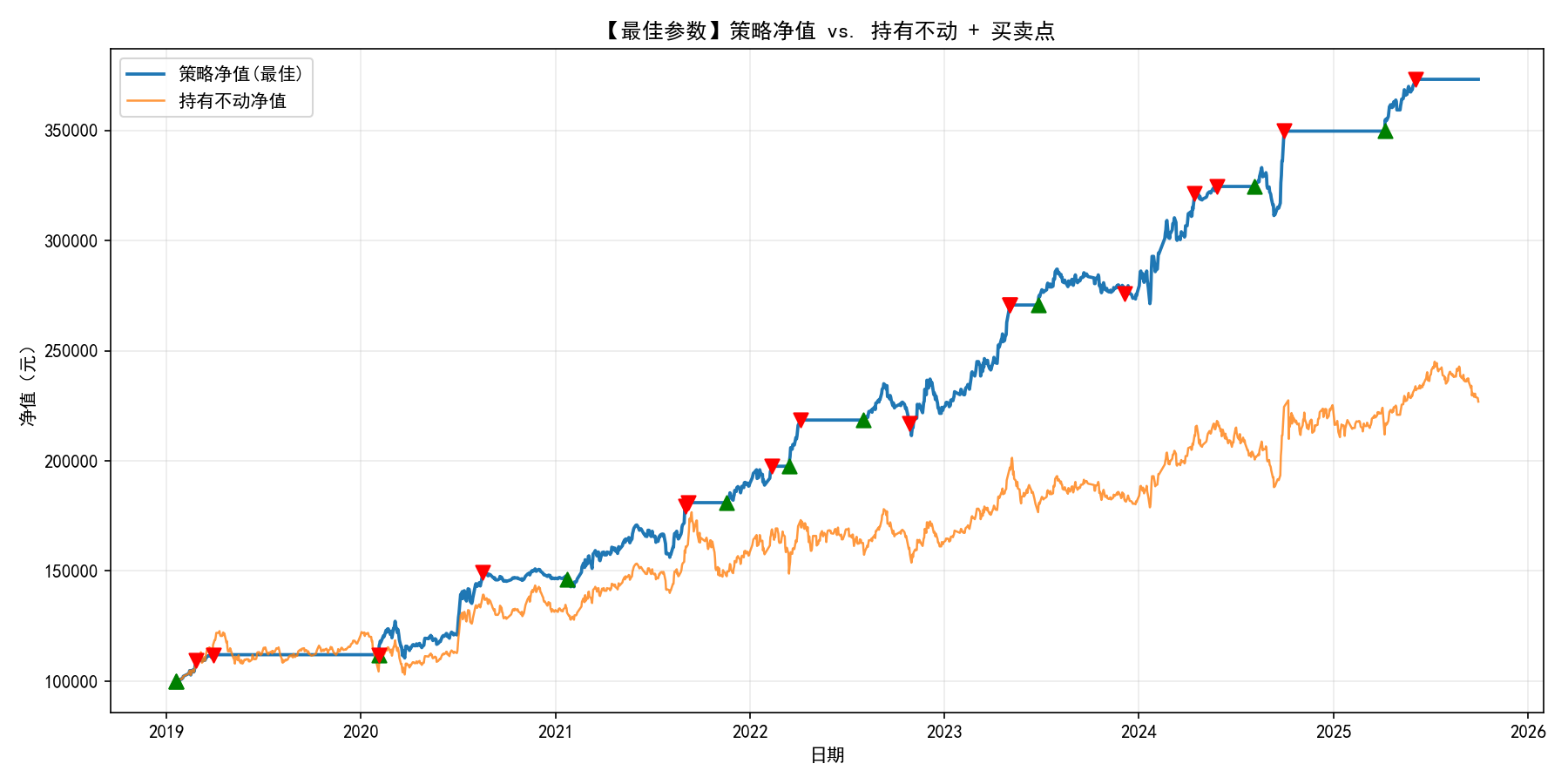

在接近7年的时间里,我们的策略让本金翻了接近3倍,达到了高达22.28%的年化收益率。具体的买卖点与净值曲线如下图所示。

代码如下:

# -*- coding: utf-8 -*-

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from pathlib import Path# 通道波段策略

# ===================== 参数区(可按需调整) =====================

data_file = '512890.xlsx' # 数据文件名(与脚本同目录)

initial_capital = 100000 # 初始现金(元)

fee_rate = 0.0 # 单边手续费比例(默认0,可设 0.0005 等)channel_quantile = 0.90 # 通道宽度的分位数(残差 |e| 的分位数,默认90%),意味着大约90%的数据会落在分布带中。分位数对离群点更鲁棒:一两次异常波动不会把通道拉得过宽。

s_pos = 0.5 # S线在中线->上沿之间的位置比例 [0,1]

b_pos = 0.5 # B线在中线->下沿之间的位置比例 [0,1]

near_upper_frac = 0.05 # “靠近上沿”的距离阈值(相对通道半宽的比例)

near_lower_frac = 0.1 # “靠近下沿”的距离阈值(相对通道半宽的比例)# ★ 新增:通道宽度缩放(不改变中线位置)

width_scale = 1.1 # >1 放大间距,<1 缩小间距;默认1.0不改变

width_extra = 0.0 # 绝对增量(与价格同单位),默认0buy_pct1 = 0.65 # 第一次买入(B线触发)金额占当日总资产比例

buy_pct2 = 0.35 # 第二次买入(靠近下沿触发)金额占当日总资产比例

# 说明:卖出金额严格与相应买入的“那一笔”对应,不单独使用 sell_pct,

# 若你希望改为固定百分比卖出,可在下方“卖出逻辑”处按注释替换。# ★ 新增:是否在第一天默认全仓买入(用 buy_pct1 / buy_pct2 拆成两笔)

init_full_position = True# Matplotlib 中文与显示

plt.rcParams['font.sans-serif'] = ['SimHei', 'Microsoft YaHei', 'Arial Unicode MS']

plt.rcParams['axes.unicode_minus'] = False# ===================== 数据读取与列名识别 =====================

path = Path(data_file)

if not path.exists():raise FileNotFoundError(f'未找到数据文件:{data_file}(请与脚本放在同一目录)')df = pd.read_excel(path)# 识别日期列

date_cols_try = ['时间', '日期', '交易日期', 'Date', 'date', '交易日']

