❗量化模型构建回测框架

❗量化模型构建&回测框架

- 1. 日志和绘图设置

- 2. 核心函数定义

- 3. 主程序执行

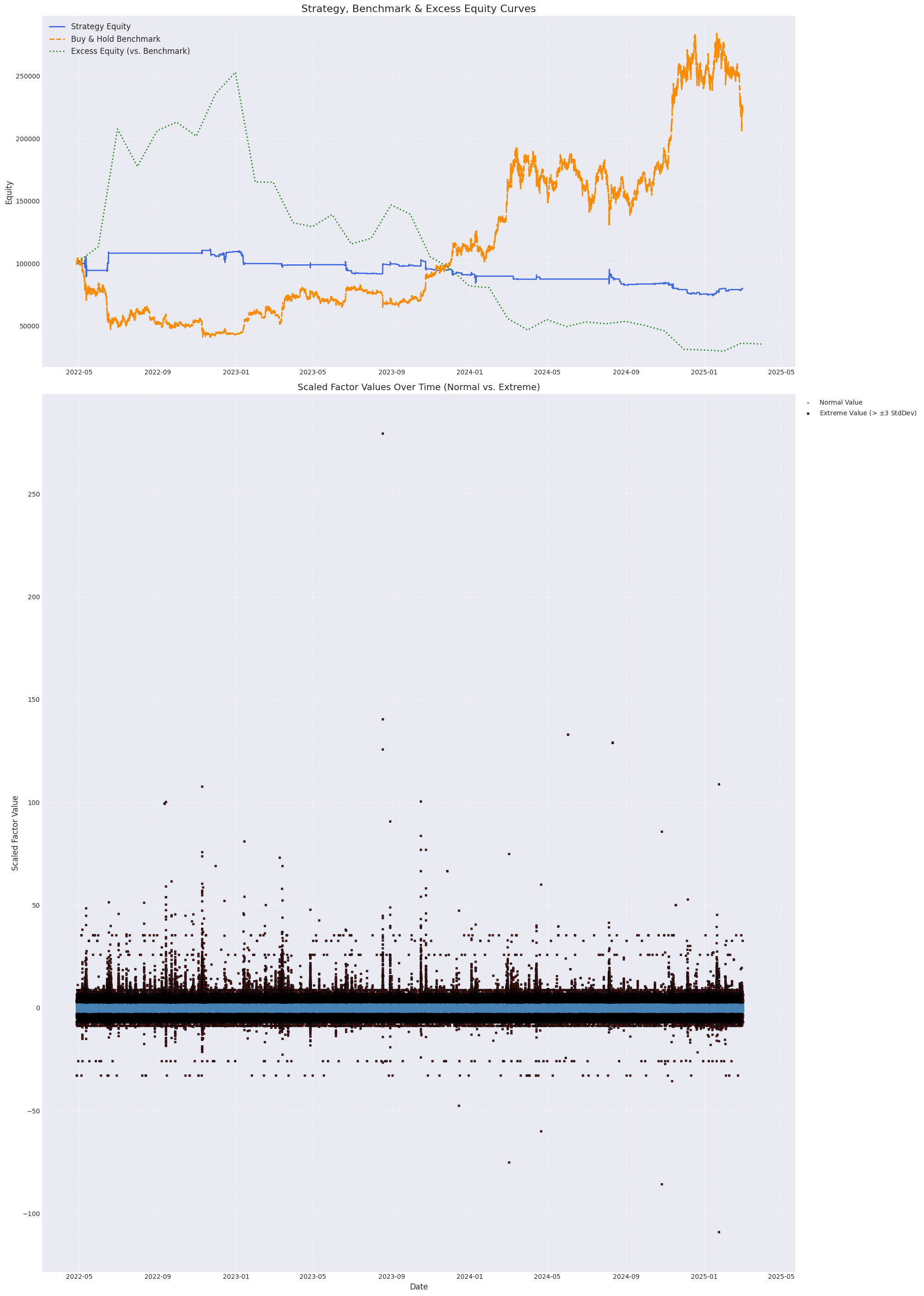

- 回测结果

完整量化策略开发流程:

- 数据加载与预处理

- 使用

LightGBM进行时间序列交叉验证和样本外预测 - 基于模型预测信号进行向量化回测

- 计算并展示策略的详细性能评估指标

import pandas as pd

import numpy as np

import lightgbm as lgb

from sklearn.model_selection import TimeSeriesSplit

import matplotlib.pyplot as plt

import os

import logging

from pandas.tseries.offsets import Week

from tabulate import tabulate

from colorama import Fore, Style, Back

from sklearn.preprocessing import StandardScaler

1. 日志和绘图设置

logging.basicConfig(level=logging.INFO, format='%(asctime)s - %(levelname)s - %(message)s')

plt.style.use('seaborn-v0_8-darkgrid') # 使用更美观的绘图风格

2. 核心函数定义

def train_and_predict_oos(X, y, model, n_splits=5):"""使用时间序列交叉验证来训练模型并生成样本外(Out-of-Sample)预测。这是回测的关键,确保预测的无偏性。参数:- X (pd.DataFrame): 特征数据- y (pd.Series): 目标数据- model: 一个遵循sklearn API的机器学习模型 (e.g., lgb.LGBMRegressor)- n_splits (int): 交叉验证的折数返回:- pd.Series: 包含所有测试集预测结果的序列,索引与原始数据对齐。"""logging.info(f"🤔开始使用 {n_splits}-fold 时间序列交叉验证进行样本外预测...")tscv = TimeSeriesSplit(n_splits=n_splits)oos_predictions = []for fold, (train_index, test_index) in enumerate(tscv.split(X)):# --- 数据分割 ---X_train, X_test = X.iloc[train_index], X.iloc[test_index]y_train, y_test = y.iloc[train_index], y.iloc[test_index]logging.info(f"--- Fold {fold+1}/{n_splits} ---")logging.info(f"训练集周期: {X_train.index.min()} -> {X_train.index.max()} (大小: {len(X_train)})")logging.info(f"测试集周期: {X_test.index.min()} -> {X_test.index.max()} (大小: {len(X_test)})")# --- 模型训练与预测 ---model.fit(X_train, y_train,eval_set=[(X_test, y_test)],eval_metric='l2',callbacks=[lgb.early_stopping(10, verbose=False)])predictions = model.predict(X_test)# --- 保存预测结果 ---fold_preds = pd.Series(predictions, index=X_test.index)oos_predictions.append(fold_preds)logging.info("🎉所有Fold的样本外预测完成。")return pd.concat(oos_predictions)

