ML4T - 第7章第6节 使用Alphalens进行分析 Alphalens Analysis

目录

一、Load Data 加载数据

二、Linear Regression 线性回归

1. Quantiles Statistics(分组统计)

2. Returns Analysis(收益分析)

3. Information Analysis(IC 分析)

4. Turnover Analysis(换手率)

5. Rank Autocorrelation(因子稳定性)

三、Ridge Regression 岭回归

四、Lasso Regression 套索回归

参考:https://github.com/stefan-jansen/machine-learning-for-trading/blob/main/07_linear_models/06_evaluating_signals_using_alphalens.ipynb

一、Load Data 加载数据

首先需要安装对应的库

! pip install alphalens-reloaded

# 原版已不再维护,推荐使用“社区重载版(alphalens-reloaded)”

import warnings

warnings.filterwarnings('ignore')from pathlib import Path

import pandas as pd

from alphalens.tears import create_summary_tear_sheet

from alphalens.utils import get_clean_factor_and_forward_returnsidx = pd.IndexSlicewith pd.HDFStore('data.h5') as store:lr_predictions = store['lr/predictions']lasso_predictions = store['lasso/predictions']lasso_scores = store['lasso/scores']ridge_predictions = store['ridge/predictions']ridge_scores = store['ridge/scores']# DATA_STORE = Path('..', 'data', 'assets.h5')

DATA_STORE = Path('data', 'assets.h5') # change to the real path 修改到真实路径def get_trade_prices(tickers, start, stop):prices = (pd.read_hdf(DATA_STORE, 'quandl/wiki/prices').swaplevel().sort_index())prices.index.names = ['symbol', 'date']prices = prices.loc[idx[tickers, str(start):str(stop)], 'adj_open']return (prices.unstack('symbol').sort_index().shift(-1).tz_localize('UTC'))def get_best_alpha(scores):return scores.groupby('alpha').ic.mean().idxmax()def get_factor(predictions):return (predictions.unstack('symbol').dropna(how='all').stack().tz_localize('UTC', level='date').sort_index()) 注意文件路径要选对:数据来源于前面几节

# DATA_STORE = Path('..', 'data', 'assets.h5')

DATA_STORE = Path('data', 'assets.h5') # change to the real path 修改到真实路径

get_trade_prices 函数:

功能:从 HDF5 数据存储中读取股票的历史价格数据,并返回指定时间段和调整后的开盘价。

get_best_alpha 函数:

功能:从一组分数中选择最佳的 alpha 值。

get_factor 函数:

功能:处理预测数据,将其转换为因子格式,并进行一些数据清洗和格式化。

二、Linear Regression 线性回归

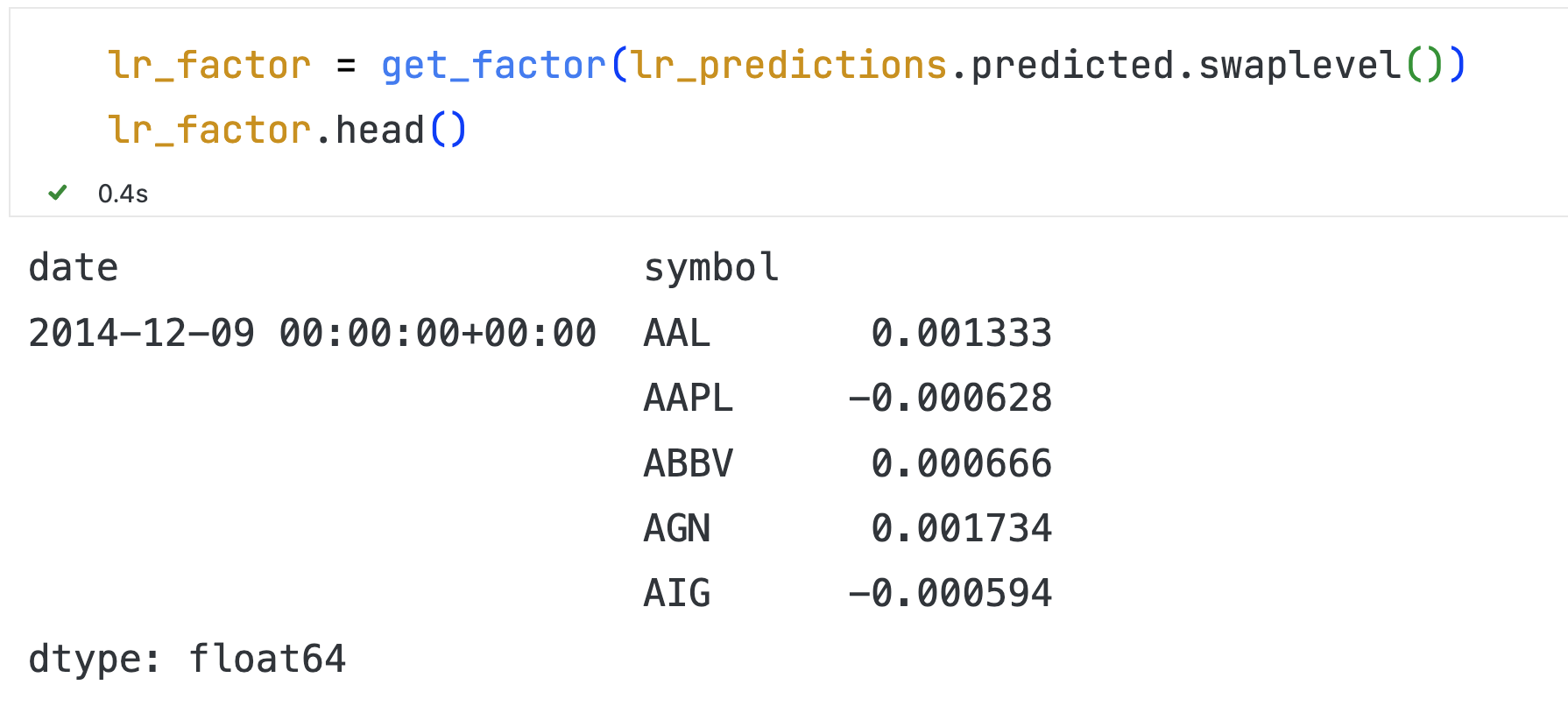

lr_factor = get_factor(lr_predictions.predicted.swaplevel())

lr_factor.head()

tickers = lr_factor.index.get_level_values('symbol').unique()trade_prices = get_trade_prices(tickers, 2014, 2017)

trade_prices.info()

lr_factor_data = get_clean_factor_and_forward_returns(factor=lr_factor,prices=trade_prices,quantiles=5,periods=(1, 5, 10, 21))

lr_factor_data.info()结果:

Dropped 0.0% entries from factor data: 0.0% in forward returns computation and 0.0% in binning phase (set max_loss=0 to see potentially suppressed Exceptions).

max_loss is 35.0%, not exceeded: OK!

<class 'pandas.core.frame.DataFrame'>

MultiIndex: 73812 entries, (Timestamp('2014-12-09 00:00:00+0000', tz='UTC'), 'AAL') to (Timestamp('2017-11-29 00:00:00+0000', tz='UTC'), 'XOM')

Data columns (total 6 columns):# Column Non-Null Count Dtype

--- ------ -------------- ----- 0 1D 73812 non-null float641 5D 73812 non-null float642 10D 73812 non-null float643 21D 73812 non-null float644 factor 73812 non-null float645 factor_quantile 73812 non-null int64

dtypes: float64(5), int64(1)

memory usage: 3.7+ MB画图并分析

Alphalens 的 create_summary_tear_sheet 负责把单个因子拆成 5 组(quantiles)做业绩/IC/换手分析

create_summary_tear_sheet(lr_factor_data);

