ML4T - 第7章第5节 用线性回归预测股票回报Prediction stock returns with linear regression

目录

一、Load Data 加载数据

二、Custom MultipleTimeSeriesCV 自定义时间序列交叉验证

三、Visualization helper functions 可视化辅助函数

四、Linear Regression with sklearn 线性回归模型

五、Linear Regression、Ridge Regression、Lasso Regression模型对比

六、Ridge Regression 岭回归

七、Lasso Regression 套索回归

八、Compare results 对比模型

一、Load Data 加载数据

这里只选取 成交额前100名的数据进行分析(需要按照前面的帖子获取原始数据)

we select top 100 of data.dollar_vol_rank to analyse.

data = data[data.dollar_vol_rank<100]

import warnings

warnings.filterwarnings('ignore')%matplotlib inlinefrom time import time

from pathlib import Path

import pandas as pd

import numpy as np

from scipy.stats import spearmanrfrom sklearn.metrics import mean_squared_error

from sklearn.preprocessing import StandardScaler

from sklearn.linear_model import LinearRegression, Ridge, Lasso

from sklearn.pipeline import Pipelineimport seaborn as sns

import matplotlib.pyplot as plt

from matplotlib.ticker import FuncFormattersns.set_style('darkgrid')

idx = pd.IndexSliceYEAR = 252with pd.HDFStore('data.h5') as store:data = (store['model_data'].dropna().drop(['open', 'close', 'low', 'high'], axis=1))data.index.names = ['symbol', 'date']

data = data.drop([c for c in data.columns if 'lag' in c], axis=1)# Select Investment Universe 选择投资范围

data = data[data.dollar_vol_rank<100]# Create Model Data 创建模型数据

y = data.filter(like='target')

X = data.drop(y.columns, axis=1)

X = X.drop(['dollar_vol', 'dollar_vol_rank', 'volume', 'consumer_durables'], axis=1)# data.info(null_counts=True)

data.info(show_counts=True)<class 'pandas.core.frame.DataFrame'>

MultiIndex: 109434 entries, ('AAL', Timestamp('2013-07-26 00:00:00')) to ('YUM', Timestamp('2015-11-03 00:00:00'))

Data columns (total 45 columns):# Column Non-Null Count Dtype

--- ------ -------------- ----- 0 volume 109434 non-null float641 dollar_vol 109434 non-null float642 dollar_vol_1m 109434 non-null float643 dollar_vol_rank 109434 non-null float644 rsi 109434 non-null float645 bb_high 109434 non-null float646 bb_low 109434 non-null float647 atr 109434 non-null float648 macd 109434 non-null float649 return_1d 109434 non-null float6410 return_5d 109434 non-null float6411 return_10d 109434 non-null float6412 return_21d 109434 non-null float6413 return_42d 109434 non-null float6414 return_63d 109434 non-null float6415 target_1d 109434 non-null float6416 target_5d 109434 non-null float6417 target_10d 109434 non-null float6418 target_21d 109434 non-null float6419 year_2014 109434 non-null bool 20 year_2015 109434 non-null bool 21 year_2016 109434 non-null bool 22 year_2017 109434 non-null bool 23 month_2 109434 non-null bool 24 month_3 109434 non-null bool 25 month_4 109434 non-null bool 26 month_5 109434 non-null bool 27 month_6 109434 non-null bool 28 month_7 109434 non-null bool 29 month_8 109434 non-null bool 30 month_9 109434 non-null bool 31 month_10 109434 non-null bool 32 month_11 109434 non-null bool 33 month_12 109434 non-null bool 34 capital_goods 109434 non-null bool 35 consumer_durables 109434 non-null bool 36 consumer_non-durables 109434 non-null bool 37 consumer_services 109434 non-null bool 38 energy 109434 non-null bool 39 finance 109434 non-null bool 40 health_care 109434 non-null bool 41 miscellaneous 109434 non-null bool 42 public_utilities 109434 non-null bool 43 technology 109434 non-null bool 44 transportation 109434 non-null bool

dtypes: bool(26), float64(19)

memory usage: 19.8+ MB二、Custom MultipleTimeSeriesCV 自定义时间序列交叉验证

这里其实只是将日期序列进行划分为训练集和测试集,后面再用时间结合原始数据得到新数据。

Here split train or test data by time, we get the date and then use them to build true data later.

class MultipleTimeSeriesCV:"""Generates tuples of train_idx, test_idx pairsAssumes the MultiIndex contains levels 'symbol' and 'date'purges overlapping outcomes"""# 这里其实只是将日期序列进行划分为训练集和测试集,后面再用时间结合原始数据得到新数据。def __init__(self,n_splits=3,train_period_length=126,test_period_length=21,lookahead=None,shuffle=False):self.n_splits = n_splitsself.lookahead = lookaheadself.test_length = test_period_lengthself.train_length = train_period_lengthself.shuffle = shuffledef split(self, X, y=None, groups=None):unique_dates = X.index.get_level_values('date').unique()days = sorted(unique_dates, reverse=True)split_idx = []for i in range(self.n_splits):test_end_idx = i * self.test_lengthtest_start_idx = test_end_idx + self.test_length# train_end_idx = test_start_idx + + self.lookahead - 1 # Maybe an extra plus sign 可能多加了+train_end_idx = test_start_idx + self.lookahead - 1train_start_idx = train_end_idx + self.train_length + self.lookahead - 1split_idx.append([train_start_idx, train_end_idx,test_start_idx, test_end_idx])dates = X.reset_index()[['date']]for train_start, train_end, test_start, test_end in split_idx:train_idx = dates[(dates.date > days[train_start])& (dates.date <= days[train_end])].indextest_idx = dates[(dates.date > days[test_start])& (dates.date <= days[test_end])].indexif self.shuffle:np.random.shuffle(list(train_idx))yield train_idx, test_idxdef get_n_splits(self, X, y, groups=None):return self.n_splits# Verify that it works 验证它是否有效

train_period_length = 63 # 3 months

test_period_length = 10 # 10 days

n_splits = int(3 * YEAR/test_period_length) # 3 years

lookahead = 1 # 向前看1天cv = MultipleTimeSeriesCV(n_splits=n_splits,test_period_length=test_period_length,lookahead=lookahead,train_period_length=train_period_length)i = 0