def run_vectorized_backtest(prices, signals, initial_capital=100000, commission_rate=0.0005, long_threshold=0.001, short_threshold=-0.001):"""执行向量化回测。参数:- prices (pd.Series): 'close'价格序列,用于计算收益和净值。- signals (pd.Series): 模型的原始预测值序列。- initial_capital (float): 初始资金。- commission_rate (float): 交易手续费率。- long_threshold (float): 做多阈值。- short_threshold (float): 做空阈值。返回:- pd.DataFrame: 包含净值曲线、收益、持仓和交易详情的结果。"""logging.info("🤔🤔开始执行向量化回测...")# --- 1. 生成交易信号和持仓 ---# 根据阈值将预测信号转换为交易方向: 1 for long, -1 for short, 0 for neutralpositions = pd.Series(np.select([signals > long_threshold, signals < short_threshold],[1, -1],default=0), index=signals.index)# 关键点: 交易决策基于上一期信号,在当期开盘时执行。shift(1)避免未来函数。positions = positions.shift(1).fillna(0)# --- 2. 计算收益 ---# 市场每日/每期收益率market_returns = prices.pct_change().fillna(0)# 策略收益率 = 持仓 * 市场收益率strategy_returns = positions * market_returns# --- 3. 计算交易成本 ---# 当持仓发生变化时,即为一次交易trades = positions.diff().fillna(0)transaction_costs = abs(trades) * commission_rate# 策略净收益率strategy_net_returns = strategy_returns - transaction_costs# --- 4. 计算权益曲线 ---cumulative_returns = (1 + strategy_net_returns).cumprod()equity_curve = initial_capital * cumulative_returns# --- 5. 整合结果 ---backtest_results = pd.DataFrame({'close': prices,'signal': signals,'position': positions,'market_returns': market_returns,'strategy_returns': strategy_returns,'transaction_costs': transaction_costs,'strategy_net_returns': strategy_net_returns,'equity_curve': equity_curve})logging.info("🎉🎉向量化回测完成。")return backtest_results

