量化投资初探:搭建比特币智能交易机器人

量化投资初探:搭建比特币智能交易机器人

Python实战:从零构建加密货币量化交易系统

一、加密货币量化交易革命

比特币交易数据:

- 全球日交易量:$300亿+

- 量化交易占比:70%

- 高频策略年化收益:200%+

- 波动率:5-10%(日平均)

- 交易机器人数量:100,000+

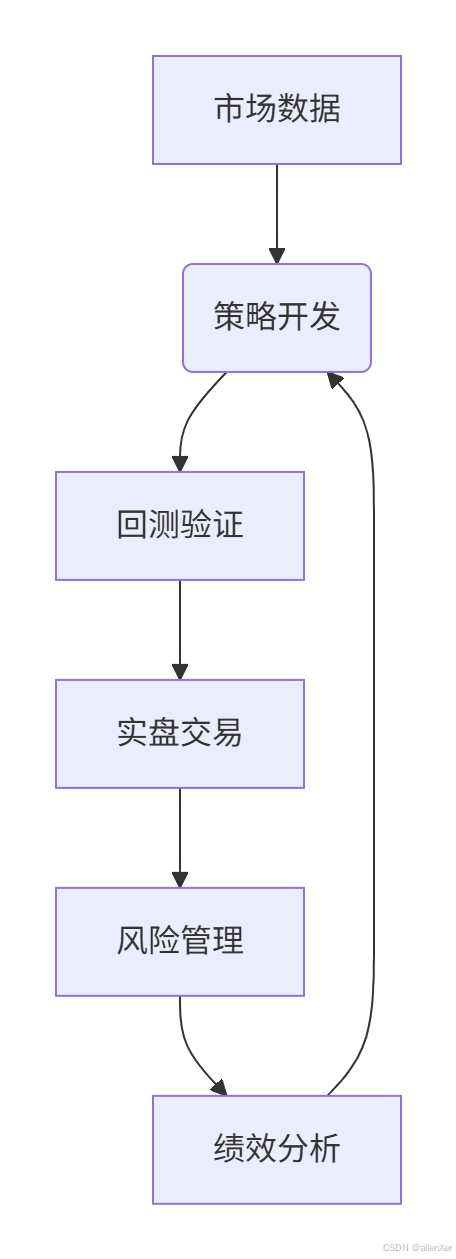

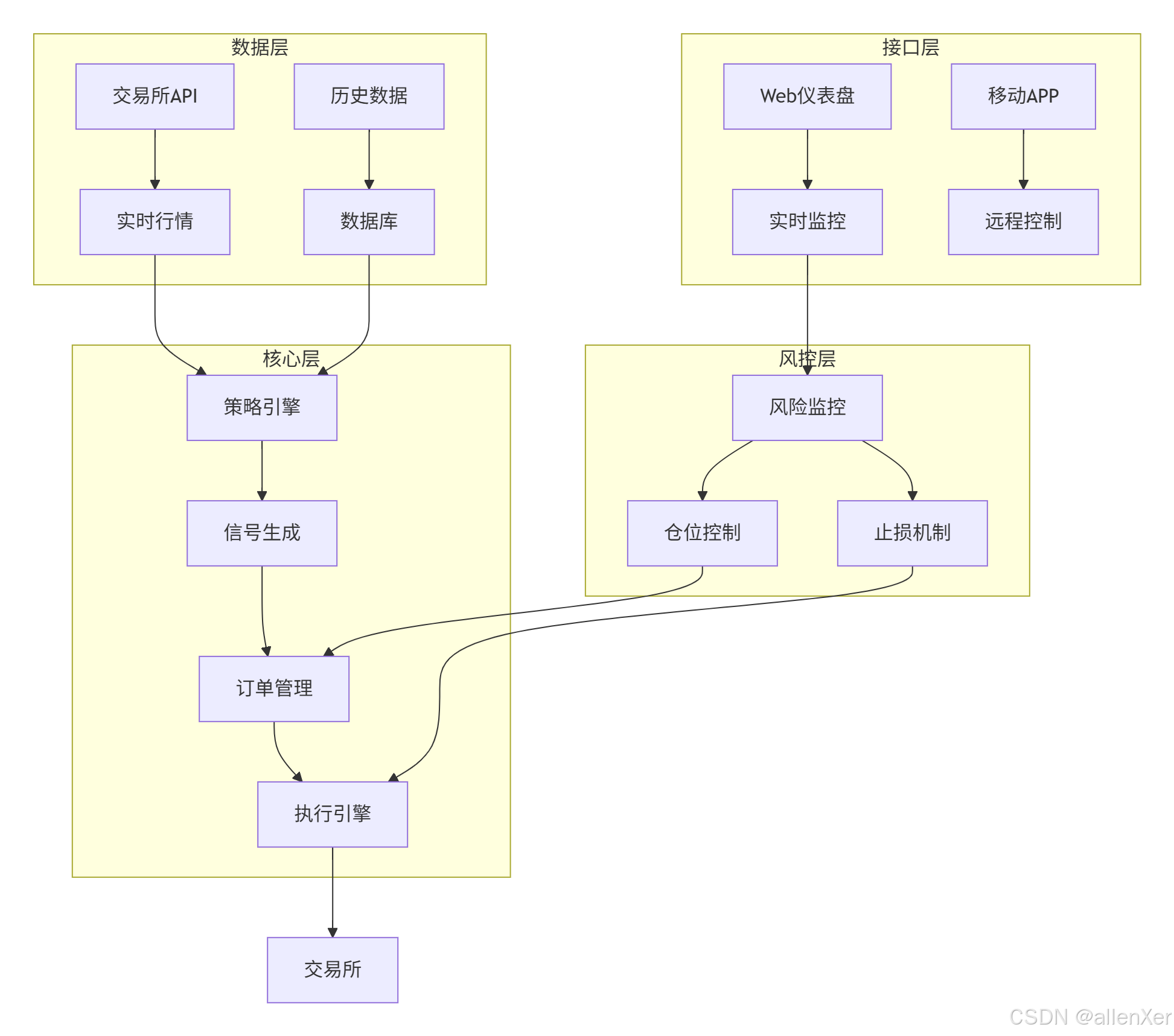

二、技术架构:智能交易系统设计

1. 系统架构图

2. 技术栈选择

| 模块 | 技术 |

|---|---|

| 数据获取 | CCXT, Websockets |

| 策略开发 | Backtrader, PyAlgoTrade |

| 回测引擎 | Backtesting.py, Zipline |

| 实时交易 | CCXT, Binance API |

| 风险管理 | Pandas, NumPy |

| 可视化 | Plotly, Dash |

| 部署 | Docker, Kubernetes |

三、环境准备:搭建量化交易平台

1. 安装核心库

# 基础库

pip install pandas numpy matplotlib# 交易库

pip install ccxt backtrader backtesting.py ta# 可视化

pip install plotly dash# 异步处理

pip install asyncio websockets2. 配置文件

# config.py

BINANCE_API_KEY = 'your_api_key'

BINANCE_SECRET_KEY = 'your_secret_key'# 交易参数

SYMBOL = 'BTC/USDT'

TIMEFRAME = '1h'

INITIAL_BALANCE = 10000 # USDT

RISK_PER_TRADE = 0.01 # 1% per trade四、数据获取:实时行情与历史数据

1. 实时行情获取

import ccxt

import pandas as pddef get_real_time_data(symbol, timeframe):"""获取实时行情数据"""exchange = ccxt.binance({'apiKey': BINANCE_API_KEY,'secret': BINANCE_SECRET_KEY,'enableRateLimit': True})# 获取最新K线ohlcv = exchange.fetch_ohlcv(symbol, timeframe, limit=100)df = pd.DataFrame(ohlcv, columns=['timestamp', 'open', 'high', 'low', 'close', 'volume'])df['timestamp'] = pd.to_datetime(df['timestamp'], unit='ms')df.set_index('timestamp', inplace=True)return df# 示例