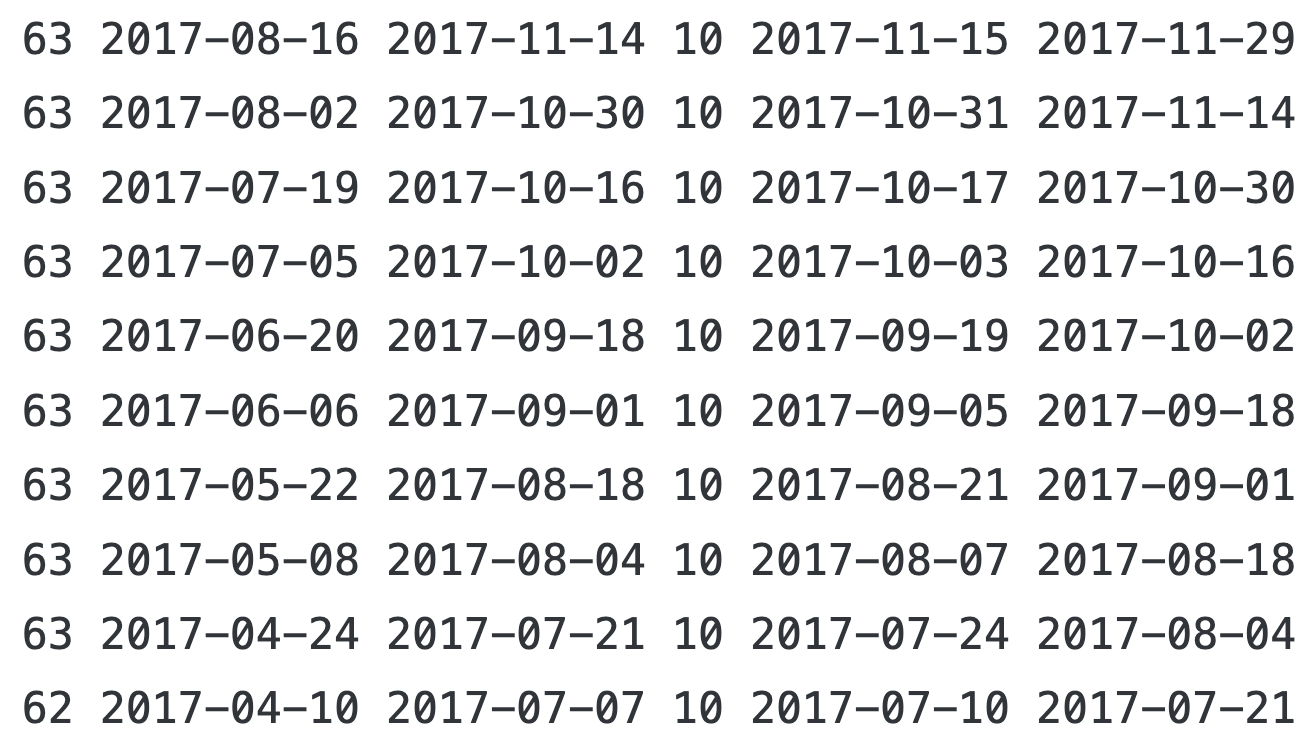

for train_idx, test_idx in cv.split(X=data):train = data.iloc[train_idx]train_dates = train.index.get_level_values('date')test = data.iloc[test_idx]test_dates = test.index.get_level_values('date')# df = train.reset_index().append(test.reset_index()) # baddf = pd.concat([train.reset_index(), test.reset_index()]) # pandas ≥ 2.0 goodn = len(df)assert n== len(df.drop_duplicates())print(train.groupby(level='symbol').size().value_counts().index[0], # 一个train的fold有多少天数据train_dates.min().date(), train_dates.max().date(), # 起止时间test.groupby(level='symbol').size().value_counts().index[0],test_dates.min().date(), test_dates.max().date())i += 1if i == 10:break

每一行:训练集的数量、开始时间、结束时间;测试集的数量、开始时间、结束时间

三、Visualization helper functions 可视化辅助函数

这是用来后面做图用的

# Prediction vs Actual Scatter Plot 预测与实际散点图

def plot_preds_scatter(df, ticker=None):if ticker is not None:idx = pd.IndexSlicedf = df.loc[idx[ticker, :], :]j = sns.jointplot(x='predicted', y='actuals',robust=True, ci=None,line_kws={'lw': 1, 'color': 'k'},scatter_kws={'s': 1},data=df,kind='reg')j.ax_joint.yaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.1%}'.format(y)))j.ax_joint.xaxis.set_major_formatter(FuncFormatter(lambda x, _: '{:.1%}'.format(x)))j.ax_joint.set_xlabel('Predicted')j.ax_joint.set_ylabel('Actuals')# Daily IC Distribution 每日IC(Information Coefficient 信息系数)分布

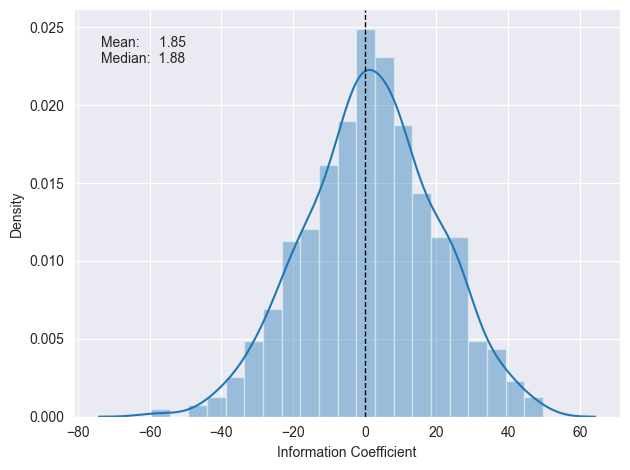

def plot_ic_distribution(df, ax=None):if ax is not None:sns.distplot(df.ic, ax=ax)else:ax = sns.distplot(df.ic)mean, median = df.ic.mean(), df.ic.median()ax.axvline(0, lw=1, ls='--', c='k')ax.text(x=.05, y=.9,s=f'Mean: {mean:8.2f}\nMedian: {median:5.2f}',horizontalalignment='left',verticalalignment='center',transform=ax.transAxes)ax.set_xlabel('Information Coefficient')sns.despine()plt.tight_layout()def plot_ic_distribution(df, ax=None):if ax is not None:sns.distplot(df.ic, ax=ax)else:ax = sns.distplot(df.ic)mean, median = df.ic.mean(), df.ic.median()ax.axvline(0, lw=1, ls='--', c='k')ax.text(x=.05, y=.9,s=f'Mean: {mean:8.2f}\nMedian: {median:5.2f}',horizontalalignment='left',verticalalignment='center',transform=ax.transAxes)ax.set_xlabel('Information Coefficient')sns.despine()plt.tight_layout()# Rolling Daily IC 滚动每日IC