def evaluate_performance(backtest_results, evaluation_criteria, initial_capital, factor_data=None):logging.info("�🤔🤔开始评估策略表现...")equity_curve = backtest_results['equity_curve']net_returns = backtest_results['strategy_net_returns']market_returns = backtest_results['market_returns'] # 基准市场收益率positions = backtest_results['position']trades_raw = positions.diff().fillna(0) # 原始交易信号变化# --- 识别单笔交易盈亏 ---# 辅助列表来存储每次完整交易的净收益individual_trade_pnl_list = []current_position_type = 0 # 0: 无仓位, 1: 多头, -1: 空头entry_time = Nonefor i in range(1, len(positions)):prev_pos = positions.iloc[i-1]curr_pos = positions.iloc[i]# 如果当前没有仓位,并且上一期有仓位,说明发生了平仓if prev_pos != 0 and curr_pos == 0:# 计算从 entry_time 到当前时间段的累计净收益率entry_idx = backtest_results.index.get_loc(entry_time)# 确保切片范围正确,包含平仓那一刻的收益trade_net_returns = (1 + backtest_results['strategy_net_returns'].iloc[entry_idx+1 : i+1]).prod() - 1individual_trade_pnl_list.append(trade_net_returns)current_position_type = 0entry_time = None# 如果当前有仓位,并且上一期没有仓位,说明发生了开仓elif prev_pos == 0 and curr_pos != 0:current_position_type = curr_posentry_time = backtest_results.index[i]# 如果仓位方向发生变化 (例如从多头变为空头,或从空头变为多头)elif prev_pos != 0 and curr_pos != 0 and prev_pos != curr_pos:# 先平掉之前的仓位entry_idx = backtest_results.index.get_loc(entry_time)trade_net_returns = (1 + backtest_results['strategy_net_returns'].iloc[entry_idx+1 : i+1]).prod() - 1individual_trade_pnl_list.append(trade_net_returns)# 再开新仓current_position_type = curr_posentry_time = backtest_results.index[i]# 处理回测结束时仍有持仓的情况if current_position_type != 0 and entry_time is not None: # Added check for entry_timeentry_idx = backtest_results.index.get_loc(entry_time)trade_net_returns = (1 + backtest_results['strategy_net_returns'].iloc[entry_idx+1 :]).prod() - 1individual_trade_pnl_list.append(trade_net_returns)trade_returns_series = pd.Series(individual_trade_pnl_list)'''--- 1. 计算核心指标 ---'''# 年化因子 (基于月度收益率进行年化,一年12个月)annualization_factor = 12 # 总天数total_days = (equity_curve.index[-1] - equity_curve.index[0]).days if len(equity_curve) > 1 else 0# 避免除以零duration_years = total_days / 365.0 if total_days > 0 else 1 # 1. 累积收益率 (Total Return)total_return = (equity_curve.iloc[-1] / initial_capital) - 1 if initial_capital != 0 else 0# 2. 年化收益率 (Annualized Return)# 此处仍使用总收益率进行几何年化,与数据频率无关,是总期间的年化表现annualized_return = (equity_curve.iloc[-1] / equity_curve.iloc[0]) ** (1.0 / duration_years) - 1 if total_days > 0 else 0if total_days <= 0:annualized_return = 0# 计算月度净收益率和月度市场收益率,用于夏普、波动率、索提诺等指标的计算monthly_net_returns = (1 + net_returns).resample('M').prod() - 1monthly_net_returns = monthly_net_returns.dropna() # 移除没有数据的月份monthly_market_returns = (1 + market_returns).resample('M').prod() - 1monthly_market_returns = monthly_market_returns.dropna() # 移除没有数据的月份# 3. 年化波动率 (Annualized Volatility)# 基于月度收益率计算标准差,再年化if not monthly_net_returns.empty and monthly_net_returns.std() != 0:annualized_volatility = monthly_net_returns.std() * np.sqrt(annualization_factor)else:annualized_volatility = 0# 4. 最大回撤 (MDD) 及日期running_max = equity_curve.cummax()drawdown = (equity_curve - running_max) / running_maxmax_drawdown = abs(drawdown.min())# 找到最大回撤的起始和结束日期temp_drawdown = drawdown.copy()end_date_idx = temp_drawdown.idxmin() # 最大回撤的最低点日期# 找到最大回撤最低点之前的最高点日期if end_date_idx is not None:peak_idx = equity_curve.loc[:end_date_idx].idxmax()max_drawdown_start_date = peak_idxmax_drawdown_end_date = end_date_idxelse:max_drawdown_start_date = Nonemax_drawdown_end_date = None# 5. 夏普比率 (Sharpe Ratio)# 基于月度收益率计算均值和标准差,再年化if not monthly_net_returns.empty and monthly_net_returns.std() != 0:sharpe_ratio = monthly_net_returns.mean() / monthly_net_returns.std() * np.sqrt(annualization_factor)else:sharpe_ratio = 0# 6. 卡玛比率 (Calmar Ratio)calmar_ratio = annualized_return / max_drawdown if max_drawdown != 0 else 0# 7. 交易统计 (使用更准确的 individual_trade_pnl_list)winning_trades_pnl = trade_returns_series[trade_returns_series > 0]losing_trades_pnl = trade_returns_series[trade_returns_series <= 0]total_trades = len(trade_returns_series)num_winning_trades = len(winning_trades_pnl)num_losing_trades = len(losing_trades_pnl)win_rate = num_winning_trades / total_trades if total_trades > 0 else 0total_profit_amount_trades = winning_trades_pnl.sum()total_loss_amount_trades = abs(losing_trades_pnl.sum())profit_loss_ratio = total_profit_amount_trades / total_loss_amount_trades if total_loss_amount_trades > 0 else np.inf# 8. 期望收益 (Expectancy)expectancy = (win_rate * profit_loss_ratio) - (1 - win_rate) if win_rate > 0 and profit_loss_ratio != np.inf else -1# 9. 每周开仓频率open_positions = trades_raw[(trades_raw == 1) | (trades_raw == -1)]num_open_trades = len(open_positions)total_weeks = len(pd.date_range(start=equity_curve.index[0],end=equity_curve.index[-1],freq=Week()))weekly_trade_frequency = num_open_trades / total_weeks if total_weeks > 0 else 0# 10. 索提诺比率 (Sortino Ratio)# 基于月度收益率计算下行波动率,再年化downside_monthly_returns = monthly_net_returns[monthly_net_returns < 0]if not downside_monthly_returns.empty and downside_monthly_returns.std() != 0:downside_std = downside_monthly_returns.std()sortino_ratio = monthly_net_returns.mean() / downside_std * np.sqrt(annualization_factor)else:sortino_ratio = 0# 11. 平均盈利和平均亏损average_win = winning_trades_pnl.mean() if num_winning_trades > 0 else 0average_loss = losing_trades_pnl.mean() if num_losing_trades > 0 else 0# 12. 总盈亏金额 (Total PnL)total_pnl_amount = equity_curve.iloc[-1] - initial_capital# 13. 逐年收益率 (Annual Returns)# 计算每个自然年的收益率annual_returns = (1 + net_returns).resample('Y').prod() - 1annual_returns.index = annual_returns.index.year # 将索引改为年份# --- 超额指标计算 ---# 基准权益曲线 (Buy & Hold)benchmark_equity = initial_capital * (backtest_results['close'] / backtest_results['close'].iloc[0])# 超额收益率 (Excess Return): (1+策略月度收益率)/(1+基准月度收益率) - 1# 基于月度收益率计算超额收益if not monthly_net_returns.empty and not monthly_market_returns.empty:excess_monthly_returns_series = (1 + monthly_net_returns) / (1 + monthly_market_returns) - 1excess_monthly_returns_series = excess_monthly_returns_series.dropna()else:excess_monthly_returns_series = pd.Series([])# 超额权益曲线 (Excess Equity Curve)# 以初始资金为基准,计算超额收益的累积乘积if not excess_monthly_returns_series.empty:excess_equity_curve = initial_capital * (1 + excess_monthly_returns_series).cumprod()else:# 如果没有超额收益数据,则超额权益曲线为初始资金excess_equity_curve = pd.Series([initial_capital], index=[equity_curve.index[0]])# 年化超额收益率 (Annualized Excess Return)# 基于超额权益曲线进行几何年化if not excess_equity_curve.empty and len(excess_equity_curve) > 1 and total_days > 0:annualized_excess_return = (excess_equity_curve.iloc[-1] / excess_equity_curve.iloc[0]) ** (1.0 / duration_years) - 1else:annualized_excess_return = 0# 超额波动率 (Excess Volatility)# 基于月度超额收益率计算波动率,再年化if not excess_monthly_returns_series.empty and excess_monthly_returns_series.std() != 0:excess_volatility = excess_monthly_returns_series.std() * np.sqrt(annualization_factor)else:excess_volatility = 0# 超额最大回撤 (Excess Maximum Drawdown)# 确保 excess_max_drawdown 始终被定义excess_max_drawdown = 0 # Initialize to 0if not excess_equity_curve.empty:excess_running_max = excess_equity_curve.cummax()excess_drawdown = (excess_equity_curve - excess_running_max) / excess_running_maxexcess_max_drawdown = abs(excess_drawdown.min())# 超额夏普比率 (Excess Sharpe Ratio)# 基于月度超额收益率计算夏普比率if not excess_monthly_returns_series.empty and excess_monthly_returns_series.std() != 0:excess_sharpe_ratio = excess_monthly_returns_series.mean() / excess_monthly_returns_series.std() * np.sqrt(annualization_factor)else:excess_sharpe_ratio = 0# 换手率 (Turnover)# 换手率 = 总交易金额 / 平均资产管理规模 (AUM)# 交易金额 = 每次仓位变化量 * 交易时的价格# 注意:positions 已经 shift(1) 了,所以 trades_raw 是在 t 时刻根据 t-1 的信号做的交易# 交易发生的价格应是 backtest_results['close'] 在 trades_raw 非零的那些点value_traded_per_period = abs(trades_raw) * backtest_results['close']total_value_traded = value_traded_per_period.sum()average_aum = equity_curve.mean() # 平均资产管理规模# 年化换手率# total_value_traded / average_aum 得到的是回测期间的总换手率# 再除以回测的年数,得到年化换手率annualized_turnover = (total_value_traded / average_aum) / duration_years if average_aum > 0 and duration_years > 0 else 0'''--- 2. 