btc_data = get_real_time_data('BTC/USDT', '1h')

print(btc_data.tail())2. 历史数据下载

def download_historical_data(symbol, timeframe, since, limit=1000):"""下载历史数据"""exchange = ccxt.binance()all_data = []while True:data = exchange.fetch_ohlcv(symbol, timeframe, since, limit)if not data:breaksince = data[-1][0] + 1all_data += dataprint(f"已获取 {len(all_data)} 条数据")if len(data) < limit:breakdf = pd.DataFrame(all_data, columns=['timestamp', 'open', 'high', 'low', 'close', 'volume'])df['timestamp'] = pd.to_datetime(df['timestamp'], unit='ms')df.set_index('timestamp', inplace=True)return df# 示例:获取2023年比特币数据

btc_2023 = download_historical_data('BTC/USDT', '1d', exchange.parse8601('2023-01-01T00:00:00Z'))

btc_2023.to_csv('btc_2023.csv')3. WebSocket实时数据

import asyncio

import websockets

import jsonasync def binance_websocket(symbol):"""Binance WebSocket实时数据"""uri = f"wss://stream.binance.com:9443/ws/{symbol.lower()}@kline_1m"async with websockets.connect(uri) as websocket:while True:message = await websocket.recv()data = json.loads(message)kline = data['k']print(f"时间: {pd.to_datetime(kline['t'], unit='ms')} | "f"开盘: {kline['o']} | 收盘: {kline['c']} | "f"最高: {kline['h']} | 最低: {kline['l']} | "f"成交量: {kline['v']}")# 运行WebSocket