date_col = None

for c in date_cols_try:if c in df.columns:date_col = cbreak

if date_col is None:raise ValueError('未识别到日期列(例如:时间/日期/交易日期/Date)。请检查数据列名。')df[date_col] = pd.to_datetime(df[date_col])

df = df.sort_values(by=date_col).reset_index(drop=True)# 识别收盘价列

close_cols_try = ['收盘', '收盘价', '收盘价(元)', 'Close', 'close', '收盘价(元)']

close_col = None

for c in close_cols_try:if c in df.columns:close_col = cbreak

if close_col is None:numeric_cols = [c for c in df.columns if c != date_col and pd.api.types.is_numeric_dtype(df[c])]if not numeric_cols:raise ValueError('未识别到收盘价列(例如:收盘/收盘价/Close)。请检查数据列名。')close_col = numeric_cols[-1]prices = df[close_col].astype(float).values

dates = df[date_col].values

n = len(prices)

if n < 3:raise ValueError('数据量太少,无法构建通道。')# ===================== 构建通道(上沿/中线/下沿 + S/B) =====================

x = np.arange(n).astype(float)

b, a = np.polyfit(x, prices, 1) # [斜率, 截距]

mid = a + b * xresid = prices - mid

w0 = np.quantile(np.abs(resid), channel_quantile)

min_w = 0.005 * np.median(prices)

w0 = max(w0, min_w)

w = max(w0 * width_scale + width_extra, min_w)upper = mid + w

lower = mid - w

S_line = mid + s_pos * w

B_line = mid - b_pos * wnear_upper_dist = near_upper_frac * w

near_lower_dist = near_lower_frac * w# ===================== 策略回测(状态机+两笔分批) =====================

cash = float(initial_capital)

shares = 0.0# 分笔持仓:b_lot 对应 B线买入;l_lot 对应“靠近下沿”买入

b_lot_qty = 0.0

l_lot_qty = 0.0equity_curve = []

bh_equity_curve = []# 基准:第一天全仓买入并持有

first_price = prices[0]

bh_shares = initial_capital / first_price# 交易记录

trades = [] # dict: time, price, action, qty, cash_delta, shares_after, equitydef total_equity(p):return cash + shares * p# ★★★ 起始建仓:第一天默认全仓买入(拆成两笔,对应后续 S/上沿 的卖出)

if init_full_position:p0 = first_priceequity0 = initial_capital# 第一笔:B线份额buy_cash1 = min(equity0 * buy_pct1, cash)if buy_cash1 > 1e-8 and p0 > 0:qty1 = buy_cash1 * (1 - fee_rate) / p0cash -= buy_cash1shares += qty1b_lot_qty += qty1trades.append({'time': dates[0], 'price': p0, 'action': '起始建仓(B线份额)','qty': qty1, 'cash_delta': -buy_cash1,'shares_after': shares, 'equity': total_equity(p0)})# 第二笔:下沿份额buy_cash2 = min(equity0 * buy_pct2, cash) # 用起始总资产拆分,保证买_pct 之和=1时为满仓if buy_cash2 > 1e-8 and p0 > 0:qty2 = buy_cash2 * (1 - fee_rate) / p0cash -= buy_cash2shares += qty2l_lot_qty += qty2trades.append({'time': dates[0], 'price': p0, 'action': '起始建仓(下沿份额)','qty': qty2, 'cash_delta': -buy_cash2,'shares_after': shares, 'equity': total_equity(p0)})# 若 buy_pct1 + buy_pct2 < 1,保留未用现金;>1 则第二笔按剩余现金自动截断prev_p = prices[0]

prev_B = B_line[0]

prev_S = S_line[0]for i in range(n):p = prices[i]# 基准净值bh_equity_curve.append(bh_shares * p)# —— 卖出侧 ——(先处理)if i > 0:# 上穿 S:卖出“B线那一笔”if (prev_p < prev_S) and (p >= S_line[i]):if b_lot_qty > 0:sell_qty = min(b_lot_qty, shares)if sell_qty > 1e-12:proceeds = sell_qty * p * (1 - fee_rate)cash += proceedsshares -= sell_qtyb_lot_qty -= sell_qtytrades.append({'time': dates[i], 'price': p, 'action': 'S线卖出(对应B线)','qty': -sell_qty, 'cash_delta': proceeds,'shares_after': shares, 'equity': total_equity(p)})# 触及上沿附近:卖出“下沿那一笔”if l_lot_qty > 0:if p >= (upper[i] - near_upper_dist):sell_qty = min(l_lot_qty, shares)if sell_qty > 1e-12:proceeds = sell_qty * p * (1 - fee_rate)cash += proceedsshares -= sell_qtyl_lot_qty -= sell_qtytrades.append({'time': dates[i], 'price': p, 'action': '上沿附近卖出(对应下沿加仓)','qty': -sell_qty, 'cash_delta': proceeds,'shares_after': shares, 'equity': total_equity(p)})# —— 买入侧 ——# 下穿 B:若尚无 B 线那一笔,则买入if i > 0:if (prev_p > prev_B) and (p <= B_line[i]):if b_lot_qty <= 1e-12:target_cash = total_equity(p) * buy_pct1buy_cash = min(target_cash, cash)if buy_cash > 1e-8 and p > 0:qty = buy_cash * (1 - fee_rate) / pcash -= buy_cashshares += qtyb_lot_qty += qtytrades.append({'time': dates[i], 'price': p, 'action': 'B线买入','qty': qty, 'cash_delta': -buy_cash,'shares_after': shares, 'equity': total_equity(p)})# 触及下沿附近:若已有 B 线那一笔且尚无下沿那一笔,则再买if (b_lot_qty > 1e-12) and (l_lot_qty <= 1e-12):if p <= (lower[i] + near_lower_dist):target_cash = total_equity(p) * buy_pct2buy_cash = min(target_cash, cash)if buy_cash > 1e-8 and p > 0:qty = buy_cash * (1 - fee_rate) / pcash -= buy_cashshares += qtyl_lot_qty += qtytrades.append({'time': dates[i], 'price': p, 'action': '下沿附近加仓','qty': qty, 'cash_delta': -buy_cash,'shares_after': shares, 'equity': total_equity(p)})# 记录每日策略净值equity_curve.append(total_equity(p))prev_p = pprev_B = B_line[i]prev_S = S_line[i]equity_curve = np.array(equity_curve, dtype=float)