打印评估报告 ---'''print("\n" + "="*80)print(Fore.CYAN + " " * 30 + "策略性能评估报告" + " " * 30 + Style.RESET_ALL)print("="*80)# 辅助函数,用于格式化输出def format_check(name, value, req_value, req_prefix, comp_func):status = "✅ 达标" if comp_func(value, req_value) else "❌ 未达标"req_str = f"{req_prefix} {req_value}"color = Fore.GREEN if comp_func(value, req_value) else Fore.REDreturn [name, f"{value:.4f}", req_str, color + status + Style.RESET_ALL]# 收益指标print("\n" + Fore.BLUE + Style.BRIGHT + "="*30 + " 收益指标 " + "="*30 + Style.RESET_ALL)sharpe_req = evaluation_criteria['sharpe_ratio']calmar_req = evaluation_criteria['calmar_ratio']expectancy_req = evaluation_criteria['expectancy']sharpe_ok = sharpe_ratio > sharpe_reqcalmar_ok = calmar_ratio > calmar_reqexpectancy_ok = expectancy > expectancy_reqprofit_plan1_ok = sharpe_ok and calmar_okprofit_plan2_ok = expectancy_okprofit_ok = profit_plan1_ok or profit_plan2_ok# 使用tabulate创建表格headers = ["指标名称", "计算结果", "要求", "状态"]profit_table = [format_check("夏普比率 (Sharpe)", sharpe_ratio, sharpe_req, ">", lambda v, r: v > r),format_check("卡玛比率 (Calmar)", calmar_ratio, calmar_req, ">", lambda v, r: v > r),format_check("期望收益 (Expectancy)", expectancy, expectancy_req, ">", lambda v, r: v > r)]print(tabulate(profit_table, headers=headers, tablefmt="grid", stralign="center", numalign="center"))# 添加方案状态plan_table = [["方案一 (夏普 & 卡玛)", Fore.GREEN + "✅ 达标" + Style.RESET_ALL if profit_plan1_ok else Fore.RED + "❌ 未达标" + Style.RESET_ALL],["方案二 (期望收益)", Fore.GREEN + "✅ 达标" + Style.RESET_ALL if profit_plan2_ok else Fore.RED + "❌ 未达标" + Style.RESET_ALL],["综合收益指标", Fore.GREEN + "✅ 达标" + Style.RESET_ALL if profit_ok else Fore.RED + "❌ 未达标" + Style.RESET_ALL]]print("\n" + tabulate(plan_table, headers=["策略方案", "状态"], tablefmt="grid", stralign="center"))# 持仓统计long_positions_count = len(positions[positions == 1])short_positions_count = len(positions[positions == -1])total_positions_count = long_positions_count + short_positions_countposition_table = [["多头持仓占比", f"{long_positions_count/total_positions_count:.2%}" if total_positions_count > 0 else "0.00%"],["空头持仓占比", f"{short_positions_count/total_positions_count:.2%}" if total_positions_count > 0 else "0.00%"]]print("\n" + tabulate(position_table, headers=["持仓统计", ""], tablefmt="grid", stralign="center"))# 风控与效率指标print("\n" + Fore.YELLOW + Style.BRIGHT + "="*30 + " 风控与效率指标 " + "="*30 + Style.RESET_ALL)mdd_req = evaluation_criteria['max_drawdown']freq_req = evaluation_criteria['weekly_frequency']mdd_ok = max_drawdown < mdd_reqfreq_ok = weekly_trade_frequency > freq_reqrisk_table = [format_check("最大回撤 (MDD)", max_drawdown, mdd_req, "<", lambda v, r: v < r),format_check("每周开仓频率", weekly_trade_frequency, freq_req, ">", lambda v, r: v > r)]print(tabulate(risk_table, headers=headers, tablefmt="grid", stralign="center", numalign="center"))# 添加风控状态risk_status_table = [["综合风控指标", Fore.GREEN + "✅ 达标" + Style.RESET_ALL if mdd_ok else Fore.RED + "❌ 未达标" + Style.RESET_ALL],["综合效率指标", Fore.GREEN + "✅ 达标" + Style.RESET_ALL if freq_ok else Fore.RED + "❌ 未达标" + Style.RESET_ALL]]print("\n" + tabulate(risk_status_table, headers=["指标", "状态"], tablefmt="grid", stralign="center"))# --- 更多常见指标展示 ---print("\n" + Fore.GREEN + Style.BRIGHT + "="*30 + " 详细指标 " + "="*30 + Style.RESET_ALL)detail_headers = ["指标名称", "值"]detail_table = [["总收益 (Total Return)", f"{total_return:.4f}"],["年化收益率 (Annualized Return)", f"{annualized_return:.4f}"],["年化波动率 (Annualized Vol)", f"{annualized_volatility:.4f}"],["索提诺比率 (Sortino Ratio)", f"{sortino_ratio:.4f}"],["总盈亏 (Total PnL)", f"{total_pnl_amount:,.2f}"],["总交易笔数 (Total Trades)", f"{total_trades}"],["盈利交易笔数 (Winning Trades)", f"{num_winning_trades}"],["亏损交易笔数 (Losing Trades)", f"{num_losing_trades}"],["胜率 (Win Rate)", f"{win_rate:.4f}"],["盈亏比 (Profit Factor)", f"{profit_loss_ratio:.4f}"],["平均盈利 (Average Win)", f"{average_win:.4f}"],["平均亏损 (Average Loss)", f"{average_loss:.4f}"],["年化换手率 (Annualized Turnover)", f"{annualized_turnover:.4f}"],["最大回撤起始日期", str(max_drawdown_start_date)],["最大回撤结束日期", str(max_drawdown_end_date)]]print(tabulate(detail_table, headers=detail_headers, tablefmt="grid", stralign="center", numalign="center"))# 逐年收益率print("\n" + Fore.MAGENTA + Style.BRIGHT + "="*30 + " 逐年收益率 " + "="*30 + Style.RESET_ALL)annual_returns_df = annual_returns.reset_index()annual_returns_df.columns = ["年份", "收益率"]annual_returns_df["收益率"] = annual_returns_df["收益率"].apply(lambda x: f"{x:.4f}")print(tabulate(annual_returns_df, headers="keys", tablefmt="grid", stralign="center", showindex=False))# 超额指标print("\n" + Fore.CYAN + Style.BRIGHT + "="*30 + " 超额指标 " + "="*30 + Style.RESET_ALL)excess_table = [["年化超额收益率", f"{annualized_excess_return:.4f}"],["超额波动率", f"{excess_volatility:.4f}"],["超额最大回撤", f"{excess_max_drawdown:.4f}"],["超额夏普比率", f"{excess_sharpe_ratio:.4f}"]]print(tabulate(excess_table, headers=detail_headers, tablefmt="grid", stralign="center", numalign="center"))'''--- 3. 绘制权益曲线图 & 基准对比 & 因子散点图 ---'''# 创建一个包含两个子图的图表# 保持宽度为 15,总高度增加,并设置 ax1 和 ax2 的高度比例# 权益曲线图高度保持在 8,因子图高度增加到 20,总高度为 28fig, (ax1, ax2) = plt.subplots(2, 1, figsize=(20, 28), sharex=True, gridspec_kw={'height_ratios': [8, 20]})# 绘制策略权益曲线equity_curve.plot(label='Strategy Equity', lw=2, color='royalblue', ax=ax1)# 绘制 "买入并持有" 基准曲线benchmark_equity.plot(label='Buy & Hold Benchmark', lw=2, linestyle='--', color='darkorange', ax=ax1)# 绘制超额权益曲线if not excess_equity_curve.empty:excess_equity_curve.plot(label='Excess Equity (vs. Benchmark)', lw=2, linestyle=':', color='forestgreen', ax=ax1)ax1.set_title('Strategy, Benchmark & Excess Equity Curves', fontsize=16)ax1.set_ylabel('Equity', fontsize=12)ax1.legend(fontsize=12)ax1.grid(True, linestyle='--', alpha=0.7)# 显式地显示第一张图的X轴标签ax1.tick_params(labelbottom=True) # 绘制因子散点图if factor_data is not None and not factor_data.empty:# 对因子数据进行标准化,以便在同一图上比较不同量纲的因子scaler = StandardScaler()scaled_factor_data = pd.DataFrame(scaler.fit_transform(factor_data), columns=factor_data.columns, index=factor_data.index)# 定义极端值的阈值(例如,超过3个标准差)EXTREME_THRESHOLD = 3 # 用于收集所有极端值信息all_extreme_values = []# 将所有因子数据堆叠起来,方便统一处理正常值和极端值all_scaled_values = scaled_factor_data.stack().reset_index()all_scaled_values.columns = ['Timestamp', 'Factor', 'Scaled Value']# 根据阈值区分正常值和极端值normal_points = all_scaled_values[abs(all_scaled_values['Scaled Value']) <= EXTREME_THRESHOLD]extreme_points = all_scaled_values[abs(all_scaled_values['Scaled Value']) > EXTREME_THRESHOLD]# 绘制正常值点 (统一颜色)normal_scatter = ax2.scatter(normal_points['Timestamp'], normal_points['Scaled Value'], s=5, alpha=0.6, color='steelblue', label='Normal Value')# 绘制极端值点 (红色 'X' 标记,略大)if not extreme_points.empty:extreme_scatter = ax2.scatter(extreme_points['Timestamp'], extreme_points['Scaled Value'], s=10, color='red', marker='X', edgecolors='black', linewidth=0.8, zorder=5, label=f'Extreme Value (> $\\pm${EXTREME_THRESHOLD} StdDev)')# 收集极端值信息for _, row in extreme_points.iterrows():all_extreme_values.append({'Timestamp': row['Timestamp'],'Factor': row['Factor'],'Scaled Value': row['Scaled Value'],'Original Value': factor_data.loc[row['Timestamp'], row['Factor']]})# 构建图例句柄和标签handles = [normal_scatter]labels = ['Normal Value']if 'extreme_scatter' in locals(): # 只有当有极端值被绘制时才添加其图例handles.append(extreme_scatter)labels.append(f'Extreme Value (> $\\pm${EXTREME_THRESHOLD} StdDev)')ax2.set_title('Scaled Factor Values Over Time (Normal vs. Extreme)', fontsize=14) # 更新标题ax2.set_xlabel('Date', fontsize=12)ax2.set_ylabel('Scaled Factor Value', fontsize=12)ax2.grid(True, linestyle='--', alpha=0.7)ax2.legend(handles=handles, labels=labels, fontsize=10, loc='upper left', bbox_to_anchor=(1, 1)) plt.subplots_adjust(right=0.85) # 调整子图参数以腾出图例空间else:logging.warning("未提供因子数据或因子数据为空,无法绘制因子散点图。")all_extreme_values = [] # 确保即使没有因子数据也定义了此变量plt.tight_layout()plt.show()'''--- 4. 极端因子值文字分析 (统计汇总) ---'''print("\n" + "="*80)print(Fore.YELLOW + Style.BRIGHT + " " * 25 + "极端因子值统计分析" + " " * 25 + Style.RESET_ALL)print("="*80)if all_extreme_values:extreme_df = pd.DataFrame(all_extreme_values)extreme_df['Timestamp'] = pd.to_datetime(extreme_df['Timestamp']) # 确保时间戳是datetime类型# 1. 极端值总数total_extreme_occurrences = len(extreme_df)print(f"检测到的极端因子值总数: {Fore.CYAN}{total_extreme_occurrences}{Style.RESET_ALL} 个 (标准化值绝对值 > {EXTREME_THRESHOLD})")# 2. 每个因子出现极端值的次数print("\n每个因子出现极端值的次数:")factor_extreme_counts = extreme_df['Factor'].value_counts().reset_index()factor_extreme_counts.columns = ['因子名称', '出现次数']print(tabulate(factor_extreme_counts, headers="keys", tablefmt="grid", stralign="center", showindex=False))# 3. 最正和最负的极端值 (例如,前10个)num_top_extremes = 10print(f"\n最正的 {num_top_extremes} 个极端因子值:")top_positive_extremes = extreme_df.nlargest(num_top_extremes, 'Scaled Value')print(tabulate(top_positive_extremes[['Timestamp', 'Factor', 'Scaled Value', 'Original Value']], headers="keys", tablefmt="grid", stralign="center", showindex=False))print(f"\n最负的 {num_top_extremes} 个极端因子值:")top_negative_extremes = extreme_df.nsmallest(num_top_extremes, 'Scaled Value')print(tabulate(top_negative_extremes[['Timestamp', 'Factor', 'Scaled Value', 'Original Value']], headers="keys", tablefmt="grid", stralign="center", showindex=False))print(Fore.BLUE + "\n分析建议: 上述统计数据有助于识别哪些因子更容易出现极端情况,以及这些极端情况的程度。".ljust(76) + Style.RESET_ALL)else:print(Fore.GREEN + "在回测期间未发现明显超出 $\\pm3$ 标准差的极端因子值。这表明因子数据在标准化后相对稳定。".ljust(76) + Style.RESET_ALL)print("\n" + "="*80)logging.info("🎊🎊🎊策略评估完成🎊🎊🎊")