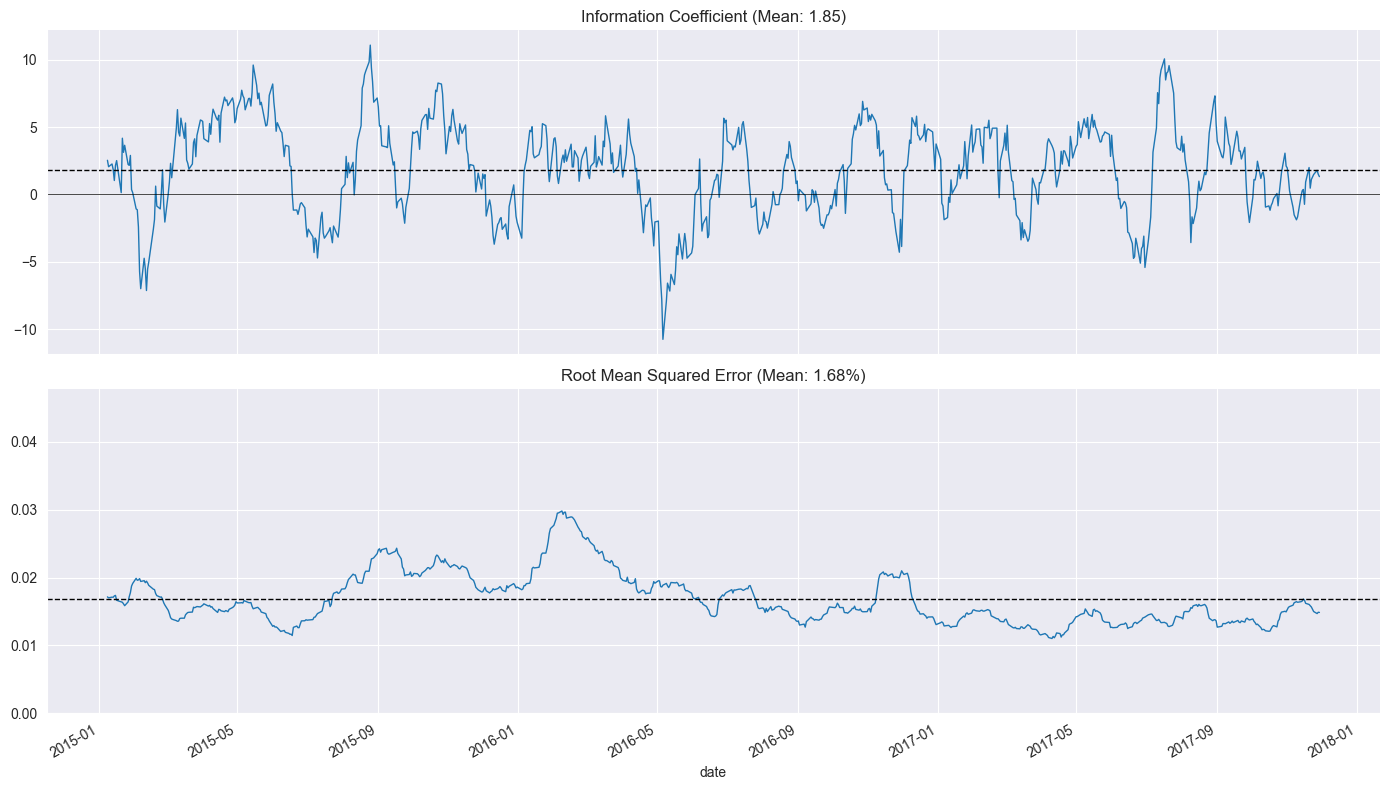

def plot_rolling_ic(df):fig, axes = plt.subplots(nrows=2, sharex=True, figsize=(14, 8))rolling_result = df.sort_index().rolling(21).mean().dropna()mean_ic = df.ic.mean()rolling_result.ic.plot(ax=axes[0],title=f'Information Coefficient (Mean: {mean_ic:.2f})',lw=1)axes[0].axhline(0, lw=.5, ls='-', color='k')axes[0].axhline(mean_ic, lw=1, ls='--', color='k')mean_rmse = df.rmse.mean()rolling_result.rmse.plot(ax=axes[1],title=f'Root Mean Squared Error (Mean: {mean_rmse:.2%})',lw=1,ylim=(0, df.rmse.max()))axes[1].axhline(df.rmse.mean(), lw=1, ls='--', color='k')sns.despine()plt.tight_layout()

四、Linear Regression with sklearn 线性回归模型

这里可以简单理解为,用很多个变量,拟合OLS模型,去预测某个变量。

We use many variables to fit OLS model, then predict some variable.

接下来,用历史数据训练线性回归模型,预测未来1天的目标值(target_1d),并通过交叉验证评估模型的预测能力(用IC和RMSE指标)。

| 指标 | 含义 |

|---|---|

| IC(Information Coefficient) | 每天预测值与真实值的Spearman秩相关系数,衡量排序能力。越高越好,>5%算不错。 |

| RMSE(Root Mean Squared Error) | 每天预测值与真实值的均方根误差,衡量预测精度。越小越好。 |

lr_r, lr_p = spearmanr(lr_predictions.actuals, lr_predictions.predicted)

print(f'Information Coefficient (overall): {lr_r:.3%} (p-value: {lr_p:.4%})')

-

整体IC:把所有预测值和真实值拼在一起,计算一个总的Spearman相关系数。

-

p-value:检验这个IC是否显著(<5%才算显著)。

-

如果这个IC是1.2%(p=12.3%),说明模型整体预测能力很弱,不显著。

%%time

# Set up cross-validation 交叉验证

train_period_length = 63

test_period_length = 10

n_splits = int(3 * YEAR / test_period_length)

lookahead = 1cv = MultipleTimeSeriesCV(n_splits=n_splits,test_period_length=test_period_length,lookahead=lookahead,train_period_length=train_period_length)# Run cross-validation with LinearRegression 运行线性回归模型的交叉验证target = f'target_{lookahead}d'

lr_predictions, lr_scores = [], []

lr = LinearRegression()

for i, (train_idx, test_idx) in enumerate(cv.split(X), 1):X_train, y_train, = X.iloc[train_idx], y[target].iloc[train_idx]X_test, y_test = X.iloc[test_idx], y[target].iloc[test_idx]lr.fit(X=X_train, y=y_train)y_pred = lr.predict(X_test)preds = y_test.to_frame('actuals').assign(predicted=y_pred)preds_by_day = preds.groupby(level='date')scores = pd.concat([preds_by_day.apply(lambda x: spearmanr(x.predicted,x.actuals)[0] * 100).to_frame('ic'),preds_by_day.apply(lambda x: np.sqrt(mean_squared_error(y_pred=x.predicted,y_true=x.actuals))).to_frame('rmse')], axis=1)lr_scores.append(scores)lr_predictions.append(preds)lr_scores = pd.concat(lr_scores)

lr_predictions = pd.concat(lr_predictions)# Persist results 保存

lr_scores.to_hdf('data.h5', 'lr/scores')

lr_predictions.to_hdf('data.h5', 'lr/predictions')

lr_scores = pd.read_hdf('data.h5', 'lr/scores')

lr_predictions = pd.read_hdf('data.h5', 'lr/predictions')# Evaluate results 评估结果

lr_r, lr_p = spearmanr(lr_predictions.actuals, lr_predictions.predicted)

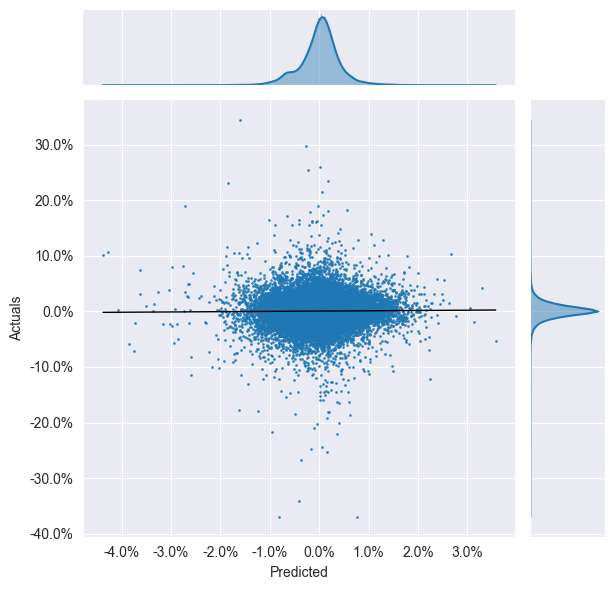

print(f'Information Coefficient (overall): {lr_r:.3%} (p-value: {lr_p:.4%})')# Prediction vs Actuals Scatter 预测值与实际值散点图

plot_preds_scatter(lr_predictions)结果:

Information Coefficient (overall): 1.346% (p-value: 0.0255%)

CPU times: user 23.7 s, sys: 2.9 s, total: 26.6 s

Wall time: 5.73 s

我的分析:

这个结果整体偏弱,虽然统计显著,但经济意义不强。

IC is too low, not good.