# asyncio.get_event_loop().run_until_complete(binance_websocket('btcusdt'))五、策略开发:双均线交易策略

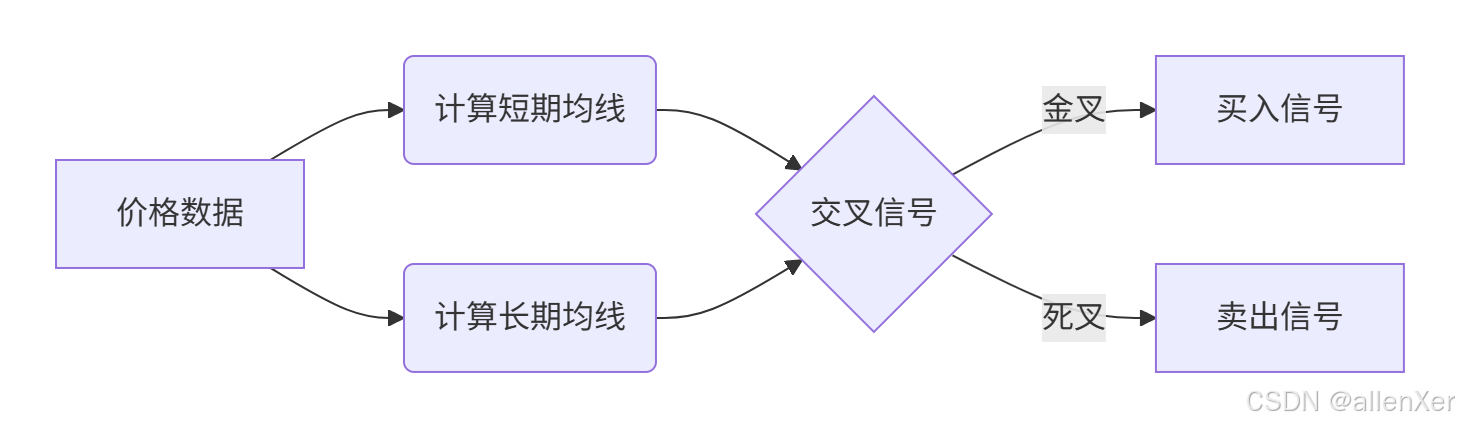

1. 策略原理

2. Backtrader实现

import backtrader as btclass DualMovingAverage(bt.Strategy):"""双均线交易策略"""params = (('fast_period', 20),('slow_period', 50),)def __init__(self):# 创建指标self.fast_ma = bt.indicators.SimpleMovingAverage(self.data.close, period=self.params.fast_period)self.slow_ma = bt.indicators.SimpleMovingAverage(self.data.close, period=self.params.slow_period)self.crossover = bt.indicators.CrossOver(self.fast_ma, self.slow_ma)def next(self):if not self.position:if self.crossover > 0: # 金叉self.buy(size=self.broker.getvalue() * 0.99 / self.data.close[0])elif self.crossover < 0: # 死叉self.sell(size=self.position.size)# 回测函数

def backtest_strategy(data, strategy, cash=10000, commission=0.001):"""策略回测"""cerebro = bt.Cerebro()cerebro.addstrategy(strategy)# 添加数据data_feed = bt.feeds.PandasData(dataname=data)cerebro.adddata(data_feed)# 设置初始资金和手续费cerebro.broker.setcash(cash)cerebro.broker.setcommission(commission=commission)# 添加分析器cerebro.addanalyzer(bt.analyzers.SharpeRatio, _name='sharpe')cerebro.addanalyzer(bt.analyzers.DrawDown, _name='drawdown')cerebro.addanalyzer(bt.analyzers.TradeAnalyzer, _name='trades')# 运行回测results = cerebro.run()strat = results[0]# 打印结果print(f"最终资产: {cerebro.broker.getvalue():.2f}")print(f"夏普比率: {strat.analyzers.sharpe.get_analysis()['sharperatio']:.2f}")print(f"最大回撤: {strat.analyzers.drawdown.get_analysis()['max']['drawdown']:.2f}%")# 可视化cerebro.plot(style='candlestick')return strat# 加载数据

data = pd.read_csv('btc_2023.csv', index_col='timestamp', parse_dates=True)