3. 主程序执行

if __name__ == '__main__':# --- 参数配置 ---# 文件路径 (请根据您的服务器环境修改)FACTOR_DATA_PATH = '/public/data/factor_data'FILE_NAME = 'BTCUSDT_15m_2020_2025_factor_data.pkl'# 数据时间范围BEGIN_DATE = '2021-01-01'END_DATE = '2025-03-01'# 回测参数LONG_THRESHOLD = 0.0005 # 预测收益率 > 0.05% 则做多SHORT_THRESHOLD = -0.0005 # 预测收益率 < -0.05% 则做空COMMISSION_RATE = 0.0005 # 按照🪙Binance taker fee: 0.05%INITIAL_CAPITAL = 100000 # 初始资金# 模型评估标准EVALUATION_CRITERIA = {'sharpe_ratio': 2.0,'calmar_ratio': 5.0,'expectancy': 0.25,'max_drawdown': 0.20, # 20%'weekly_frequency': 5}# --- 步骤 1: 数据加载和准备 ---file_path = os.path.join(FACTOR_DATA_PATH, FILE_NAME)logging.info(f"正在从 {file_path} 加载数据...")data = pd.read_pickle(file_path)# 定义预测目标: 未来10个15分钟bar后的收益率data['target'] = data['close'].shift(-10) / data['close'] - 1# 动态选择所有因子# 首先定义已知的非因子列 (OHLCV + target)non_factor_columns = ['open', 'high', 'low', 'close', 'volume', 'target']# 从数据的所有列中排除非因子列,剩下的就是因子列all_columns = data.columns.tolist()SELECTED_FACTORS = [col for col in all_columns if col not in non_factor_columns]logging.info(f"动态选择了 {len(SELECTED_FACTORS)} 个因子。")# 选取工作数据区间并去除NaN值columns_to_keep = SELECTED_FACTORS + ['target', 'close']working_data = data[columns_to_keep][BEGIN_DATE:END_DATE].dropna()X_data = working_data[SELECTED_FACTORS]y_data = working_data['target']logging.info(f"数据准备完成。工作数据区间大小: {len(working_data)}")# --- 步骤 2: 模型训练和样本外预测 ---lgbm = lgb.LGBMRegressor(random_state=42, n_estimators=200, learning_rate=0.05, num_leaves=31)# 获取样本外预测结果oos_preds = train_and_predict_oos(X_data, y_data, lgbm, n_splits=5)# 将预测结果与回测所需的价格数据对齐backtest_data = working_data.loc[oos_preds.index].copy()backtest_data['prediction'] = oos_preds# --- 3. 执行回测 ---backtest_results = run_vectorized_backtest(prices=backtest_data['close'],signals=backtest_data['prediction'],initial_capital=INITIAL_CAPITAL,commission_rate=COMMISSION_RATE,long_threshold=LONG_THRESHOLD,short_threshold=SHORT_THRESHOLD)# --- 4. 性能评估 ---# 传入 INITIAL_CAPITAL 用于基准计算# 传入 X_data (即因子数据) 用于因子可视化evaluate_performance(backtest_results, EVALUATION_CRITERIA, INITIAL_CAPITAL, factor_data=X_data.loc[backtest_results.index])

回测结果

2025-07-21 23:32:37,548 - INFO - 正在从 /public/data/factor_data/BTCUSDT_15m_2020_2025_factor_data.pkl 加载数据...