# Daily IC Distribution

plot_ic_distribution(lr_scores)

# Rolling Daily IC

plot_rolling_ic(lr_scores)

五、Linear Regression、Ridge Regression、Lasso Regression模型对比

因为我们后面还需要用到不同其他模型,所以这里我新增了一些对比知识。

| 英文 | 规范中文名 | 又常见叫法 |

|---|---|---|

| Linear Regression | 线性回归 | 普通最小二乘回归、OLS 回归 |

| Ridge Regression | 岭回归 | 吉洪诺夫正则化、L2 正则回归 |

| Lasso Regression | 套索回归 | L1 正则回归、最小绝对值压缩选择算子 |

-

“套索”是 LASSO acronym(Least Absolute Shrinkage and Selection Operator)的音意合译,形象地表示“把无用变量套走”。

这三者都属于线性模型,核心区别在损失函数里有没有“惩罚项”,也就是对系数大小的约束。

| 模型 | 关键词 | 本质区别 |

|---|---|---|

| Linear Regression | 无惩罚 | 最小化残差平方和,系数无约束,容易过拟合 |

| Ridge Regression | L2 惩罚 | 在损失函数里加 λ·Σβ²,让系数变小但不归零,解决多重共线性 |

| Lasso Regression | L1 惩罚 | 加 λ·Σβ,能把无用特征的系数压到 0,实现自动特征选择 |

-

Linear Regression:解是最小二乘点,系数随便长。

-

Ridge:解被拉向原点,圆约束 ⇒ 系数变小但非零。

-

Lasso:解被拉向原点,菱形约束 ⇒ 顶点在坐标轴上 ⇒ 某些系数=0。

六、Ridge Regression 岭回归

在用时间序列交叉验证方式,遍历18个 Ridge 正则化强度 alpha,评估每个 alpha 下模型的预测能力(IC 和 RMSE),并记录模型系数,为后续选择最优 alpha 提供依据。

Using time series cross-validation, we evaluated the predictive performance (IC and RMSE) of the model for each of the 18 Ridge regularization strengths, denoted as alpha. We also recorded the model coefficients to inform the subsequent selection of the optimal alpha.

# %%time

# 在用时间序列交叉验证方式,遍历18个 Ridge 正则化强度 alpha,评估每个 alpha 下模型的预测能力(IC 和 RMSE),并记录模型系数,为后续选择最优 alpha 提供依据。

# Define cross-validation parameters

ridge_alphas = np.logspace(-4, 4, 9)

ridge_alphas = sorted(list(ridge_alphas) + list(ridge_alphas * 5))n_splits = int(3 * YEAR/test_period_length)

train_period_length = 63

test_period_length = 10

lookahead = 1cv = MultipleTimeSeriesCV(n_splits=n_splits,test_period_length=test_period_length,lookahead=lookahead,train_period_length=train_period_length)# Run cross-validation

target = f'target_{lookahead}d'X = X.drop([c for c in X.columns if 'year' in c], axis=1)ridge_coeffs, ridge_scores, ridge_predictions = {}, [], []for alpha in ridge_alphas:print(alpha, end=' ', flush=True)start = time()model = Ridge(alpha=alpha,fit_intercept=False,random_state=42)pipe = Pipeline([('scaler', StandardScaler()),('model', model)])coeffs = []for i, (train_idx, test_idx) in enumerate(cv.split(X), 1):X_train, y_train, = X.iloc[train_idx], y[target].iloc[train_idx]X_test, y_test = X.iloc[test_idx], y[target].iloc[test_idx]pipe.fit(X=X_train, y=y_train)y_pred = pipe.predict(X_test)preds = y_test.to_frame('actuals').assign(predicted=y_pred)preds_by_day = preds.groupby(level='date')scores = pd.concat([preds_by_day.apply(lambda x: spearmanr(x.predicted,x.actuals)[0] * 100).to_frame('ic'),preds_by_day.apply(lambda x: np.sqrt(mean_squared_error(y_pred=x.predicted,y_true=x.actuals))).to_frame('rmse')], axis=1)ridge_scores.append(scores.assign(alpha=alpha))ridge_predictions.append(preds.assign(alpha=alpha))coeffs.append(pipe.named_steps['model'].coef_)ridge_coeffs[alpha] = np.mean(coeffs, axis=0)print('\n')Evaluate Ridge Results 评估

# Persist results

ridge_scores = pd.concat(ridge_scores)

ridge_scores.to_hdf('data.h5', 'ridge/scores')ridge_coeffs = pd.DataFrame(ridge_coeffs, index=X.columns).T

ridge_coeffs.to_hdf('data.h5', 'ridge/coeffs')ridge_predictions = pd.concat(ridge_predictions)

ridge_predictions.to_hdf('data.h5', 'ridge/predictions')ridge_scores = pd.read_hdf('data.h5', 'ridge/scores')

ridge_coeffs = pd.read_hdf('data.h5', 'ridge/coeffs')

ridge_predictions = pd.read_hdf('data.h5', 'ridge/predictions')# Evaluate Ridge Results

ridge_r, ridge_p = spearmanr(ridge_predictions.actuals, ridge_predictions.predicted)

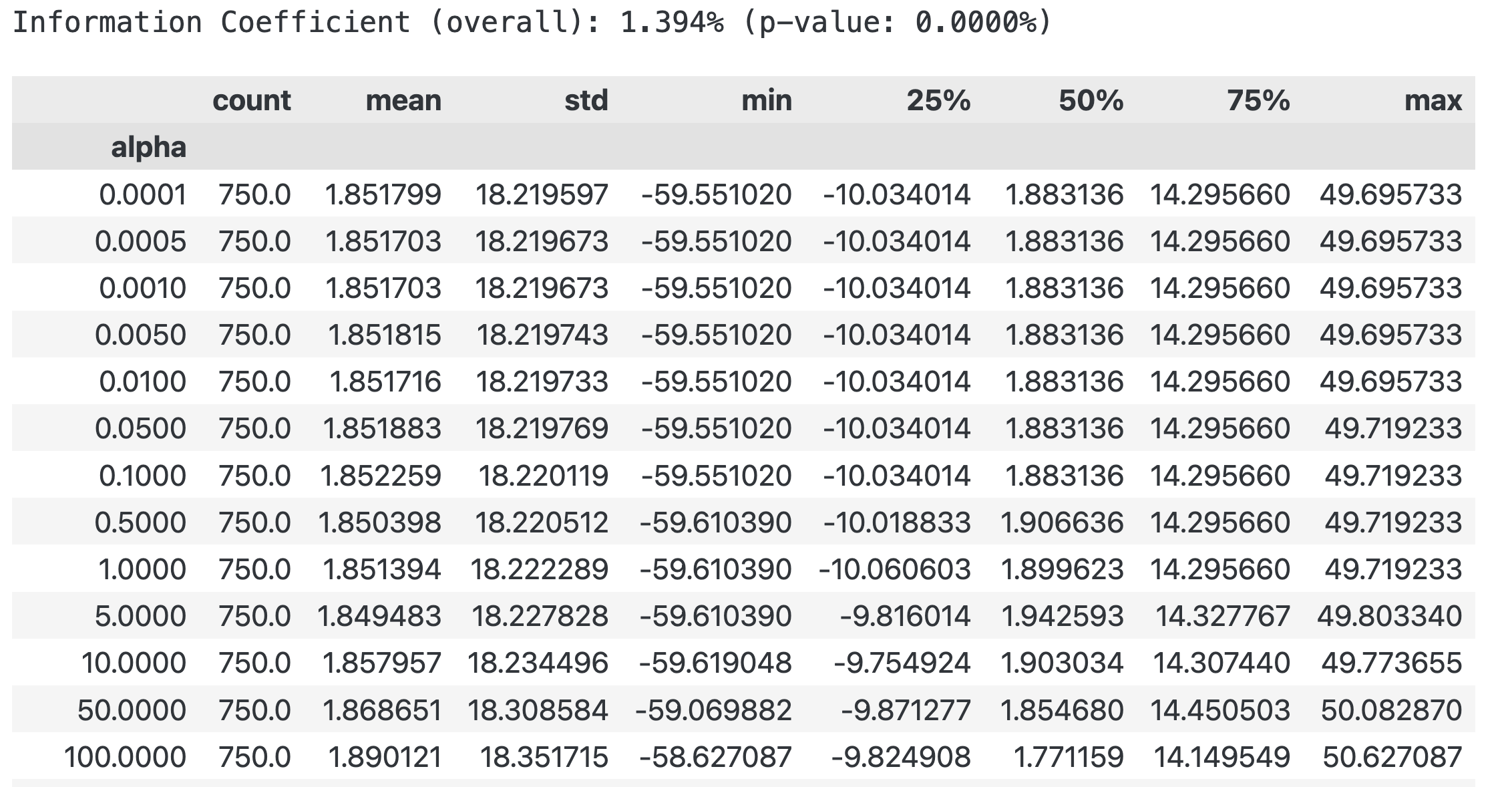

print(f'Information Coefficient (overall): {ridge_r:.3%} (p-value: {ridge_p:.4%})')ridge_scores.groupby('alpha').ic.describe()