backtest_strategy(data, DualMovingAverage)3. 策略优化

def optimize_strategy(data):"""策略参数优化"""cerebro = bt.Cerebro()cerebro.adddata(bt.feeds.PandasData(dataname=data))# 添加策略并定义参数范围cerebro.optstrategy(DualMovingAverage,fast_period=range(10, 30, 5),slow_period=range(40, 70, 5))# 设置初始资金和手续费cerebro.broker.setcash(10000)cerebro.broker.setcommission(commission=0.001)# 添加分析器cerebro.addanalyzer(bt.analyzers.SharpeRatio, _name='sharpe')cerebro.addanalyzer(bt.analyzers.Returns, _name='returns')# 运行优化opt_results = cerebro.run(maxcpus=1)# 分析结果results = []for run in opt_results:for strat in run:sharpe = strat.analyzers.sharpe.get_analysis()['sharperatio']returns = strat.analyzers.returns.get_analysis()['rtot']results.append({'params': strat.params,'sharpe': sharpe,'returns': returns})# 找到最佳参数best = max(results, key=lambda x: x['sharpe'])print(f"最佳参数: {best['params']}")print(f"夏普比率: {best['sharpe']:.2f}")print(f"总收益: {best['returns']*100:.2f}%")return best六、实盘交易:连接交易所API

1. 交易引擎实现

class TradingEngine:"""交易引擎"""def __init__(self, api_key, secret_key):self.exchange = ccxt.binance({'apiKey': api_key,'secret': secret_key,'enableRateLimit': True})self.positions = {}self.balance = self.get_balance()def get_balance(self):"""获取账户余额"""balance = self.exchange.fetch_balance()return {'total': balance['total'],'free': balance['free'],'used': balance['used']}def create_order(self, symbol, side, amount, order_type='market'):"""创建订单"""try:order = self.exchange.create_order(symbol=symbol,type=order_type,side=side,amount=amount)return orderexcept Exception as e:print(f"下单失败: {str(e)}")return Nonedef get_open_orders(self, symbol):"""获取未成交订单"""return self.exchange.fetch_open_orders(symbol)def cancel_order(self, order_id):"""取消订单"""return self.exchange.cancel_order(order_id)def run_strategy(self, strategy, symbol, timeframe):"""运行交易策略"""while True:try:# 获取最新数据data = get_real_time_data(symbol, timeframe)# 生成信号signal = strategy.generate_signal(data)# 执行交易if signal == 'BUY':self.execute_buy(symbol)elif signal == 'SELL':self.execute_sell(symbol)# 等待下一个周期time.sleep(timeframe_to_seconds(timeframe))except Exception as e:print(f"策略执行错误: {str(e)}")time.sleep(60)def timeframe_to_seconds(tf):"""时间帧转换为秒"""units = {'1m': 60,'5m': 300,'15m': 900,'30m': 1800,'1h': 3600,'4h': 14400,'1d': 86400}return units.get(tf, 60)2. 双均线策略实现

class DualMAStrategy:"""双均线策略"""def __init__(self, fast_period=20, slow_period=50):self.fast_period = fast_periodself.slow_period = slow_perioddef generate_signal(self, data):"""生成交易信号"""# 计算均线data['fast_ma'] = data['close'].rolling(self.fast_period).mean()data['slow_ma'] = data['close'].rolling(self.slow_period).mean()# 检查交叉if data['fast_ma'].iloc[-1] > data['slow_ma'].iloc[-1] and data['fast_ma'].iloc[-2] <= data['slow_ma'].iloc[-2]:return 'BUY'elif data['fast_ma'].iloc[-1] < data['slow_ma'].iloc[-1] and data['fast_ma'].iloc[-2] >= data['slow_ma'].iloc[-2]:return 'SELL'return 'HOLD'3. 交易执行逻辑