/tmp/ipykernel_4183159/2238288424.py:33: PerformanceWarning: DataFrame is highly fragmented. This is usually the result of calling `frame.insert` many times, which has poor performance. Consider joining all columns at once using pd.concat(axis=1) instead. To get a de-fragmented frame, use `newframe = frame.copy()`data['target'] = data['close'].shift(-10) / data['close'] - 1

2025-07-21 23:32:37,579 - INFO - 动态选择了 136 个因子。

2025-07-21 23:32:37,775 - INFO - 数据准备完成。工作数据区间大小: 119767

2025-07-21 23:32:37,775 - INFO - 🤔开始使用 5-fold 时间序列交叉验证进行样本外预测...

2025-07-21 23:32:37,787 - INFO - --- Fold 1/5 ---

2025-07-21 23:32:37,788 - INFO - 训练集周期: 2021-10-01 00:00:00 -> 2022-04-26 22:15:00 (大小: 19962)

2025-07-21 23:32:37,789 - INFO - 测试集周期: 2022-04-26 22:30:00 -> 2022-11-21 06:45:00 (大小: 19961)

2025-07-21 23:32:37,956 - INFO - --- Fold 2/5 ---

2025-07-21 23:32:37,957 - INFO - 训练集周期: 2021-10-01 00:00:00 -> 2022-11-21 06:45:00 (大小: 39923)

2025-07-21 23:32:37,957 - INFO - 测试集周期: 2022-11-21 07:00:00 -> 2023-06-17 05:00:00 (大小: 19961)

[LightGBM] [Info] Auto-choosing col-wise multi-threading, the overhead of testing was 0.006534 seconds.

You can set `force_col_wise=true` to remove the overhead.

[LightGBM] [Info] Total Bins 24835

[LightGBM] [Info] Number of data points in the train set: 19962, number of used features: 133

[LightGBM] [Info] Start training from score -0.000011

2025-07-21 23:32:38,221 - INFO - --- Fold 3/5 ---

2025-07-21 23:32:38,229 - INFO - 训练集周期: 2021-10-01 00:00:00 -> 2023-06-17 05:00:00 (大小: 59884)

2025-07-21 23:32:38,230 - INFO - 测试集周期: 2023-06-17 05:15:00 -> 2024-01-11 03:15:00 (大小: 19961)

[LightGBM] [Info] Auto-choosing col-wise multi-threading, the overhead of testing was 0.006951 seconds.

You can set `force_col_wise=true` to remove the overhead.

[LightGBM] [Info] Total Bins 24843

[LightGBM] [Info] Number of data points in the train set: 39923, number of used features: 135

[LightGBM] [Info] Start training from score -0.000191

2025-07-21 23:32:38,656 - INFO - --- Fold 4/5 ---

2025-07-21 23:32:38,657 - INFO - 训练集周期: 2021-10-01 00:00:00 -> 2024-01-11 03:15:00 (大小: 79845)

2025-07-21 23:32:38,658 - INFO - 测试集周期: 2024-01-11 03:30:00 -> 2024-08-06 01:30:00 (大小: 19961)

[LightGBM] [Info] Auto-choosing col-wise multi-threading, the overhead of testing was 0.008437 seconds.

You can set `force_col_wise=true` to remove the overhead.

[LightGBM] [Info] Total Bins 24843

[LightGBM] [Info] Number of data points in the train set: 59884, number of used features: 135

[LightGBM] [Info] Start training from score -0.000033

2025-07-21 23:32:39,127 - INFO - --- Fold 5/5 ---

2025-07-21 23:32:39,128 - INFO - 训练集周期: 2021-10-01 00:00:00 -> 2024-08-06 01:30:00 (大小: 99806)

2025-07-21 23:32:39,129 - INFO - 测试集周期: 2024-08-06 01:45:00 -> 2025-03-01 23:45:00 (大小: 19961)

[LightGBM] [Info] Auto-choosing col-wise multi-threading, the overhead of testing was 0.008386 seconds.

You can set `force_col_wise=true` to remove the overhead.

[LightGBM] [Info] Total Bins 24845

[LightGBM] [Info] Number of data points in the train set: 79845, number of used features: 135

[LightGBM] [Info] Start training from score 0.000050

2025-07-21 23:32:39,632 - INFO - 🎉所有Fold的样本外预测完成。

2025-07-21 23:32:39,691 - INFO - 🤔🤔开始执行向量化回测...

2025-07-21 23:32:39,698 - INFO - 🎉🎉向量化回测完成。

2025-07-21 23:32:39,729 - INFO - �🤔🤔开始评估策略表现...

[LightGBM] [Info] Auto-choosing col-wise multi-threading, the overhead of testing was 0.011500 seconds.

You can set `force_col_wise=true` to remove the overhead.

[LightGBM] [Info] Total Bins 24844

[LightGBM] [Info] Number of data points in the train set: 99806, number of used features: 135

[LightGBM] [Info] Start training from score 0.000067================================================================================

[36m 策略性能评估报告 [0m

================================================================================[34m[1m============================== 收益指标 ==============================[0m

+-----------------------+------------+--------+-----------+

| 指标名称 | 计算结果 | 要求 | 状态 |

+=======================+============+========+===========+

| 夏普比率 (Sharpe) | -0.4403 | > 2.0 | [31m❌ 未达标[0m |

+-----------------------+------------+--------+-----------+

| 卡玛比率 (Calmar) | -0.224 | > 5.0 | [31m❌ 未达标[0m |

+-----------------------+------------+--------+-----------+

| 期望收益 (Expectancy) | -0.483 | > 0.25 | [31m❌ 未达标[0m |

+-----------------------+------------+--------+-----------++----------------------+-----------+

| 策略方案 | 状态 |

+======================+===========+

| 方案一 (夏普 & 卡玛) | [31m❌ 未达标[0m |

+----------------------+-----------+

| 方案二 (期望收益) | [31m❌ 未达标[0m |

+----------------------+-----------+

| 综合收益指标 | [31m❌ 未达标[0m |

+----------------------+-----------++--------------+--------+

| 持仓统计 | |

+==============+========+

| 多头持仓占比 | 19.52% |

+--------------+--------+

| 空头持仓占比 | 80.48% |

+--------------+--------+[33m[1m============================== 风控与效率指标 ==============================[0m

+----------------+------------+--------+-----------+

| 指标名称 | 计算结果 | 要求 | 状态 |

+================+============+========+===========+

| 最大回撤 (MDD) | 0.3355 | < 0.2 | [31m❌ 未达标[0m |

+----------------+------------+--------+-----------+

| 每周开仓频率 | 4.8322 | > 5 | [31m❌ 未达标[0m |

+----------------+------------+--------+-----------++--------------+-----------+

| 指标 | 状态 |

+==============+===========+

| 综合风控指标 | [31m❌ 未达标[0m |

+--------------+-----------+

| 综合效率指标 | [31m❌ 未达标[0m |

+--------------+-----------+[32m[1m============================== 详细指标 ==============================[0m