fig, axes = plt.subplots(ncols=2, sharex=True, figsize=(15, 5))scores_by_alpha = ridge_scores.groupby('alpha').ic.agg(['mean', 'median'])

best_alpha_mean = scores_by_alpha['mean'].idxmax()

best_alpha_median = scores_by_alpha['median'].idxmax()ax = sns.lineplot(x='alpha',y='ic',data=ridge_scores,estimator=np.mean,label='Mean',ax=axes[0])scores_by_alpha['median'].plot(logx=True,ax=axes[0],label='Median')axes[0].axvline(best_alpha_mean,ls='--',c='k',lw=1,label='Max. Mean')

axes[0].axvline(best_alpha_median,ls='-.',c='k',lw=1,label='Max. Median')

axes[0].legend()

axes[0].set_xscale('log')

axes[0].set_xlabel('Alpha')

axes[0].set_ylabel('Information Coefficient')

axes[0].set_title('Cross Validation Performance')ridge_coeffs.plot(logx=True,legend=False,ax=axes[1],title='Ridge Coefficient Path')axes[1].axvline(best_alpha_mean,ls='--',c='k',lw=1,label='Max. Mean')

axes[1].axvline(best_alpha_median,ls='-.',c='k',lw=1,label='Max. Median')

axes[1].set_xlabel('Alpha')

axes[1].set_ylabel('Coefficient Value')fig.suptitle('Ridge Results', fontsize=14)

sns.despine()

fig.tight_layout()

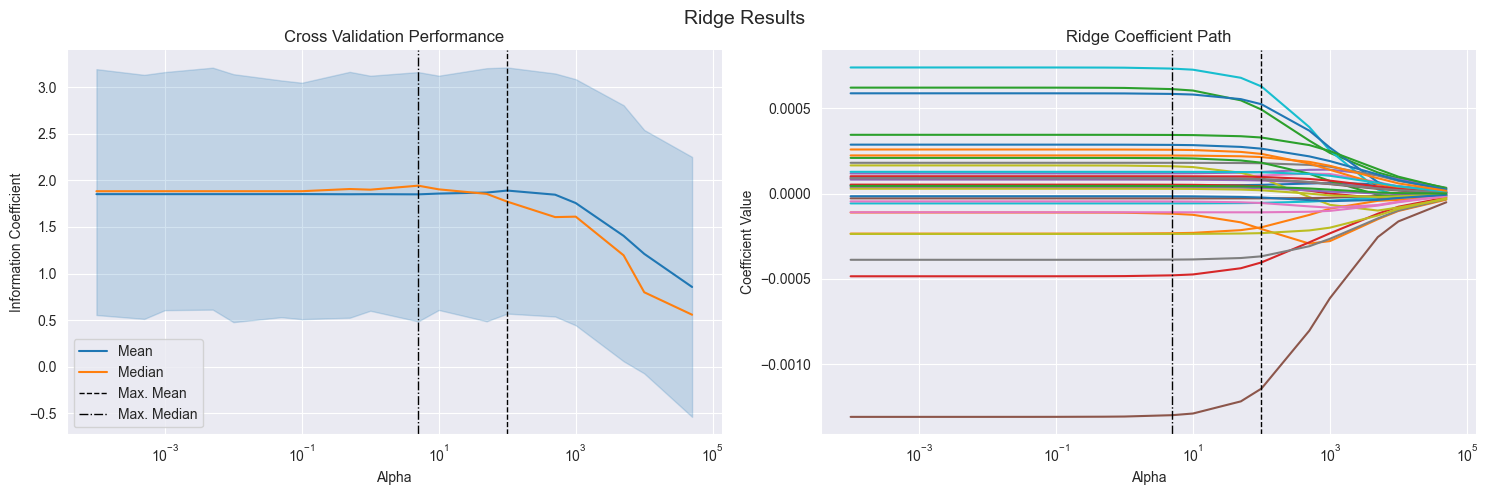

fig.subplots_adjust(top=.9)# 下面的左图:展示了不同 alpha 值下模型的 IC 分布。表示当alpha很大时效果变差了。

# 右图:展示了不同 alpha 值下模型的系数路径。表示当alpha很大时,模型的系数突然都变小了。

我的分析:

左图:展示了不同 alpha 值下模型的 IC 分布。表示当alpha很大时效果变差了。

右图:展示了不同 alpha 值下模型的系数路径。表示当alpha很大时,模型的系数突然都变小了。

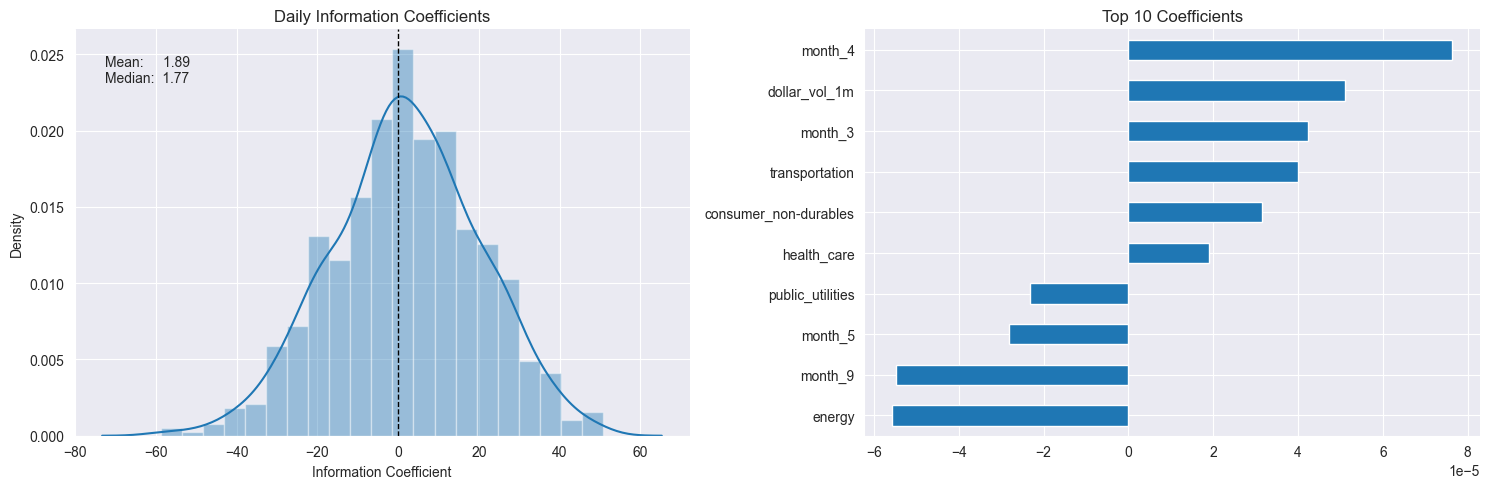

# 只用最优 alpha 下的所有交叉验证折的结果

# 左图:如果分布集中在正值区域,说明模型大多数时候预测方向是对的。如果分布很宽、偏负,说明模型不稳定或信号弱。

# 右图:选出绝对值最大的10个特征,看哪些特征对预测贡献最大。best_alpha = ridge_scores.groupby('alpha').ic.mean().idxmax()

fig, axes = plt.subplots(ncols=2, figsize=(15, 5))

plot_ic_distribution(ridge_scores[ridge_scores.alpha == best_alpha],ax=axes[0])

axes[0].set_title('Daily Information Coefficients')

top_coeffs = ridge_coeffs.loc[best_alpha].abs().sort_values().head(10).index

top_coeffs.tolist()

ridge_coeffs.loc[best_alpha, top_coeffs].sort_values().plot.barh(ax=axes[1],title='Top 10 Coefficients')

sns.despine()

fig.tight_layout()