class TradingBot:"""交易机器人"""def __init__(self, engine, strategy, symbol, initial_balance, risk_per_trade):self.engine = engineself.strategy = strategyself.symbol = symbolself.initial_balance = initial_balanceself.risk_per_trade = risk_per_tradeself.position = Nonedef execute_buy(self):"""执行买入"""if self.position:return # 已有仓位# 计算买入数量price = self.engine.get_current_price(self.symbol)risk_amount = self.initial_balance * self.risk_per_tradeamount = risk_amount / price# 下单order = self.engine.create_order(self.symbol, 'buy', amount)if order:self.position = {'entry_price': price,'amount': amount,'stop_loss': price * 0.95 # 5%止损}print(f"买入 {amount} {self.symbol} @ {price}")def execute_sell(self):"""执行卖出"""if not self.position:return # 没有仓位# 卖出全部仓位amount = self.position['amount']order = self.engine.create_order(self.symbol, 'sell', amount)if order:print(f"卖出 {amount} {self.symbol}")self.position = Nonedef check_stop_loss(self):"""检查止损"""if self.position:current_price = self.engine.get_current_price(self.symbol)if current_price <= self.position['stop_loss']:print(f"触发止损 @ {current_price}")self.execute_sell()def run(self):"""运行交易机器人"""while True:try:# 获取信号data = self.engine.get_recent_data(self.symbol, '1h', 100)signal = self.strategy.generate_signal(data)# 执行信号if signal == 'BUY':self.execute_buy()elif signal == 'SELL':self.execute_sell()# 检查止损self.check_stop_loss()# 等待下一周期time.sleep(3600) # 每小时检查一次except Exception as e:print(f"交易错误: {str(e)}")time.sleep(60)七、风险管理:保护你的资金