bh_equity_curve = np.array(bh_equity_curve, dtype=float)# ===================== 绩效统计 =====================

final_equity = float(equity_curve[-1])

final_bh = float(bh_equity_curve[-1])total_return = final_equity / initial_capital - 1.0

bh_return = final_bh / initial_capital - 1.0days = (pd.to_datetime(dates[-1]) - pd.to_datetime(dates[0])).days

years = days / 365.25 if days > 0 else 0

def ann_ret(v0, v1, yrs):if yrs <= 0 or v0 <= 0:return np.nanreturn (v1 / v0) ** (1.0 / yrs) - 1.0ann_return = ann_ret(initial_capital, final_equity, years)

bh_ann_return = ann_ret(initial_capital, final_bh, years)print(f'初始本金:{initial_capital:,.2f} 元')

print(f'最终净值(策略):{final_equity:,.2f} 元')

print(f'最终净值(持有不动):{final_bh:,.2f} 元')

print(f'总收益(策略):{total_return*100:.2f}%')

print(f'总收益(持有不动):{bh_return*100:.2f}%')

if not np.isnan(ann_return):print(f'年化收益(策略):{ann_return*100:.2f}%')

if not np.isnan(bh_ann_return):print(f'年化收益(持有不动):{bh_ann_return*100:.2f}%')# ===================== 画图 =====================

# 1) 价格 + 通道五线 + 买卖点

fig1, ax1 = plt.subplots(figsize=(12, 6))

ax1.plot(dates, prices, label='收盘价', linewidth=1.5)

ax1.plot(dates, upper, '--', label='上沿', linewidth=1.0)

ax1.plot(dates, S_line, '--', label='S线', linewidth=1.0)

ax1.plot(dates, mid, '-', label='中线', linewidth=1.0, alpha=0.7)

ax1.plot(dates, B_line, '--', label='B线', linewidth=1.0)

ax1.plot(dates, lower, '--', label='下沿', linewidth=1.0)# 标注买卖点(价格图)

if len(trades) > 0:buy_B_x = [t['time'] for t in trades if 'B线买入' in t['action'] or '起始建仓(B线份额)' in t['action']]buy_B_y = [t['price'] for t in trades if 'B线买入' in t['action'] or '起始建仓(B线份额)' in t['action']]buy_L_x = [t['time'] for t in trades if '下沿附近加仓' in t['action'] or '起始建仓(下沿份额)' in t['action']]buy_L_y = [t['price'] for t in trades if '下沿附近加仓' in t['action'] or '起始建仓(下沿份额)' in t['action']]sell_S_x = [t['time'] for t in trades if 'S线卖出' in t['action']]sell_S_y = [t['price'] for t in trades if 'S线卖出' in t['action']]sell_U_x = [t['time'] for t in trades if '上沿附近卖出' in t['action']]sell_U_y = [t['price'] for t in trades if '上沿附近卖出' in t['action']]ax1.scatter(buy_B_x, buy_B_y, marker='^', s=70, label='B线买入/起始份额', zorder=5)ax1.scatter(buy_L_x, buy_L_y, marker='P', s=70, label='下沿加仓/起始份额', zorder=5)ax1.scatter(sell_S_x, sell_S_y, marker='v', s=70, label='S线卖出(对应B线)', zorder=5)ax1.scatter(sell_U_x, sell_U_y, marker='v', s=70, label='上沿附近卖出(对应下沿)', zorder=5)ax1.set_title('价格 + 通道五线 + 买卖点')

ax1.set_xlabel('日期')

ax1.set_ylabel('价格')

ax1.legend(loc='best')

ax1.grid(alpha=0.25)# 2) 净值曲线 + 买卖点

fig2, ax2 = plt.subplots(figsize=(12, 6))

ax2.plot(dates, equity_curve, label='策略净值', linewidth=1.8)

ax2.plot(dates, bh_equity_curve, label='持有不动净值', linewidth=1.2, alpha=0.8)# 在净值图上也标注买卖点(用当日策略净值)

if len(trades) > 0:bx = [t['time'] for t in trades]by = [t['equity'] for t in trades]colors = []markers = []for t in trades:if '买入' in t['action'] or '起始建仓' in t['action']:colors.append('green'); markers.append('^')else:colors.append('red'); markers.append('v')for x_i, y_i, m_i, c_i in zip(bx, by, markers, colors):ax2.scatter(x_i, y_i, marker=m_i, s=60, color=c_i, zorder=5)ax2.set_title('策略净值 vs. 持有不动 + 买卖点')

ax2.set_xlabel('日期')

ax2.set_ylabel('净值(元)')

ax2.legend(loc='best')

ax2.grid(alpha=0.25)plt.tight_layout()

plt.show()

# 如需保存图片,建议放在 plt.show() 之前(避免某些环境下空图):

fig1.savefig('价格_通道_买卖点.png', dpi=150)

fig2.savefig('净值曲线_买卖点.png', dpi=150)# ===================== 使用说明与可选改动 =====================