# 说明可以参考:alphalens入门篇 https://blog.csdn.net/u011331731/article/details/88314459

# 分析结论:短线有点信号,长线更稳,但都不强; turnover 高,费用吃利润,适合当排序信号,不适合单独对冲。Quantiles Statistics

| min | max | mean | std | count | count % | |

|---|---|---|---|---|---|---|

| factor_quantile | ||||||

| 1 | -0.043757 | 0.009896 | -0.002980 | 0.004034 | 14982 | 20.297513 |

| 2 | -0.014429 | 0.012193 | -0.000901 | 0.003243 | 14666 | 19.869398 |

| 3 | -0.012309 | 0.013843 | 0.000169 | 0.003228 | 14516 | 19.666179 |

| 4 | -0.011109 | 0.016001 | 0.001188 | 0.003352 | 14666 | 19.869398 |

| 5 | -0.009576 | 0.035734 | 0.003144 | 0.004032 | 14982 | 20.297513 |

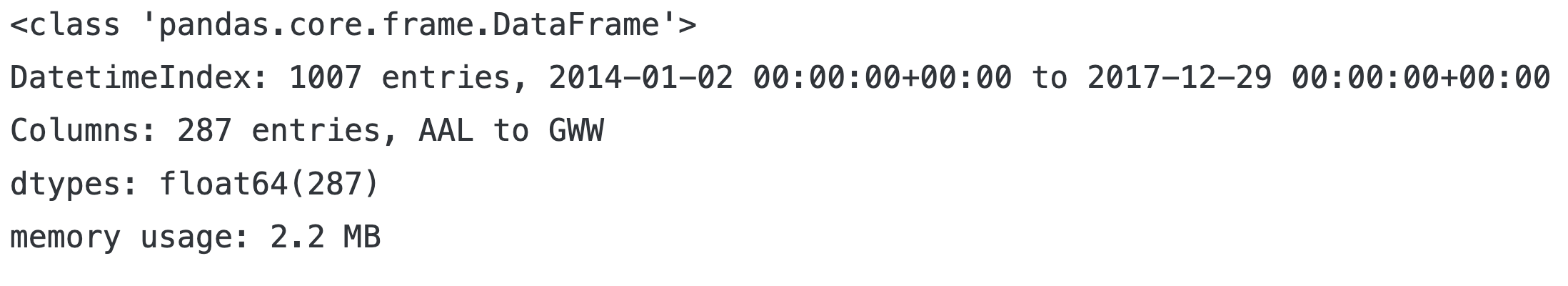

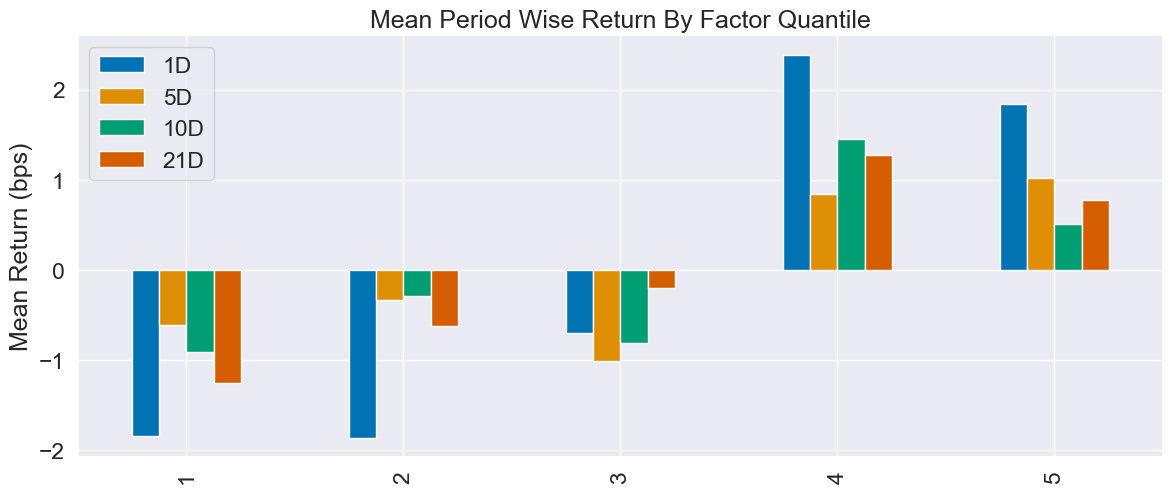

Returns Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Ann. alpha | 0.048 | 0.017 | 0.019 | 0.020 |