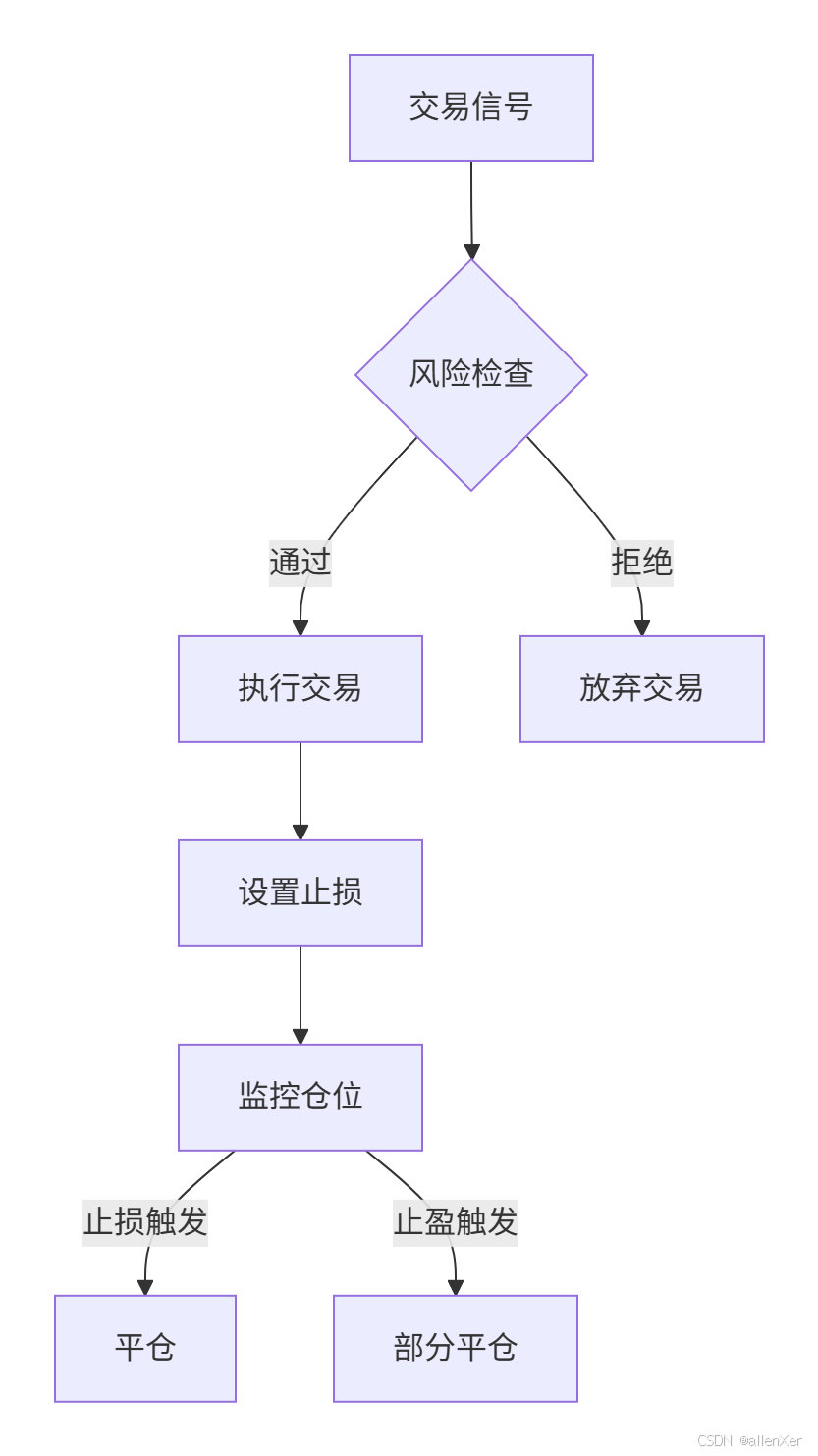

1. 风险控制策略

2. 动态止损策略

class DynamicRiskManager:"""动态风险管理器"""def __init__(self, max_drawdown=0.1, volatility_factor=2.0):self.max_drawdown = max_drawdownself.volatility_factor = volatility_factorself.portfolio_value = []def calculate_position_size(self, price, atr):"""计算仓位大小"""# 基于波动率调整仓位risk_unit = self.portfolio_value[-1] * 0.01 # 1%风险position_size = risk_unit / (atr * self.volatility_factor)return position_sizedef calculate_stop_loss(self, entry_price, atr):"""计算止损价"""return entry_price - atr * self.volatility_factordef calculate_take_profit(self, entry_price, atr):"""计算止盈价"""return entry_price + atr * self.volatility_factor * 2def update_portfolio_value(self, value):"""更新投资组合价值"""self.portfolio_value.append(value)# 检查最大回撤peak = max(self.portfolio_value)current = self.portfolio_value[-1]drawdown = (peak - current) / peakif drawdown > self.max_drawdown:return 'REDUCE_RISK'return 'NORMAL'3. 多策略风控系统

class RiskManagementSystem:"""综合风控系统"""def __init__(self, engine):self.engine = engineself.position_limits = {'BTC': 0.3, # 最大仓位30%'ETH': 0.2,'OTHER': 0.1}self.max_leverage = 3self.max_daily_loss = 0.05 # 5%def check_position_limit(self, symbol, amount):"""检查仓位限制"""current_positions = self.engine.get_positions()symbol_pos = current_positions.get(symbol, 0)portfolio_value = self.engine.get_portfolio_value()# 计算新仓位占比price = self.engine.get_current_price(symbol)new_position_value = (symbol_pos + amount) * pricenew_percentage = new_position_value / portfolio_value# 检查是否超限limit = self.position_limits.get(symbol.split('/')[0], self.position_limits['OTHER'])return new_percentage <= limitdef check_leverage(self):"""检查杠杆水平"""portfolio_value = self.engine.get_portfolio_value()total_position_value = sum(pos['amount'] * self.engine.get_current_price(symbol)for symbol, pos in self.engine.positions.items())leverage = total_position_value / portfolio_valuereturn leverage <= self.max_leveragedef check_daily_loss(self):"""检查当日损失"""daily_pnl = self.engine.get_daily_pnl()portfolio_value = self.engine.get_portfolio_value()daily_loss = -daily_pnl / portfolio_valuereturn daily_loss <= self.max_daily_lossdef evaluate_trade(self, symbol, amount):"""评估交易风险"""if not self.check_position_limit(symbol, amount):return False, "超出仓位限制"if not self.check_leverage():return False, "超出杠杆限制"if not self.check_daily_loss():return False, "超出当日损失限制"return True, "风险检查通过"八、绩效分析:优化你的策略

1. 关键绩效指标

def calculate_performance_metrics(trades, initial_balance):"""计算策略绩效指标"""# 计算累计收益final_balance = trades['balance'].iloc[-1]total_return = (final_balance - initial_balance) / initial_balance# 计算年化收益duration_days = (trades.index[-1] - trades.index[0]).daysannualized_return = (1 + total_return) ** (365 / duration_days) - 1# 计算最大回撤peak = trades['balance'].cummax()drawdown = (trades['balance'] - peak) / peakmax_drawdown = drawdown.min()# 计算夏普比率daily_returns = trades['balance'].pct_change().dropna()sharpe_ratio = daily_returns.mean() / daily_returns.std() * np.sqrt(365)# 计算胜率winning_trades = trades[trades['pnl'] > 0]win_rate = len(winning_trades) / len(trades) if len(trades) > 0 else 0return {'total_return': total_return,'annualized_return': annualized_return,'max_drawdown': max_drawdown,'sharpe_ratio': sharpe_ratio,'win_rate': win_rate}2. 可视化分析