# 1) 若你希望“卖出比例可独立设置”,而不是严格对应那一笔买入,

# 可以把“卖出逻辑”里 sell_qty 的定义替换为:

# - S线卖出:sell_qty = min(shares, (total_equity(p) * sell_pct1) / p)

# - 上沿卖出:sell_qty = min(shares, (total_equity(p) * sell_pct2) / p)

# 并在参数区添加 sell_pct1、sell_pct2(默认 0.5)。

#

# 2) 通道宽度:当前使用 |残差| 的分位数(channel_quantile)来控制包含度;

# 或改为 k 倍标准差:w = k * resid.std()。

#

# 3) “靠近上/下沿”的定义:使用 near_upper_frac/near_lower_frac * w 的距离阈值。

#

# 4) 资金使用:买入金额以“当日总资产”为基准,自动受“现金余额”约束;卖出按对应分笔数量。

# 起始建仓后,会先等待卖出触发;当两笔都卖完后,才会进入下一轮 B/下沿 的买入。

#

# 注意:代码的线(中线/通道宽度)是用到今天为止的历史重新估出来的,所以每天的阈值会随数据滚动更新(这在实盘里是合理的“当期可见信息”)。

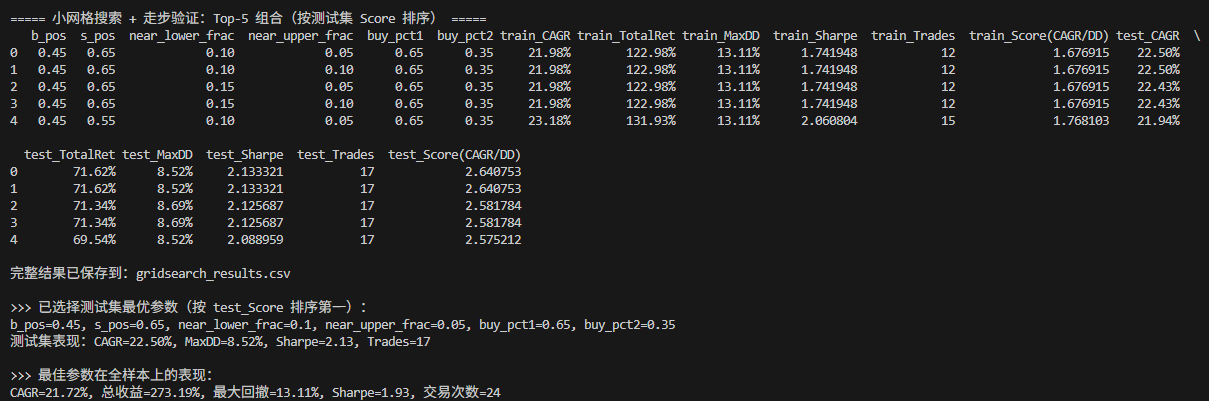

4.优化参数组合

考虑到我们当前敲定的参数组合可能并不是最优解,因此我们需要搜索更优的参数组合。

这里我使用小网格搜索 + 走步验证(walk-forward)+ 指标表的方式,在前 60% 样本做调参(训练集),在后 40% 做验证(测试集),输出每个参数组合在训练/测试上的 CAGR复合年化、总收益、最大回撤、Sharpe夏普比率、交易次数。

运行后我们得到如下结果:

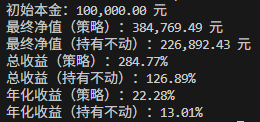

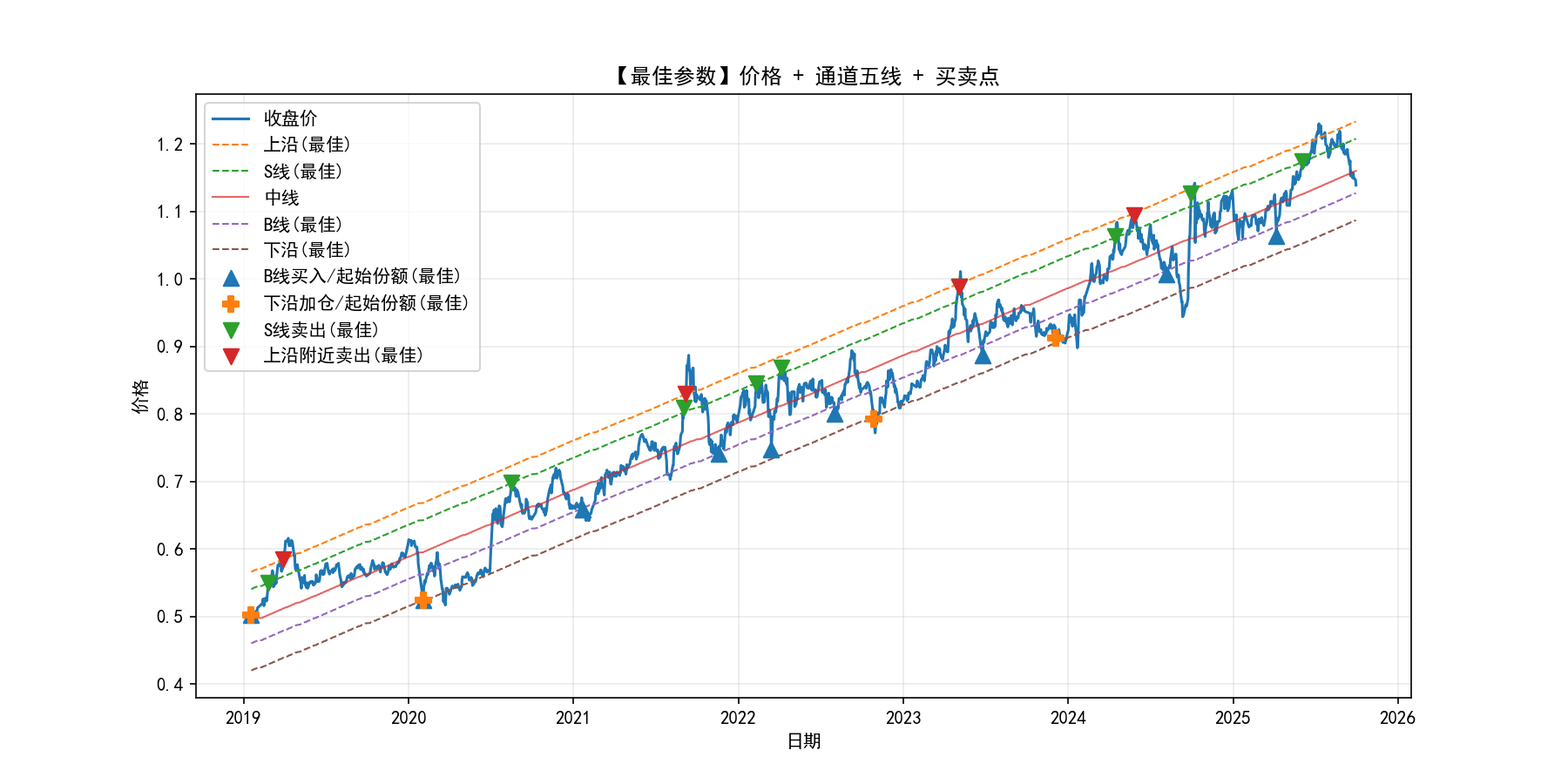

通过此方法搜索到的最佳参数组合为:

设置B线在35%的位置,S线在65%的位置,下沿线“靠近阈值”为10%,上沿线“靠近阈值”为5%,B线买入仓位为65%,下沿线买入仓位为35%

在测试集上的表现为:CAGR年化=21.72%, 总收益=273.19%, 最大回撤=13.11%, Sharpe夏普比率=1.93, 交易次数=24

从夏普比率来看,此策略的风险收益比相当优秀。

(需要注意的是,这一步的收益率没有上一章节高,原因是这里将原始数据划分为训练集和测试集了,得出的收益率是测试集上的数据,所以会有一定的差距,但这也侧面说明此策略具有一定的健壮性)

具体情况如下图:

代码如下:

# -*- coding: utf-8 -*-

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from pathlib import Path# ===================== 参数区(可按需调整) =====================

data_file = '512890.xlsx' # 数据文件名(与脚本同目录)

initial_capital = 100000 # 初始现金(元)

fee_rate = 0.0 # 单边手续费比例(默认0,可设 0.0005 等)channel_quantile = 0.90 # 通道宽度分位数(|残差|的分位数)

s_pos = 0.5 # S线在中线->上沿之间的位置比例 [0,1]

b_pos = 0.5 # B线在中线->下沿之间的位置比例 [0,1]

near_upper_frac = 0.05 # “靠近上沿”的阈值(相对半宽比例)

near_lower_frac = 0.10 # “靠近下沿”的阈值(相对半宽比例)# 通道宽度缩放(不改变中线)

width_scale = 1.1 # >1 放大间距,<1 缩小间距

width_extra = 0.0 # 绝对增量(与价格同单位)# 仓位分配

buy_pct1 = 0.65 # 第一次买入(B线触发)金额占当日总资产比例

buy_pct2 = 0.35 # 第二次买入(下沿附近触发)金额占当日总资产比例# 第一日起始建仓

init_full_position = True # True:第一天按 buy_pct1/buy_pct2 拆成两笔建仓# ====== 网格搜索与走步验证设置 ======

do_grid_search = True # 是否执行小网格搜索 + 走步验证

train_ratio = 0.60 # 训练/验证划分(按时间顺序)

# 小网格(先定“时点”):B/S 位置 + 上/下沿触发距离

grid_b_pos = [0.45, 0.55, 0.65]

grid_s_pos = [0.55, 0.65, 0.75]

grid_near_lower = [0.10, 0.15]

grid_near_upper = [0.05, 0.10]

# 可选:第二步微调仓位(默认关闭,避免计算太多)

enable_buy_grid = False

grid_buy_pct1 = [max(0.2, buy_pct1-0.1), buy_pct1, min(0.8, buy_pct1+0.1)]

grid_buy_pct2 = [max(0.2, buy_pct2-0.1), buy_pct2, min(0.8, buy_pct2+0.1)]# Matplotlib 中文与显示

plt.rcParams['font.sans-serif'] = ['SimHei', 'Microsoft YaHei', 'Arial Unicode MS']

plt.rcParams['axes.unicode_minus'] = False# ===================== 数据读取与列名识别 =====================

path = Path(data_file)

if not path.exists():raise FileNotFoundError(f'未找到数据文件:{data_file}(请与脚本放在同一目录)')df = pd.read_excel(path)# 识别日期列

date_cols_try = ['时间', '日期', '交易日期', 'Date', 'date', '交易日']

date_col = None

for c in date_cols_try:if c in df.columns:date_col = cbreak

if date_col is None:raise ValueError('未识别到日期列(例如:时间/日期/交易日期/Date)。请检查数据列名。')df[date_col] = pd.to_datetime(df[date_col])

df = df.sort_values(by=date_col).reset_index(drop=True)# 识别收盘价列

close_cols_try = ['收盘', '收盘价', '收盘价(元)', 'Close', 'close', '收盘价(元)']

close_col = None

for c in close_cols_try:if c in df.columns:close_col = cbreak

if close_col is None:numeric_cols = [c for c in df.columns if c != date_col and pd.api.types.is_numeric_dtype(df[c])]if not numeric_cols:raise ValueError('未识别到收盘价列(例如:收盘/收盘价/Close)。请检查数据列名。')close_col = numeric_cols[-1]prices = df[close_col].astype(float).values

dates = df[date_col].values

n = len(prices)

if n < 50:raise ValueError('样本太少,建议至少 50 根K线。')# ===================== 通用函数 =====================