进一步分析:

左图:如果分布集中在正值区域,说明模型大多数时候预测方向是对的。如果分布很宽、偏负,说明模型不稳定或信号弱。

右图:选出绝对值最大的10个特征,看哪些特征对预测贡献最大。

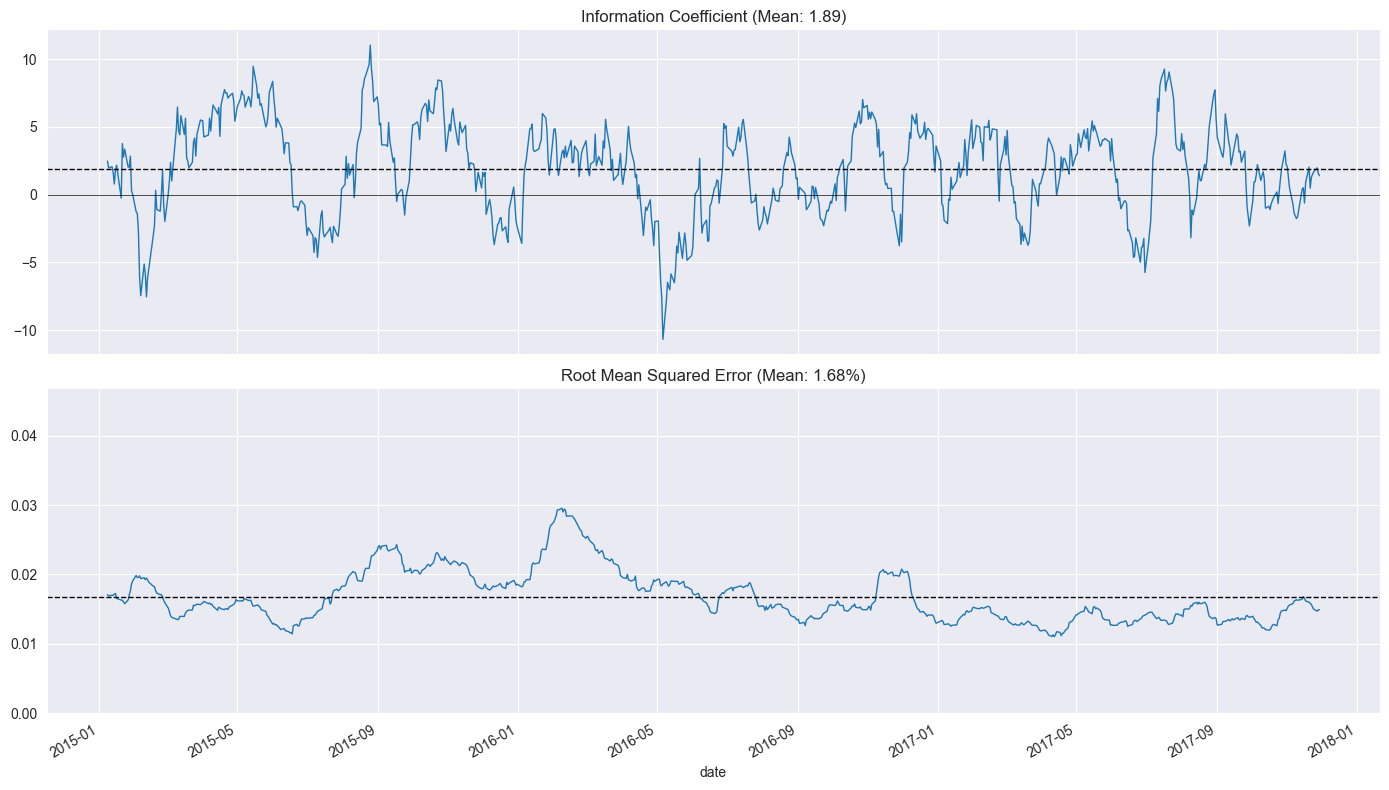

plot_rolling_ic(ridge_scores[ridge_scores.alpha==best_alpha])

七、Lasso Regression 套索回归

和岭回归完全类似,

# 类似地

# Define cross-validation parameters

lasso_alphas = np.logspace(-10, -3, 8)train_period_length = 63

test_period_length = 10

YEAR = 252

n_splits = int(3 * YEAR / test_period_length) # three years

lookahead = 1cv = MultipleTimeSeriesCV(n_splits=n_splits,test_period_length=test_period_length,lookahead=lookahead,train_period_length=train_period_length)# Run cross-validation with Lasso regression

target = f'target_{lookahead}d'scaler = StandardScaler()

X = X.drop([c for c in X.columns if 'year' in c], axis=1)lasso_coeffs, lasso_scores, lasso_predictions = {}, [], []

for alpha in lasso_alphas:print(alpha, end=' ', flush=True)model = Lasso(alpha=alpha,fit_intercept=False, # StandardScaler centers datarandom_state=42,tol=1e-3,max_iter=1000,warm_start=True,selection='random')pipe = Pipeline([('scaler', StandardScaler()),('model', model)])coeffs = []for i, (train_idx, test_idx) in enumerate(cv.split(X), 1):t = time()X_train, y_train, = X.iloc[train_idx], y[target].iloc[train_idx]X_test, y_test = X.iloc[test_idx], y[target].iloc[test_idx]pipe.fit(X=X_train, y=y_train)y_pred = pipe.predict(X_test)preds = y_test.to_frame('actuals').assign(predicted=y_pred)preds_by_day = preds.groupby(level='date')scores = pd.concat([preds_by_day.apply(lambda x: spearmanr(x.predicted,x.actuals)[0] * 100).to_frame('ic'),preds_by_day.apply(lambda x: np.sqrt(mean_squared_error(y_pred=x.predicted,y_true=x.actuals))).to_frame('rmse')],axis=1)lasso_scores.append(scores.assign(alpha=alpha))lasso_predictions.append(preds.assign(alpha=alpha))coeffs.append(pipe.named_steps['model'].coef_)lasso_coeffs[alpha] = np.mean(coeffs, axis=0)# Persist results

lasso_scores = pd.concat(lasso_scores)

lasso_scores.to_hdf('data.h5', 'lasso/scores')lasso_coeffs = pd.DataFrame(lasso_coeffs, index=X.columns).T

lasso_coeffs.to_hdf('data.h5', 'lasso/coeffs')lasso_predictions = pd.concat(lasso_predictions)

lasso_predictions.to_hdf('data.h5', 'lasso/predictions')Evaluate Lasso Results 评估

best_alpha = lasso_scores.groupby('alpha').ic.mean().idxmax()

preds = lasso_predictions[lasso_predictions.alpha==best_alpha]lasso_r, lasso_p = spearmanr(preds.actuals, preds.predicted)