| beta | -0.017 | -0.068 | -0.058 | 0.041 |

| Mean Period Wise Return Top Quantile (bps) | 1.842 | 1.016 | 0.514 | 0.778 |

| Mean Period Wise Return Bottom Quantile (bps) | -1.847 | -0.613 | -0.910 | -1.259 |

| Mean Period Wise Spread (bps) | 3.689 | 1.652 | 1.433 | 2.028 |

Information Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| IC Mean | 0.019 | 0.017 | 0.019 | 0.023 |

| IC Std. | 0.178 | 0.165 | 0.172 | 0.156 |

| Risk-Adjusted IC | 0.107 | 0.100 | 0.111 | 0.148 |

| t-stat(IC) | 2.940 | 2.745 | 3.053 | 4.045 |

| p-value(IC) | 0.003 | 0.006 | 0.002 | 0.000 |

| IC Skew | -0.093 | 0.031 | -0.158 | -0.142 |

| IC Kurtosis | -0.212 | -0.053 | -0.107 | -0.231 |

Turnover Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Quantile 1 Mean Turnover | 0.300 | 0.527 | 0.630 | 0.747 |

| Quantile 2 Mean Turnover | 0.516 | 0.705 | 0.758 | 0.797 |

| Quantile 3 Mean Turnover | 0.560 | 0.739 | 0.773 | 0.807 |

| Quantile 4 Mean Turnover | 0.515 | 0.704 | 0.756 | 0.789 |

| Quantile 5 Mean Turnover | 0.302 | 0.530 | 0.637 | 0.741 |

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Mean Factor Rank Autocorrelation | 0.817 | 0.551 | 0.401 | 0.236 |

<Figure size 640x480 with 0 Axes>

把单个因子拆成 5 组进行分析,通俗的例子就是:

因子值是“今天给学生按某科成绩排队”,

收益是“过几天再看他们总分涨了多少”,

拆 5 组就是“看看排在前面的学生是不是涨得最多”。

分析结论:短线有点信号,长线更稳,但都不强; turnover 高,费用吃利润,适合当排序信号,不适合单独对冲。

1. Quantiles Statistics(分组统计)

单调性良好:因子值从 Q1 到 Q5 递增,说明因子方向正确,没有反转。

2. Returns Analysis(收益分析)

alpha 低(<5%),beta 接近 0 ;市场中性,但超额收益也不高

多空对冲收益(spread) 1D 最高,但 5D/10D 下降,21D 略有回升。

收益不大,1D 的 3.7bps 扣掉交易成本(双边 ~2bps+滑点)后,净利很薄。

3. Information Analysis(IC 分析)

21D 的 IC 最高,t-stat 最显著(>4),说明因子在月度频率上更稳定。

但 IC 绝对值仍低于 0.03,属于“弱信号”,不能单独作为策略核心。

4. Turnover Analysis(换手率)

1D 换手率太高,双边 60%,扣掉费用后利润几乎被吃光。

21D 换手率相对可控,更适合实盘。

5. Rank Autocorrelation(因子稳定性)

短期因子排名稳定,适合短周期预测;

长期排名变化快,说明因子衰减快,不适合长周期持仓。

三、Ridge Regression 岭回归

类似的:

best_ridge_alpha = get_best_alpha(ridge_scores)

ridge_predictions = ridge_predictions[ridge_predictions.alpha==best_ridge_alpha].drop('alpha', axis=1)ridge_factor = get_factor(ridge_predictions.predicted.swaplevel())

ridge_factor.head()ridge_factor_data = get_clean_factor_and_forward_returns(factor=ridge_factor,prices=trade_prices,quantiles=5,periods=(1, 5, 10, 21))

ridge_factor_data.info()create_summary_tear_sheet(ridge_factor_data);结果:

Dropped 0.0% entries from factor data: 0.0% in forward returns computation and 0.0% in binning phase (set max_loss=0 to see potentially suppressed Exceptions).

max_loss is 35.0%, not exceeded: OK!