def build_channel(prices_local, channel_quantile, width_scale, width_extra, s_pos, b_pos,near_upper_frac, near_lower_frac):"""基于当前窗口数据构建通道五线与触发距离"""m = len(prices_local)x = np.arange(m).astype(float)slope, intercept = np.polyfit(x, prices_local, 1) # [斜率, 截距]mid = intercept + slope * xresid = prices_local - midw0 = np.quantile(np.abs(resid), channel_quantile)min_w = 0.005 * np.median(prices_local) # 至少中位价的0.5%w0 = max(w0, min_w)w = max(w0 * width_scale + width_extra, min_w)upper = mid + wlower = mid - wS_line = mid + s_pos * wB_line = mid - b_pos * wnear_upper_dist = near_upper_frac * wnear_lower_dist = near_lower_frac * wreturn mid, upper, lower, S_line, B_line, near_upper_dist, near_lower_distdef backtest_once(prices_local, dates_local, params):"""按给定参数在一个窗口内回测,返回指标、净值曲线、交易记录"""(channel_quantile, width_scale, width_extra, s_pos, b_pos,near_upper_frac, near_lower_frac, buy_pct1, buy_pct2,fee_rate, init_full_position) = paramsmid, upper, lower, S_line, B_line, near_U, near_L = build_channel(prices_local, channel_quantile, width_scale, width_extra, s_pos, b_pos,near_upper_frac, near_lower_frac)cash = float(initial_capital)shares = 0.0b_lot_qty = 0.0l_lot_qty = 0.0equity_curve = []trades = []# 基准:第一天全仓买入(买入持有)first_price = prices_local[0]bh_shares = initial_capital / first_pricebh_equity_curve = [bh_shares * p for p in prices_local]def total_equity(p): return cash + shares * p# 起始建仓(按两笔拆分)if init_full_position:p0 = first_priceeq0 = initial_capital# B线份额buy_cash1 = min(eq0 * buy_pct1, cash)if buy_cash1 > 1e-8 and p0 > 0:qty1 = buy_cash1 * (1 - fee_rate) / p0cash -= buy_cash1; shares += qty1; b_lot_qty += qty1trades.append({'time': dates_local[0], 'price': p0, 'action': '起始建仓(B线份额)','qty': qty1, 'cash_delta': -buy_cash1,'shares_after': shares, 'equity': total_equity(p0)})# 下沿份额buy_cash2 = min(eq0 * buy_pct2, cash)if buy_cash2 > 1e-8 and p0 > 0:qty2 = buy_cash2 * (1 - fee_rate) / p0cash -= buy_cash2; shares += qty2; l_lot_qty += qty2trades.append({'time': dates_local[0], 'price': p0, 'action': '起始建仓(下沿份额)','qty': qty2, 'cash_delta': -buy_cash2,'shares_after': shares, 'equity': total_equity(p0)})prev_p = prices_local[0]prev_B = B_line[0]prev_S = S_line[0]for i, p in enumerate(prices_local):# —— 卖出侧 —— 先处理if i > 0:# 上穿 S:卖出“B线那一笔”if (prev_p < prev_S) and (p >= S_line[i]):if b_lot_qty > 0:sell_qty = min(b_lot_qty, shares)if sell_qty > 1e-12:proceeds = sell_qty * p * (1 - fee_rate)cash += proceeds; shares -= sell_qty; b_lot_qty -= sell_qtytrades.append({'time': dates_local[i], 'price': p, 'action': 'S线卖出(对应B线)','qty': -sell_qty, 'cash_delta': proceeds,'shares_after': shares, 'equity': total_equity(p)})# 上沿附近:卖出“下沿那一笔”if l_lot_qty > 0 and p >= (upper[i] - near_U):sell_qty = min(l_lot_qty, shares)if sell_qty > 1e-12:proceeds = sell_qty * p * (1 - fee_rate)cash += proceeds; shares -= sell_qty; l_lot_qty -= sell_qtytrades.append({'time': dates_local[i], 'price': p, 'action': '上沿附近卖出(对应下沿)','qty': -sell_qty, 'cash_delta': proceeds,'shares_after': shares, 'equity': total_equity(p)})# —— 买入侧 ——if i > 0 and (prev_p > prev_B) and (p <= B_line[i]) and (b_lot_qty <= 1e-12):buy_cash = min(total_equity(p) * buy_pct1, cash)if buy_cash > 1e-8 and p > 0:qty = buy_cash * (1 - fee_rate) / pcash -= buy_cash; shares += qty; b_lot_qty += qtytrades.append({'time': dates_local[i], 'price': p, 'action': 'B线买入','qty': qty, 'cash_delta': -buy_cash,'shares_after': shares, 'equity': total_equity(p)})if (b_lot_qty > 1e-12) and (l_lot_qty <= 1e-12) and (p <= (lower[i] + near_L)):buy_cash = min(total_equity(p) * buy_pct2, cash)if buy_cash > 1e-8 and p > 0:qty = buy_cash * (1 - fee_rate) / pcash -= buy_cash; shares += qty; l_lot_qty += qtytrades.append({'time': dates_local[i], 'price': p, 'action': '下沿附近加仓','qty': qty, 'cash_delta': -buy_cash,'shares_after': shares, 'equity': total_equity(p)})equity_curve.append(total_equity(p))prev_p = p; prev_B = B_line[i]; prev_S = S_line[i]equity_curve = np.array(equity_curve, dtype=float)bh_equity_curve = np.array(bh_equity_curve, dtype=float)# 指标final_equity = float(equity_curve[-1])total_return = final_equity / initial_capital - 1.0days = (pd.to_datetime(dates_local[-1]) - pd.to_datetime(dates_local[0])).daysyears = days / 365.25 if days > 0 else np.nanCAGR = (final_equity / initial_capital) ** (1/years) - 1 if years and years > 0 else np.nan# 最大回撤peak = np.maximum.accumulate(equity_curve)dd = (equity_curve - peak) / peakmaxDD = -dd.min() if len(dd) > 0 else np.nan# Sharpe(按交易日 252)daily_ret = pd.Series(equity_curve).pct_change().dropna()if not daily_ret.empty:sharpe = np.sqrt(252) * daily_ret.mean() / (daily_ret.std(ddof=0) + 1e-12)else:sharpe = np.nan# 统计交易次数(不含起始建仓)trade_count = sum(1 for t in trades if '起始建仓' not in t['action'])metrics = {'CAGR': CAGR, 'TotalRet': total_return, 'MaxDD': maxDD, 'Sharpe': sharpe,'Trades': trade_count, 'EquityCurve': equity_curve, 'BHCurve': bh_equity_curve,'TradesList': trades}return metricsdef fmt_pct(x):return None if pd.isna(x) else f"{x*100:.2f}%"# ===================== 主回测(用当前参数绘图) =====================

# 先跑一遍主参数,便于可视化

params_main = (channel_quantile, width_scale, width_extra, s_pos, b_pos,near_upper_frac, near_lower_frac, buy_pct1, buy_pct2,fee_rate, init_full_position)

m_main = backtest_once(prices, dates, params_main)print(f'初始本金:{initial_capital:,.2f} 元')

print(f'最终净值(策略):{m_main["EquityCurve"][-1]:,.2f} 元')

print(f'总收益(策略):{fmt_pct(m_main["TotalRet"])}')

print(f'年化收益(策略):{fmt_pct(m_main["CAGR"])}')

print(f'最大回撤(策略):{fmt_pct(m_main["MaxDD"])}')

print(f'Sharpe(策略):{m_main["Sharpe"]:.2f}')

print(f'交易次数:{m_main["Trades"]}')# ===== 画图:价格 + 五线 + 买卖点(用主参数重算通道) =====

mid, upper, lower, S_line_draw, B_line_draw, near_U_d, near_L_d = build_channel(prices, channel_quantile, width_scale, width_extra, s_pos, b_pos,near_upper_frac, near_lower_frac