+----------------------------------+---------------------+

| 指标名称 | 值 |

+==================================+=====================+

| 总收益 (Total Return) | -0.1996 |

+----------------------------------+---------------------+

| 年化收益率 (Annualized Return) | -0.0752 |

+----------------------------------+---------------------+

| 年化波动率 (Annualized Vol) | 0.1453 |

+----------------------------------+---------------------+

| 索提诺比率 (Sortino Ratio) | -0.6855 |

+----------------------------------+---------------------+

| 总盈亏 (Total PnL) | -19,960.49 |

+----------------------------------+---------------------+

| 总交易笔数 (Total Trades) | 378 |

+----------------------------------+---------------------+

| 盈利交易笔数 (Winning Trades) | 114 |

+----------------------------------+---------------------+

| 亏损交易笔数 (Losing Trades) | 264 |

+----------------------------------+---------------------+

| 胜率 (Win Rate) | 0.3016 |

+----------------------------------+---------------------+

| 盈亏比 (Profit Factor) | 0.7143 |

+----------------------------------+---------------------+

| 平均盈利 (Average Win) | 0.0062 |

+----------------------------------+---------------------+

| 平均亏损 (Average Loss) | -0.0038 |

+----------------------------------+---------------------+

| 年化换手率 (Annualized Turnover) | 144.9805 |

+----------------------------------+---------------------+

| 最大回撤起始日期 | 2022-11-21 12:15:00 |

+----------------------------------+---------------------+

| 最大回撤结束日期 | 2025-01-13 15:30:00 |

+----------------------------------+---------------------+[35m[1m============================== 逐年收益率 ==============================[0m

+--------+----------+

| 年份 | 收益率 |

+========+==========+

| 2022 | 0.0952 |

+--------+----------+

| 2023 | -0.1702 |

+--------+----------+

| 2024 | -0.1686 |

+--------+----------+

| 2025 | 0.0593 |

+--------+----------+[36m[1m============================== 超额指标 ==============================[0m

+----------------+---------+

| 指标名称 | 值 |

+================+=========+

| 年化超额收益率 | -0.3081 |

+----------------+---------+

| 超额波动率 | 0.7051 |

+----------------+---------+

| 超额最大回撤 | 0.882 |

+----------------+---------+

| 超额夏普比率 | -0.1774 |

+----------------+---------+

================================================================================

[33m[1m 极端因子值统计分析 [0m

================================================================================

2025-07-21 23:33:06,951 - INFO - 🎊🎊🎊策略评估完成🎊🎊🎊

检测到的极端因子值总数: [36m252956[0m 个 (标准化值绝对值 > 3)每个因子出现极端值的次数:

+-----------------------------------+------------+

| 因子名称 | 出现次数 |

+===================================+============+

| ret_ma_arrangement_sig | 9715 |

+-----------------------------------+------------+

| ret_macd_sig_price | 7965 |

+-----------------------------------+------------+

| ret_skdj_sig_price | 7095 |

+-----------------------------------+------------+

| ret_wma_signals | 6994 |

+-----------------------------------+------------+

| ret_ma20_ma120_cross_sig_price | 6174 |

+-----------------------------------+------------+

| ret_ena_signals | 6145 |

+-----------------------------------+------------+

| ret_rsi_boll_sig | 5134 |

+-----------------------------------+------------+

| ret_hv_ratio_signals | 4932 |

+-----------------------------------+------------+

| ret_ao_signals | 4867 |

+-----------------------------------+------------+

| ret_po_signals | 4441 |

+-----------------------------------+------------+

| ret_bollinger_rsi_signals | 4196 |

+-----------------------------------+------------+

| ret_ma_short_long_cross_sig_price | 4088 |

+-----------------------------------+------------+

| ret_ma120_macd_1_cross_sig_price | 4041 |

+-----------------------------------+------------+

| ret_macd_cross_signal | 3984 |

+-----------------------------------+------------+

| ret_mfi_sig_price | 2715 |

+-----------------------------------+------------+

| ret_ma120_macd_02_cross_sig_price | 2610 |

+-----------------------------------+------------+

| ret_ma_atr_cross_sig_price | 2601 |

+-----------------------------------+------------+

| ret_td_signals | 2385 |

+-----------------------------------+------------+

| ret_vao_signals | 2329 |

+-----------------------------------+------------+

| c_hide_024 | 2260 |

+-----------------------------------+------------+

| c_hide_018 | 2242 |

+-----------------------------------+------------+

| c_hide_032 | 2238 |

+-----------------------------------+------------+

| c_hide_012 | 2218 |

+-----------------------------------+------------+

| c_hide_006 | 2215 |

+-----------------------------------+------------+

| c_hide_011 | 2204 |

+-----------------------------------+------------+

| c_hide_005 | 2204 |

+-----------------------------------+------------+

| c_hide_017 | 2185 |

+-----------------------------------+------------+

| c_hide_031 | 2181 |

+-----------------------------------+------------+

| c_hide_023 | 2181 |

+-----------------------------------+------------+

| c_hide_026 | 2170 |

+-----------------------------------+------------+

| c_chu002 | 2139 |

+-----------------------------------+------------+

| c_hide_027 | 2137 |

+-----------------------------------+------------+

| ret_cci_fibonacci_signals | 2119 |

+-----------------------------------+------------+

| c_chu021 | 2112 |

+-----------------------------------+------------+

| c_hide_025 | 2111 |

+-----------------------------------+------------+

| c_chu014 | 2111 |

+-----------------------------------+------------+

| c_hide_004 | 2111 |

+-----------------------------------+------------+

| c_hide_028 | 2110 |

+-----------------------------------+------------+

| c_chu030 | 2108 |

+-----------------------------------+------------+

| c_chu025 | 2107 |

+-----------------------------------+------------+

| ret_ma20_rsi_macd_cross_sig_price | 2107 |

+-----------------------------------+------------+

| c_hide_010 | 2104 |

+-----------------------------------+------------+

| c_chu051 | 2102 |

+-----------------------------------+------------+

| c_hide_019 | 2099 |

+-----------------------------------+------------+

| c_chu061 | 2091 |

+-----------------------------------+------------+

| c_chu015 | 2089 |

+-----------------------------------+------------+

| c_chu042 | 2082 |

+-----------------------------------+------------+

| ret_ma_bbi_rsi_sig_price | 2081 |

+-----------------------------------+------------+

| c_hide_013 | 2069 |

+-----------------------------------+------------+

| c_hide_016 | 2069 |

+-----------------------------------+------------+

| c_hide_007 | 2040 |

+-----------------------------------+------------+

| c_hide_030 | 2037 |

+-----------------------------------+------------+

| c_hide_022 | 2037 |

+-----------------------------------+------------+

| c_hide_009 | 2037 |

+-----------------------------------+------------+

| c_hide_003 | 2037 |

+-----------------------------------+------------+

| c_chu060 | 2028 |

+-----------------------------------+------------+

| c_chu026 | 2028 |

+-----------------------------------+------------+

| c_hide_029 | 2020 |

+-----------------------------------+------------+

| c_hide_020 | 2019 |

+-----------------------------------+------------+

| c_chu052 | 2013 |

+-----------------------------------+------------+

| c_chu057 | 2011 |

+-----------------------------------+------------+

| c_hide_002 | 1998 |

+-----------------------------------+------------+

| c_chu012 | 1988 |

+-----------------------------------+------------+

| c_chu032 | 1987 |

+-----------------------------------+------------+

| c_chu047 | 1979 |

+-----------------------------------+------------+

| c_chu041 | 1979 |

+-----------------------------------+------------+

| trade_count | 1969 |

+-----------------------------------+------------+

| c_chu040 | 1933 |

+-----------------------------------+------------+

| c_chu022 | 1928 |

+-----------------------------------+------------+

| turnover | 1928 |

+-----------------------------------+------------+

| c_hide_014 | 1921 |

+-----------------------------------+------------+

| c_hide_021 | 1921 |

+-----------------------------------+------------+

| c_hide_015 | 1917 |

+-----------------------------------+------------+

| c_hide_008 | 1917 |

+-----------------------------------+------------+

| taker_buy_turnover | 1908 |

+-----------------------------------+------------+

| c_chu039 | 1903 |

+-----------------------------------+------------+

| taker_buy_volume | 1902 |

+-----------------------------------+------------+

| c_chu019 | 1902 |

+-----------------------------------+------------+

| c_chu028 | 1901 |

+-----------------------------------+------------+

| c_chu020 | 1901 |

+-----------------------------------+------------+

| c_chu013 | 1872 |

+-----------------------------------+------------+

| c_chu005 | 1819 |

+-----------------------------------+------------+

| c_chu043 | 1818 |

+-----------------------------------+------------+

| c_chu024 | 1811 |

+-----------------------------------+------------+

| c_hide_001 | 1808 |

+-----------------------------------+------------+

| c_chu055 | 1739 |

+-----------------------------------+------------+

| c_chu034 | 1719 |

+-----------------------------------+------------+

| c_chu004 | 1718 |

+-----------------------------------+------------+

| c_chu038 | 1665 |

+-----------------------------------+------------+

| c_chu001 | 1634 |

+-----------------------------------+------------+

| ret_ma120_cci_cross_sig_price | 1619 |

+-----------------------------------+------------+

| c_chu033 | 1583 |

+-----------------------------------+------------+

| c_chu056 | 1509 |

+-----------------------------------+------------+

| c_chu059 | 1405 |

+-----------------------------------+------------+

| c_chu058 | 1338 |

+-----------------------------------+------------+

| ret_rma_cross_sig_price | 1315 |

+-----------------------------------+------------+

| c_chu048 | 1065 |

+-----------------------------------+------------+

| c_chu053 | 916 |

+-----------------------------------+------------+

| c_chu029 | 879 |

+-----------------------------------+------------+

| c_chu046 | 803 |

+-----------------------------------+------------+

| c_chu045 | 745 |

+-----------------------------------+------------+

| c_chu006 | 645 |

+-----------------------------------+------------+

| c_chu049 | 632 |

+-----------------------------------+------------+

| c_chu062 | 586 |

+-----------------------------------+------------+

| c_chu018 | 583 |

+-----------------------------------+------------+

| c_chu044 | 537 |

+-----------------------------------+------------+

| c_chu050 | 386 |

+-----------------------------------+------------+

| c_chu010 | 290 |

+-----------------------------------+------------+

| ret_ma20_volume_cross_signals | 149 |

+-----------------------------------+------------+

| c_chu009 | 141 |

+-----------------------------------+------------+

| c_chu037 | 140 |

+-----------------------------------+------------+

| ret_rsi_ma120_cross_sig_price | 93 |

+-----------------------------------+------------+

| ret_ma_vol_cci_sig | 79 |

+-----------------------------------+------------+

| c_chu054 | 59 |

+-----------------------------------+------------+最正的 10 个极端因子值:

+---------------------+----------+----------------+------------------+

| Timestamp | Factor | Scaled Value | Original Value |

+=====================+==========+================+==================+

| 2023-08-17 21:30:00 | c_chu054 | 279.348 | 90.9516 |

+---------------------+----------+----------------+------------------+

| 2023-08-17 21:30:00 | c_chu046 | 140.615 | 0.000173079 |

+---------------------+----------+----------------+------------------+

| 2024-06-02 07:00:00 | c_chu037 | 133.088 | 1615.79 |

+---------------------+----------+----------------+------------------+

| 2024-06-02 07:00:00 | c_chu009 | 133.008 | 1615.79 |

+---------------------+----------+----------------+------------------+

| 2024-08-10 19:15:00 | c_chu037 | 129.101 | 1567.39 |

+---------------------+----------+----------------+------------------+

| 2024-08-10 19:15:00 | c_chu009 | 129.024 | 1567.39 |

+---------------------+----------+----------------+------------------+

| 2023-08-17 21:30:00 | c_chu048 | 125.71 | 0.0101074 |

+---------------------+----------+----------------+------------------+

| 2025-01-23 07:45:00 | c_chu037 | 108.896 | 1322.17 |

+---------------------+----------+----------------+------------------+

| 2022-11-08 19:15:00 | c_chu045 | 107.645 | 7.85681e+10 |

+---------------------+----------+----------------+------------------+

| 2023-10-16 13:30:00 | c_chu029 | 100.607 | 1.83134e+11 |

+---------------------+----------+----------------+------------------+最负的 10 个极端因子值:

+---------------------+-------------------------------+----------------+------------------+

| Timestamp | Factor | Scaled Value | Original Value |

+=====================+===============================+================+==================+

| 2025-01-23 07:45:00 | c_chu009 | -108.838 | -1322.17 |

+---------------------+-------------------------------+----------------+------------------+

| 2024-10-26 05:30:00 | c_chu009 | -85.7351 | -1041.51 |

+---------------------+-------------------------------+----------------+------------------+

| 2024-03-01 17:00:00 | c_chu009 | -74.9715 | -910.753 |

+---------------------+-------------------------------+----------------+------------------+

| 2024-04-21 05:00:00 | c_chu009 | -59.9688 | -728.5 |

+---------------------+-------------------------------+----------------+------------------+

| 2023-12-14 22:15:00 | c_chu009 | -47.4842 | -576.836 |

+---------------------+-------------------------------+----------------+------------------+

| 2024-11-11 07:30:00 | c_chu009 | -35.4511 | -430.657 |

+---------------------+-------------------------------+----------------+------------------+

| 2022-04-27 07:15:00 | ret_rsi_ma120_cross_sig_price | -32.7548 | -1 |

+---------------------+-------------------------------+----------------+------------------+

| 2022-04-27 08:00:00 | ret_rsi_ma120_cross_sig_price | -32.7548 | -1 |

+---------------------+-------------------------------+----------------+------------------+

| 2022-04-27 08:15:00 | ret_rsi_ma120_cross_sig_price | -32.7548 | -1 |

+---------------------+-------------------------------+----------------+------------------+

| 2022-05-04 02:30:00 | ret_rsi_ma120_cross_sig_price | -32.7548 | -1 |

+---------------------+-------------------------------+----------------+------------------+

[34m

分析建议: 上述统计数据有助于识别哪些因子更容易出现极端情况,以及这些极端情况的程度。 [0m================================================================================