<class 'pandas.core.frame.DataFrame'>

MultiIndex: 73812 entries, (Timestamp('2014-12-09 00:00:00+0000', tz='UTC'), 'AAL') to (Timestamp('2017-11-29 00:00:00+0000', tz='UTC'), 'XOM')

Data columns (total 6 columns):# Column Non-Null Count Dtype

--- ------ -------------- ----- 0 1D 73812 non-null float641 5D 73812 non-null float642 10D 73812 non-null float643 21D 73812 non-null float644 factor 73812 non-null float645 factor_quantile 73812 non-null int64

dtypes: float64(5), int64(1)

memory usage: 3.7+ MBQuantiles Statistics

| min | max | mean | std | count | count % | |

|---|---|---|---|---|---|---|

| factor_quantile | ||||||

| 1 | -0.037486 | 0.010285 | -0.003205 | 0.003644 | 14982 | 20.297513 |

| 2 | -0.011773 | 0.012590 | -0.001242 | 0.003003 | 14666 | 19.869398 |

| 3 | -0.009860 | 0.014102 | -0.000230 | 0.003023 | 14516 | 19.666179 |

| 4 | -0.008802 | 0.016130 | 0.000739 | 0.003175 | 14666 | 19.869398 |

| 5 | -0.007385 | 0.035124 | 0.002576 | 0.003867 | 14982 | 20.297513 |

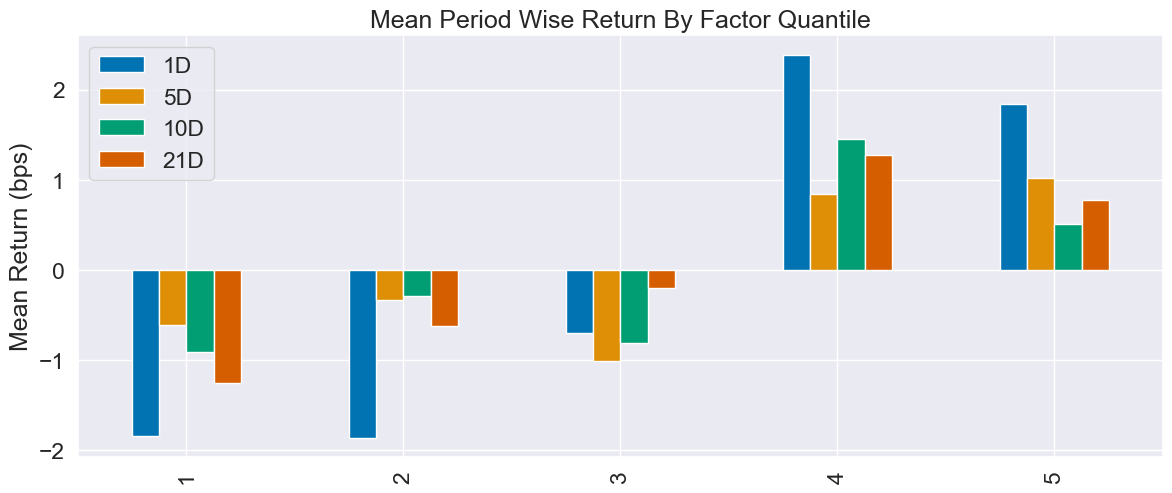

Returns Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Ann. alpha | 0.048 | 0.020 | 0.022 | 0.020 |

| beta | -0.018 | -0.074 | -0.065 | 0.038 |

| Mean Period Wise Return Top Quantile (bps) | 1.686 | 0.947 | 0.353 | 0.654 |

| Mean Period Wise Return Bottom Quantile (bps) | -2.010 | -0.639 | -1.074 | -1.285 |

| Mean Period Wise Spread (bps) | 3.696 | 1.612 | 1.441 | 1.937 |

Information Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| IC Mean | 0.019 | 0.017 | 0.020 | 0.021 |