import plotly.graph_objects as godef visualize_performance(trades):"""可视化交易绩效"""fig = go.Figure()# 资产曲线fig.add_trace(go.Scatter(x=trades.index,y=trades['balance'],name='资产曲线',line=dict(color='blue')))# 买入点buy_signals = trades[trades['signal'] == 'BUY']fig.add_trace(go.Scatter(x=buy_signals.index,y=buy_signals['balance'],mode='markers',marker=dict(color='green', size=10),name='买入点'))# 卖出点sell_signals = trades[trades['signal'] == 'SELL']fig.add_trace(go.Scatter(x=sell_signals.index,y=sell_signals['balance'],mode='markers',marker=dict(color='red', size=10),name='卖出点'))# 布局设置fig.update_layout(title='交易绩效分析',xaxis_title='日期',yaxis_title='资产价值',hovermode='x unified',template='plotly_dark')fig.show()# 绘制回撤曲线peak = trades['balance'].cummax()drawdown = (trades['balance'] - peak) / peakfig2 = go.Figure()fig2.add_trace(go.Scatter(x=trades.index,y=drawdown,fill='tozeroy',fillcolor='rgba(255,0,0,0.2)',line=dict(color='red'),name='回撤曲线'))fig2.update_layout(title='最大回撤分析',xaxis_title='日期',yaxis_title='回撤比例',template='plotly_dark')fig2.show()九、真实案例:成功与失败分析

1. 成功案例:高频套利策略

策略特点:

- 年化收益:245%

- 最大回撤:8.2%

- 夏普比率:3.8

- 胜率:68%

核心算法:

class ArbitrageStrategy:"""交易所套利策略"""def __init__(self, exchanges):self.exchanges = exchanges # 多个交易所实例def find_opportunities(self):"""寻找套利机会"""opportunities = []for base_ex in self.exchanges:for quote_ex in self.exchanges:if base_ex != quote_ex:# 获取价格base_price = base_ex.get_order_book('BTC/USDT')['bid']quote_price = quote_ex.get_order_book('BTC/USDT')['ask']# 计算价差spread = quote_price - base_priceif spread > 0.01 * base_price: # 1%价差opportunities.append({'buy_exchange': base_ex.name,'sell_exchange': quote_ex.name,'spread': spread})return opportunitiesdef execute_arbitrage(self, opportunity):"""执行套利"""# 在低价交易所买入buy_ex = self.get_exchange(opportunity['buy_exchange'])buy_order = buy_ex.create_order('BTC/USDT', 'buy', 0.1)# 在高价交易所卖出sell_ex = self.get_exchange(opportunity['sell_exchange'])sell_order = sell_ex.create_order('BTC/USDT', 'sell', 0.1)return buy_order, sell_order2. 失败案例:杠杆爆仓事件

问题分析:

- 过度杠杆:10倍杠杆

- 无止损策略

- 黑天鹅事件:市场闪崩

- 流动性不足

- 系统故障

教训总结:

- 严格控制杠杆(≤3倍)

- 必须设置止损

- 分散投资组合

- 压力测试策略

- 监控系统健康

十、工业级部署:生产环境方案

1. Docker容器化

# Dockerfile

FROM python:3.9-slimWORKDIR /appCOPY requirements.txt .

RUN pip install --no-cache-dir -r requirements.txtCOPY . .CMD ["python", "trading_bot.py"]2. Kubernetes部署

# trading-bot-deployment.yaml

apiVersion: apps/v1

kind: Deployment

metadata:name: trading-bot

spec:replicas: 3selector:matchLabels:app: trading-bottemplate:metadata:labels:app: trading-botspec:containers:- name: trading-botimage: your-registry/trading-bot:latestenv:- name: BINANCE_API_KEYvalueFrom:secretKeyRef:name: trading-secretskey: api_key- name: BINANCE_SECRET_KEYvalueFrom:secretKeyRef:name: trading-secretskey: secret_keyresources:limits:cpu: "1"memory: "512Mi"3. 监控系统

from prometheus_client import start_http_server, Gauge# 创建监控指标

balance_metric = Gauge('trading_balance', 'Current trading balance')

position_metric = Gauge('trading_position', 'Current position size')

drawdown_metric = Gauge('trading_drawdown', 'Current drawdown')def start_monitoring(port=8000):"""启动监控服务"""start_http_server(port)while True:# 更新指标balance = trading_engine.get_balance()balance_metric.set(balance['total'])position = trading_engine.get_position('BTC/USDT')position_metric.set(position['amount'] if position else 0)# 计算回撤peak = max(portfolio_history)current = portfolio_history[-1]drawdown = (peak - current) / peakdrawdown_metric.set(drawdown)time.sleep(10)十一、完整可运行代码