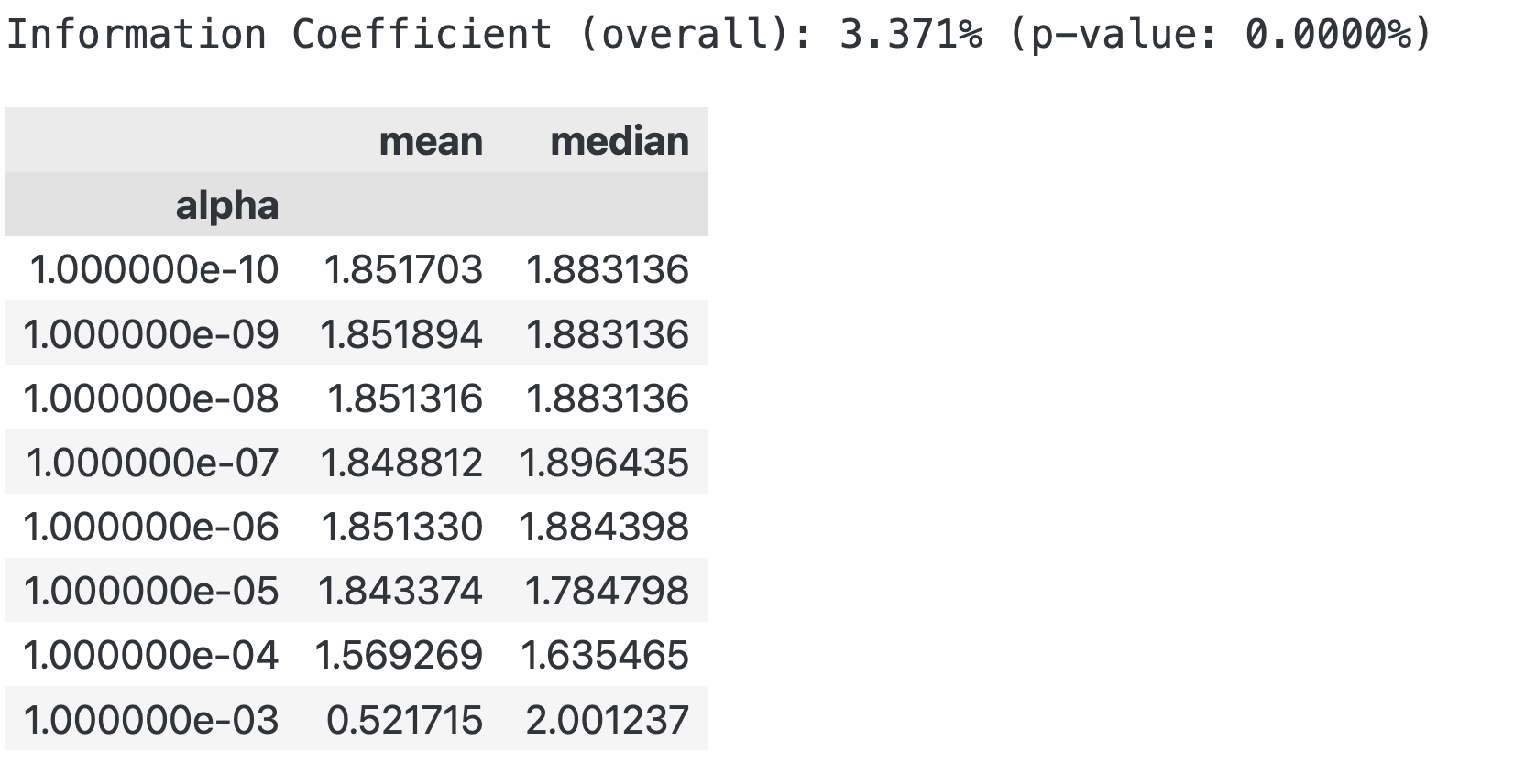

print(f'Information Coefficient (overall): {lasso_r:.3%} (p-value: {lasso_p:.4%})')lasso_scores.groupby('alpha').ic.agg(['mean', 'median'])

# Lasso Coefficient Path

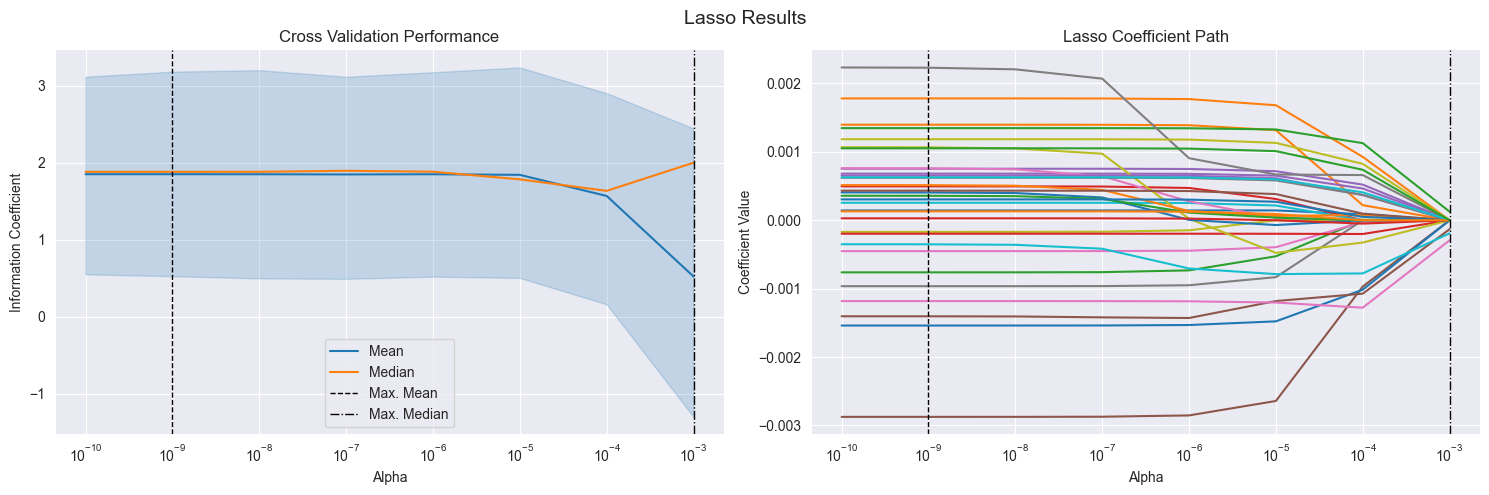

fig, axes = plt.subplots(ncols=2, sharex=True, figsize=(15, 5))scores_by_alpha = lasso_scores.groupby('alpha').ic.agg(['mean', 'median'])

best_alpha_mean = scores_by_alpha['mean'].idxmax()

best_alpha_median = scores_by_alpha['median'].idxmax()# add code:

# Check if index is unique

print(lasso_scores.index.is_unique) # False表示索引不是唯一的

lasso_scores = lasso_scores.reset_index(drop=True)ax = sns.lineplot(x='alpha', y='ic', data=lasso_scores, estimator=np.mean, label='Mean', ax=axes[0])scores_by_alpha['median'].plot(logx=True, ax=axes[0], label='Median')axes[0].axvline(best_alpha_mean, ls='--', c='k', lw=1, label='Max. Mean')

axes[0].axvline(best_alpha_median, ls='-.', c='k', lw=1, label='Max. Median')

axes[0].legend()

axes[0].set_xscale('log')

axes[0].set_xlabel('Alpha')

axes[0].set_ylabel('Information Coefficient')

axes[0].set_title('Cross Validation Performance')lasso_coeffs.plot(logx=True, legend=False, ax=axes[1], title='Lasso Coefficient Path')

axes[1].axvline(best_alpha_mean, ls='--', c='k', lw=1, label='Max. Mean')

axes[1].axvline(best_alpha_median, ls='-.', c='k', lw=1, label='Max. Median')

axes[1].set_xlabel('Alpha')

axes[1].set_ylabel('Coefficient Value')fig.suptitle('Lasso Results', fontsize=14)

fig.tight_layout()

fig.subplots_adjust(top=.9)

sns.despine();上面这段代码中,我们添加了:

# add code:

# Check if index is unique

print(lasso_scores.index.is_unique) # False表示索引不是唯一的

lasso_scores = lasso_scores.reset_index(drop=True)

否则可能不能正确执行。因为索引不唯一。

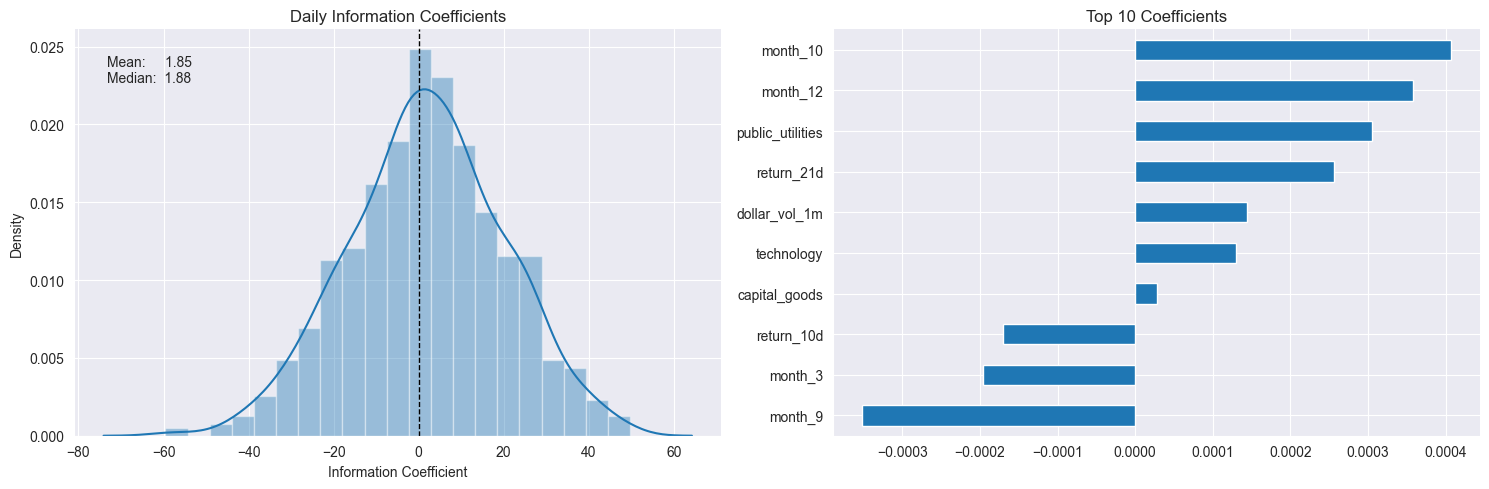

# Lasso IC Distribution and Top 10 Features

best_alpha = lasso_scores.groupby('alpha').ic.mean().idxmax()fig, axes = plt.subplots(ncols=2, figsize=(15, 5))

plot_ic_distribution(lasso_scores[lasso_scores.alpha==best_alpha], ax=axes[0])

axes[0].set_title('Daily Information Coefficients')top_coeffs = lasso_coeffs.loc[best_alpha].abs().sort_values().head(10).index

top_coeffs.tolist()

lasso_coeffs.loc[best_alpha, top_coeffs].sort_values().plot.barh(ax=axes[1], title='Top 10 Coefficients')sns.despine()

fig.tight_layout();

这里和原书作者结果有点不一样,感兴趣的可以参考原文:

https://github.com/stefan-jansen/machine-learning-for-trading/blob/main/07_linear_models/05_predicting_stock_returns_with_linear_regression.ipynb

# Lasso IC Distribution and Top 10 Features

best_alpha = lasso_scores.groupby('alpha').ic.mean().idxmax()fig, axes = plt.subplots(ncols=2, figsize=(15, 5))

plot_ic_distribution(lasso_scores[lasso_scores.alpha==best_alpha], ax=axes[0])

axes[0].set_title('Daily Information Coefficients')top_coeffs = lasso_coeffs.loc[best_alpha].abs().sort_values().head(10).index

top_coeffs.tolist()

lasso_coeffs.loc[best_alpha, top_coeffs].sort_values().plot.barh(ax=axes[1], title='Top 10 Coefficients')sns.despine()

fig.tight_layout();

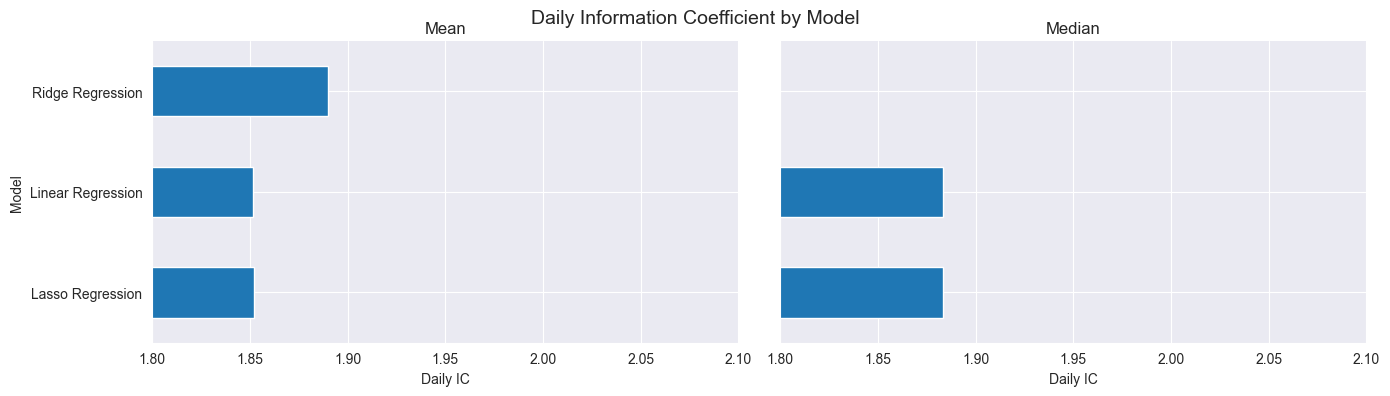

八、Compare results 对比模型

best_ridge_alpha = ridge_scores.groupby('alpha').ic.mean().idxmax()

best_ridge_preds = ridge_predictions[ridge_predictions.alpha==best_ridge_alpha]

best_ridge_scores = ridge_scores[ridge_scores.alpha==best_ridge_alpha]best_lasso_alpha = lasso_scores.groupby('alpha').ic.mean().idxmax()

best_lasso_preds = lasso_predictions[lasso_predictions.alpha==best_lasso_alpha]

best_lasso_scores = lasso_scores[lasso_scores.alpha==best_lasso_alpha]df = pd.concat([lr_scores.assign(Model='Linear Regression'),best_ridge_scores.assign(Model='Ridge Regression'),best_lasso_scores.assign(Model='Lasso Regression')]).drop('alpha', axis=1)

df.columns = ['IC', 'RMSE', 'Model']scores = df.groupby('Model').IC.agg(['mean', 'median'])

fig, axes = plt.subplots(ncols=2, figsize=(14,4), sharey=True, sharex=True)scores['mean'].plot.barh(ax=axes[0], xlim=(1.85, 2), title='Mean')

scores['median'].plot.barh(ax=axes[1], xlim=(1.8, 2.1), title='Median')

axes[0].set_xlabel('Daily IC')

axes[1].set_xlabel('Daily IC')fig.suptitle('Daily Information Coefficient by Model', fontsize=14)

sns.despine()

fig.tight_layout()

fig.subplots_adjust(top=.9)

可以发现,基础版的线性回归效果不好时,可以试试成升级版的岭回归和套索回归。

Linear Regression IC is not the best(largest), we can try some other models.