| IC Std. | 0.179 | 0.167 | 0.174 | 0.156 |

| Risk-Adjusted IC | 0.108 | 0.103 | 0.114 | 0.137 |

| t-stat(IC) | 2.952 | 2.829 | 3.110 | 3.748 |

| p-value(IC) | 0.003 | 0.005 | 0.002 | 0.000 |

| IC Skew | -0.105 | 0.011 | -0.160 | -0.149 |

| IC Kurtosis | -0.175 | -0.024 | -0.091 | -0.244 |

Turnover Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Quantile 1 Mean Turnover | 0.294 | 0.514 | 0.619 | 0.739 |

| Quantile 2 Mean Turnover | 0.507 | 0.697 | 0.752 | 0.795 |

| Quantile 3 Mean Turnover | 0.554 | 0.733 | 0.773 | 0.804 |

| Quantile 4 Mean Turnover | 0.509 | 0.698 | 0.757 | 0.786 |

| Quantile 5 Mean Turnover | 0.296 | 0.520 | 0.628 | 0.736 |

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Mean Factor Rank Autocorrelation | 0.822 | 0.569 | 0.417 | 0.247 |

<Figure size 640x480 with 0 Axes>

分析:

预测力:跟普通线性回归几乎打平,IC 同样“刚踩线”(0.019→0.021),t-stat 也没飞起来。

赚钱力:1D 对冲 spread 3.7 bps,跟 LR 一样“薄如纸”,扣完双边成本只剩 1 bps 左右。

稳定性:Rank 自相关更高(0.82),换手略低一点,说明岭回归“平滑”后,因子排名短期更耐操,但长周期照样衰减。

总结:岭回归只是“把 LR 的毛刺磨平”,没长出新增信息;成本端省 1 bps,收益端零提升,可留作候选

四、Lasso Regression 套索回归

代码,类似地:

best_lasso_alpha = get_best_alpha(lasso_scores)

lasso_predictions = lasso_predictions[lasso_predictions.alpha==best_lasso_alpha].drop('alpha', axis=1)lasso_factor = get_factor(lasso_predictions.predicted.swaplevel())

lasso_factor.head()lasso_factor_data = get_clean_factor_and_forward_returns(factor=lasso_factor,prices=trade_prices,quantiles=5,periods=(1, 5, 10, 21))

lasso_factor_data.info()create_summary_tear_sheet(lasso_factor_data);结果:

Dropped 0.0% entries from factor data: 0.0% in forward returns computation and 0.0% in binning phase (set max_loss=0 to see potentially suppressed Exceptions).

max_loss is 35.0%, not exceeded: OK!

<class 'pandas.core.frame.DataFrame'>

MultiIndex: 73812 entries, (Timestamp('2014-12-09 00:00:00+0000', tz='UTC'), 'AAL') to (Timestamp('2017-11-29 00:00:00+0000', tz='UTC'), 'XOM')

Data columns (total 6 columns):# Column Non-Null Count Dtype

--- ------ -------------- ----- 0 1D 73812 non-null float641 5D 73812 non-null float642 10D 73812 non-null float643 21D 73812 non-null float644 factor 73812 non-null float645 factor_quantile 73812 non-null int64

dtypes: float64(5), int64(1)