)fig1, ax1 = plt.subplots(figsize=(12, 6))

ax1.plot(dates, prices, label='收盘价', linewidth=1.5)

ax1.plot(dates, upper, '--', label='上沿', linewidth=1.0)

ax1.plot(dates, S_line_draw, '--', label='S线', linewidth=1.0)

ax1.plot(dates, mid, '-', label='中线', linewidth=1.0, alpha=0.7)

ax1.plot(dates, B_line_draw, '--', label='B线', linewidth=1.0)

ax1.plot(dates, lower, '--', label='下沿', linewidth=1.0)trades_main = m_main['TradesList']

if len(trades_main) > 0:buy_B_x = [t['time'] for t in trades_main if 'B线买入' in t['action'] or '起始建仓(B线份额)' in t['action']]buy_B_y = [t['price'] for t in trades_main if 'B线买入' in t['action'] or '起始建仓(B线份额)' in t['action']]buy_L_x = [t['time'] for t in trades_main if '下沿附近加仓' in t['action'] or '起始建仓(下沿份额)' in t['action']]buy_L_y = [t['price'] for t in trades_main if '下沿附近加仓' in t['action'] or '起始建仓(下沿份额)' in t['action']]sell_S_x = [t['time'] for t in trades_main if 'S线卖出' in t['action']]sell_S_y = [t['price'] for t in trades_main if 'S线卖出' in t['action']]sell_U_x = [t['time'] for t in trades_main if '上沿附近卖出' in t['action']]sell_U_y = [t['price'] for t in trades_main if '上沿附近卖出' in t['action']]ax1.scatter(buy_B_x, buy_B_y, marker='^', s=70, label='B线买入/起始份额', zorder=5)ax1.scatter(buy_L_x, buy_L_y, marker='P', s=70, label='下沿加仓/起始份额', zorder=5)ax1.scatter(sell_S_x, sell_S_y, marker='v', s=70, label='S线卖出(对应B线)', zorder=5)ax1.scatter(sell_U_x, sell_U_y, marker='v', s=70, label='上沿附近卖出(对应下沿)', zorder=5)ax1.set_title('价格 + 通道五线 + 买卖点')

ax1.set_xlabel('日期'); ax1.set_ylabel('价格'); ax1.legend(loc='best'); ax1.grid(alpha=0.25)# 净值曲线

fig2, ax2 = plt.subplots(figsize=(12, 6))

ax2.plot(dates, m_main['EquityCurve'], label='策略净值', linewidth=1.8)

bh_curve = (initial_capital / prices[0]) * prices # 买入持有

ax2.plot(dates, bh_curve, label='持有不动净值', linewidth=1.2, alpha=0.8)

if len(trades_main) > 0:bx = [t['time'] for t in trades_main]by = [t['equity'] for t in trades_main]for t, x_i, y_i in zip(trades_main, bx, by):mkr = '^' if ('买入' in t['action'] or '起始建仓' in t['action']) else 'v'col = 'green' if mkr == '^' else 'red'ax2.scatter(x_i, y_i, marker=mkr, s=60, color=col, zorder=5)

ax2.set_title('策略净值 vs. 持有不动 + 买卖点')

ax2.set_xlabel('日期'); ax2.set_ylabel('净值(元)'); ax2.legend(loc='best'); ax2.grid(alpha=0.25)plt.tight_layout()