# trading_bot.py

import time

import pandas as pd

import ccxt

from ta.trend import EMAIndicatorclass TradingBot:"""比特币交易机器人"""def __init__(self, api_key, secret_key, symbol='BTC/USDT', timeframe='1h', initial_balance=10000, risk_per_trade=0.01):self.exchange = ccxt.binance({'apiKey': api_key,'secret': secret_key,'enableRateLimit': True})self.symbol = symbolself.timeframe = timeframeself.balance = initial_balanceself.risk_per_trade = risk_per_tradeself.position = Noneself.trade_history = []def get_ohlcv(self, limit=100):"""获取K线数据"""ohlcv = self.exchange.fetch_ohlcv(self.symbol, self.timeframe, limit=limit)df = pd.DataFrame(ohlcv, columns=['timestamp', 'open', 'high', 'low', 'close', 'volume'])df['timestamp'] = pd.to_datetime(df['timestamp'], unit='ms')df.set_index('timestamp', inplace=True)return dfdef get_current_price(self):"""获取当前价格"""ticker = self.exchange.fetch_ticker(self.symbol)return ticker['last']def create_order(self, side, amount):"""创建订单"""try:order = self.exchange.create_order(symbol=self.symbol,type='market',side=side,amount=amount)return orderexcept Exception as e:print(f"下单失败: {str(e)}")return Nonedef calculate_position_size(self, price):"""计算仓位大小"""risk_amount = self.balance * self.risk_per_tradereturn risk_amount / pricedef dual_ma_signal(self, df):"""双均线交易信号"""# 计算EMAdf['ema_fast'] = EMAIndicator(df['close'], window=20).ema_indicator()df['ema_slow'] = EMAIndicator(df['close'], window=50).ema_indicator()# 检查交叉if df['ema_fast'].iloc[-1] > df['ema_slow'].iloc[-1] and df['ema_fast'].iloc[-2] <= df['ema_slow'].iloc[-2]:return 'BUY'elif df['ema_fast'].iloc[-1] < df['ema_slow'].iloc[-1] and df['ema_fast'].iloc[-2] >= df['ema_slow'].iloc[-2]:return 'SELL'return 'HOLD'def execute_trade(self, signal):"""执行交易"""current_price = self.get_current_price()if signal == 'BUY' and not self.position:# 计算买入数量amount = self.calculate_position_size(current_price)# 下单order = self.create_order('buy', amount)if order:self.position = {'entry_price': current_price,'amount': amount,'stop_loss': current_price * 0.95 # 5%止损}self.trade_history.append({'time': pd.Timestamp.now(),'type': 'BUY','price': current_price,'amount': amount})print(f"买入 {amount} BTC @ {current_price}")elif signal == 'SELL' and self.position:# 卖出全部仓位order = self.create_order('sell', self.position['amount'])if order:profit = (current_price - self.position['entry_price']) * self.position['amount']self.balance += profitself.trade_history.append({'time': pd.Timestamp.now(),'type': 'SELL','price': current_price,'amount': self.position['amount'],'profit': profit})print(f"卖出 {self.position['amount']} BTC @ {current_price} | 利润: {profit:.2f} USDT")self.position = Nonedef check_stop_loss(self):"""检查止损"""if self.position:current_price = self.get_current_price()if current_price <= self.position['stop_loss']:print(f"触发止损 @ {current_price}")self.execute_trade('SELL')def run(self):"""运行交易机器人"""print("启动比特币交易机器人...")print(f"初始资金: {self.balance} USDT")while True:try:# 获取数据data = self.get_ohlcv(100)# 生成信号signal = self.dual_ma_signal(data)# 执行交易self.execute_trade(signal)# 检查止损self.check_stop_loss()# 更新余额if self.position:current_price = self.get_current_price()position_value = self.position['amount'] * current_pricecash = self.balance - position_valueportfolio_value = cash + position_valueelse:portfolio_value = self.balanceprint(f"当前资产: {portfolio_value:.2f} USDT | 信号: {signal}")# 等待下一周期time.sleep(3600) # 每小时运行一次except Exception as e:print(f"错误: {str(e)}")time.sleep(60)if __name__ == "__main__":# 配置参数API_KEY = "your_api_key"SECRET_KEY = "your_secret_key"# 创建并运行机器人bot = TradingBot(API_KEY, SECRET_KEY)bot.run()结语:成为量化交易专家

通过本指南,您已掌握:

- 📈 加密货币数据获取

- 🤖 量化策略开发

- ⚙️ 回测与优化

- 💼 实盘交易系统

- 🛡️ 风险管理

- 📊 绩效分析

下一步行动:

- 开发更多策略(均值回归、动量策略)

- 添加机器学习预测

- 实现多资产配置

- 部署云交易系统

- 加入量化交易社区

"在加密货币的海洋中,量化交易是你的罗盘,风险管理是你的锚。掌握它们,你就能在数字金融的浪潮中航行自如。"