memory usage: 3.7+ MBQuantiles Statistics

| min | max | mean | std | count | count % | |

|---|---|---|---|---|---|---|

| factor_quantile | ||||||

| 1 | -0.043925 | 0.010653 | -0.003470 | 0.004004 | 14982 | 20.297513 |

| 2 | -0.013494 | 0.012950 | -0.001383 | 0.003265 | 14666 | 19.869398 |

| 3 | -0.011373 | 0.014600 | -0.000327 | 0.003284 | 14516 | 19.666179 |

| 4 | -0.010174 | 0.016758 | 0.000706 | 0.003431 | 14666 | 19.869398 |

| 5 | -0.008641 | 0.035891 | 0.002654 | 0.004164 | 14982 | 20.297513 |

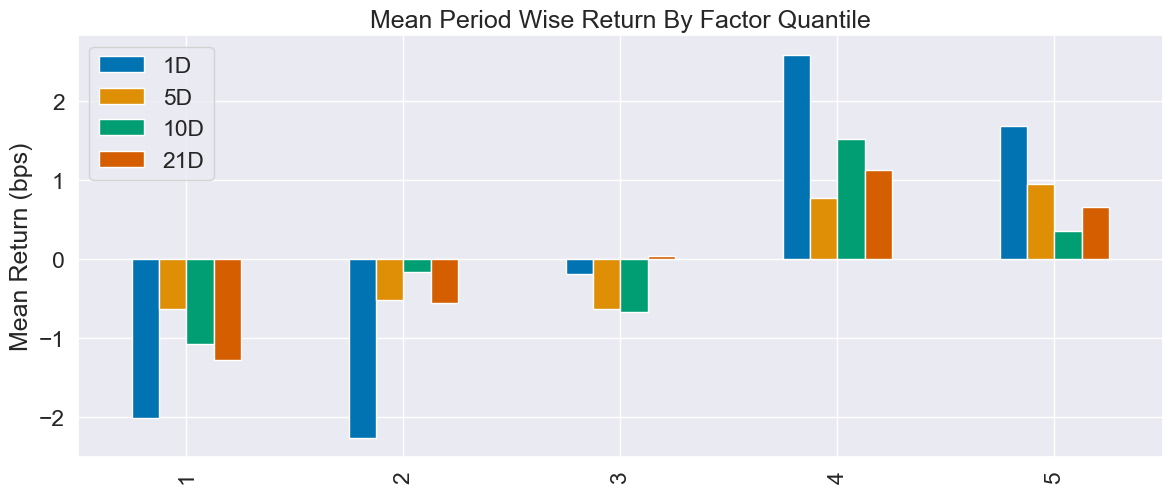

Returns Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Ann. alpha | 0.048 | 0.017 | 0.019 | 0.020 |

| beta | -0.017 | -0.068 | -0.058 | 0.041 |

| Mean Period Wise Return Top Quantile (bps) | 1.842 | 1.016 | 0.514 | 0.778 |

| Mean Period Wise Return Bottom Quantile (bps) | -1.847 | -0.613 | -0.910 | -1.259 |

| Mean Period Wise Spread (bps) | 3.689 | 1.652 | 1.433 | 2.028 |

Information Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| IC Mean | 0.019 | 0.017 | 0.019 | 0.023 |

| IC Std. | 0.178 | 0.165 | 0.172 | 0.156 |

| Risk-Adjusted IC | 0.107 | 0.100 | 0.111 | 0.148 |

| t-stat(IC) | 2.940 | 2.744 | 3.053 | 4.045 |

| p-value(IC) | 0.003 | 0.006 | 0.002 | 0.000 |

| IC Skew | -0.093 | 0.031 | -0.158 | -0.142 |

| IC Kurtosis | -0.212 | -0.053 | -0.107 | -0.231 |

Turnover Analysis

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Quantile 1 Mean Turnover | 0.300 | 0.527 | 0.630 | 0.747 |

| Quantile 2 Mean Turnover | 0.516 | 0.705 | 0.758 | 0.797 |

| Quantile 3 Mean Turnover | 0.560 | 0.739 | 0.773 | 0.807 |

| Quantile 4 Mean Turnover | 0.515 | 0.704 | 0.756 | 0.789 |

| Quantile 5 Mean Turnover | 0.302 | 0.530 | 0.637 | 0.741 |

| 1D | 5D | 10D | 21D | |

|---|---|---|---|---|

| Mean Factor Rank Autocorrelation | 0.817 | 0.551 | 0.401 | 0.236 |

<Figure size 640x480 with 0 Axes>

我的分析:

数字几乎跟普通线性回归重合,

Lasso 在这里只是“ LR 的影分身”,没有把任何变量真的压到 0,预测力、赚钱力、换手、衰减曲线几乎 1:1 复刻;正则化没起作用,说明原始特征里本来就没有明显冗余或共线。