# 如需保存图片,建议放在 show 之前

# fig1.savefig('价格_通道_买卖点.png', dpi=150)

# fig2.savefig('净值曲线_买卖点.png', dpi=150)

plt.show()# ===================== 小网格搜索 + 走步验证 =====================

if do_grid_search:split_idx = int(len(prices) * train_ratio)prices_train, dates_train = prices[:split_idx], dates[:split_idx]prices_test, dates_test = prices[split_idx:], dates[split_idx:]rows = []# 组装网格if enable_buy_grid:buy1_list = grid_buy_pct1buy2_list = grid_buy_pct2else:buy1_list = [buy_pct1]buy2_list = [buy_pct2]for bp in grid_b_pos:for sp in grid_s_pos:for nl in grid_near_lower:for nu in grid_near_upper:for b1 in buy1_list:for b2 in buy2_list:params_train = (channel_quantile, width_scale, width_extra,sp, bp, nu, nl, b1, b2, fee_rate, init_full_position)m_tr = backtest_once(prices_train, dates_train, params_train)score_tr = (m_tr['CAGR'] / max(m_tr['MaxDD'], 1e-6)if (m_tr['CAGR'] is not None and not pd.isna(m_tr['CAGR'])) else -np.inf)# 在测试集复用同一组参数独立回测(注意:每个窗口内部都会重新拟合通道)m_te = backtest_once(prices_test, dates_test, params_train)score_te = (m_te['CAGR'] / max(m_te['MaxDD'], 1e-6)if (m_te['CAGR'] is not None and not pd.isna(m_te['CAGR'])) else -np.inf)rows.append({'b_pos': bp, 's_pos': sp,'near_lower_frac': nl, 'near_upper_frac': nu,'buy_pct1': b1, 'buy_pct2': b2,'train_CAGR': m_tr['CAGR'], 'train_TotalRet': m_tr['TotalRet'],'train_MaxDD': m_tr['MaxDD'], 'train_Sharpe': m_tr['Sharpe'],'train_Trades': m_tr['Trades'], 'train_Score(CAGR/DD)': score_tr,'test_CAGR': m_te['CAGR'], 'test_TotalRet': m_te['TotalRet'],'test_MaxDD': m_te['MaxDD'], 'test_Sharpe': m_te['Sharpe'],'test_Trades': m_te['Trades'], 'test_Score(CAGR/DD)': score_te})res_df = pd.DataFrame(rows)# 排序:按测试集评分,其次按测试CAGRres_df_sorted = res_df.sort_values(by=['test_Score(CAGR/DD)', 'test_CAGR'], ascending=[False, False]).reset_index(drop=True)# 保存全量结果res_df_sorted.to_csv('gridsearch_results.csv', index=False, encoding='utf-8-sig')# 展示 Top-5(格式化输出)top5 = res_df_sorted.head(5).copy()def _fmt(df, cols_pct):for c in cols_pct:df[c] = df[c].apply(lambda x: fmt_pct(x) if pd.notna(x) else None)return dftop5_display = top5.copy()top5_display = _fmt(top5_display, ['train_CAGR','train_TotalRet','train_MaxDD','test_CAGR','test_TotalRet','test_MaxDD'])# 打印print('\n===== 小网格搜索 + 走步验证:Top-5 组合(按测试集 Score 排序) =====')with pd.option_context('display.max_columns', None, 'display.width', 180):print(top5_display[['b_pos','s_pos','near_lower_frac','near_upper_frac','buy_pct1','buy_pct2','train_CAGR','train_TotalRet','train_MaxDD','train_Sharpe','train_Trades','train_Score(CAGR/DD)','test_CAGR','test_TotalRet','test_MaxDD','test_Sharpe','test_Trades','test_Score(CAGR/DD)']])print('\n完整结果已保存到:gridsearch_results.csv')# —— 自动选取测试集最优参数并回填到主图,重新在全样本上回测与作图 —— #if not res_df_sorted.empty:best_row = res_df_sorted.iloc[0]# 打印最优参数与测试集成绩print('\n>>> 已选择测试集最优参数(按 test_Score 排序第一):')print(f"b_pos={best_row['b_pos']}, s_pos={best_row['s_pos']}, "f"near_lower_frac={best_row['near_lower_frac']}, near_upper_frac={best_row['near_upper_frac']}, "f"buy_pct1={best_row['buy_pct1']}, buy_pct2={best_row['buy_pct2']}")print(f"测试集表现:CAGR={fmt_pct(best_row['test_CAGR'])}, "f"MaxDD={fmt_pct(best_row['test_MaxDD'])}, Sharpe={best_row['test_Sharpe']:.2f}, "f"Trades={int(best_row['test_Trades'])}")# 回填参数并在“全样本”上重跑一次best_params = (channel_quantile, width_scale, width_extra,float(best_row['s_pos']), float(best_row['b_pos']),float(best_row['near_upper_frac']), float(best_row['near_lower_frac']),float(best_row['buy_pct1']), float(best_row['buy_pct2']),fee_rate, init_full_position)m_best = backtest_once(prices, dates, best_params)# 再计算一遍五条线用于绘图(全样本 + 最优参数)mid_b, upper_b, lower_b, S_b, B_b, nearU_b, nearL_b = build_channel(prices, channel_quantile, width_scale, width_extra,float(best_row['s_pos']), float(best_row['b_pos']),float(best_row['near_upper_frac']), float(best_row['near_lower_frac']))# —— 图3:价格 + 五线 +(最优参数下的)买卖点 —— #fig3, ax3 = plt.subplots(figsize=(12, 6))ax3.plot(dates, prices, label='收盘价', linewidth=1.5)ax3.plot(dates, upper_b, '--', label='上沿(最佳)', linewidth=1.0)ax3.plot(dates, S_b, '--', label='S线(最佳)', linewidth=1.0)ax3.plot(dates, mid_b, '-', label='中线', linewidth=1.0, alpha=0.7)ax3.plot(dates, B_b, '--', label='B线(最佳)', linewidth=1.0)ax3.plot(dates, lower_b, '--', label='下沿(最佳)', linewidth=1.0)trades_best = m_best['TradesList']if len(trades_best) > 0:buy_B_x = [t['time'] for t in trades_best if 'B线买入' in t['action'] or '起始建仓(B线份额)' in t['action']]buy_B_y = [t['price'] for t in trades_best if 'B线买入' in t['action'] or '起始建仓(B线份额)' in t['action']]buy_L_x = [t['time'] for t in trades_best if '下沿附近加仓' in t['action'] or '起始建仓(下沿份额)' in t['action']]buy_L_y = [t['price'] for t in trades_best if '下沿附近加仓' in t['action'] or '起始建仓(下沿份额)' in t['action']]sell_S_x = [t['time'] for t in trades_best if 'S线卖出' in t['action']]sell_S_y = [t['price'] for t in trades_best if 'S线卖出' in t['action']]sell_U_x = [t['time'] for t in trades_best if '上沿附近卖出' in t['action']]sell_U_y = [t['price'] for t in trades_best if '上沿附近卖出' in t['action']]ax3.scatter(buy_B_x, buy_B_y, marker='^', s=70, label='B线买入/起始份额(最佳)', zorder=5)ax3.scatter(buy_L_x, buy_L_y, marker='P', s=70, label='下沿加仓/起始份额(最佳)', zorder=5)ax3.scatter(sell_S_x, sell_S_y, marker='v', s=70, label='S线卖出(最佳)', zorder=5)ax3.scatter(sell_U_x, sell_U_y, marker='v', s=70, label='上沿附近卖出(最佳)', zorder=5)ax3.set_title('【最佳参数】价格 + 通道五线 + 买卖点')ax3.set_xlabel('日期'); ax3.set_ylabel('价格'); ax3.legend(loc='best'); ax3.grid(alpha=0.25)# —— 图4:最优参数下的净值曲线 —— #fig4, ax4 = plt.subplots(figsize=(12, 6))ax4.plot(dates, m_best['EquityCurve'], label='策略净值(最佳)', linewidth=1.8)bh_curve = (initial_capital / prices[0]) * pricesax4.plot(dates, bh_curve, label='持有不动净值', linewidth=1.2, alpha=0.8)if len(trades_best) > 0:bx = [t['time'] for t in trades_best]by = [t['equity'] for t in trades_best]for t, x_i, y_i in zip(trades_best, bx, by):mkr = '^' if ('买入' in t['action'] or '起始建仓' in t['action']) else 'v'col = 'green' if mkr == '^' else 'red'ax4.scatter(x_i, y_i, marker=mkr, s=60, color=col, zorder=5)# 打印全样本绩效(最佳参数)print('\n>>> 最佳参数在全样本上的表现:')print(f"CAGR={fmt_pct(m_best['CAGR'])}, 总收益={fmt_pct(m_best['TotalRet'])}, "f"最大回撤={fmt_pct(m_best['MaxDD'])}, Sharpe={m_best['Sharpe']:.2f}, "f"交易次数={m_best['Trades']}")ax4.set_title('【最佳参数】策略净值 vs. 持有不动 + 买卖点')ax4.set_xlabel('日期'); ax4.set_ylabel('净值(元)'); ax4.legend(loc='best'); ax4.grid(alpha=0.25)plt.tight_layout()plt.show()# 如需保存,取消注释fig3.savefig('最佳参数_价格_通道_买卖点.png', dpi=150)fig4.savefig('最佳参数_净值曲线_买卖点.png', dpi=150)else:print('网格结果为空,无法回填最佳参数。')总结

富在术数不在劳身,利在势局不在力耕。——《盐铁论》